The strength of US Dollar still exists yet we are now seeing more hesitation from the market pushing the Dollar to a higher level.

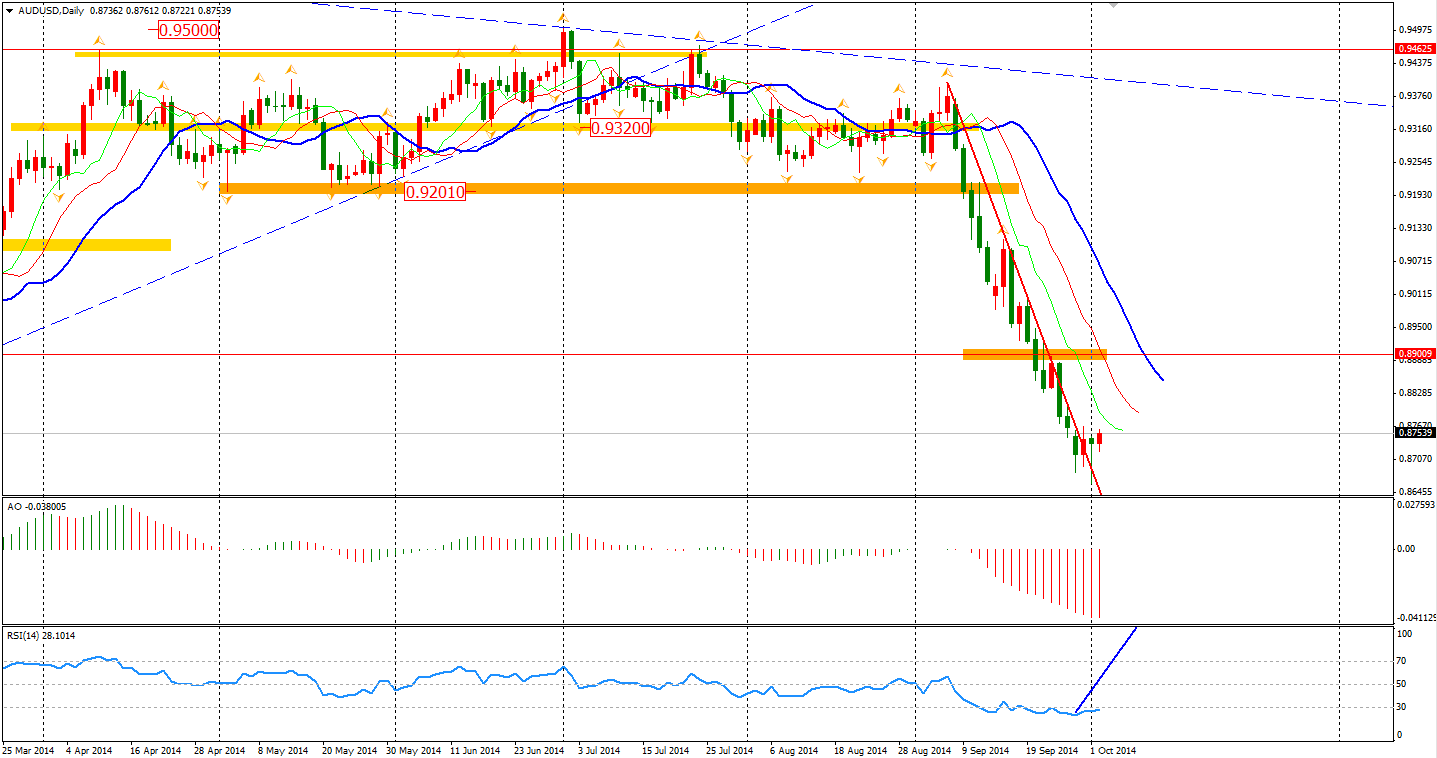

After the news that China’s official October PMI is 51.1 – the same as the previous one, the Aussie Dollar slumped to 0.87 in response to the disappointing retail sales. The growth was only

0.1% in August, missing the expected 0.4% showing a weakness in the domestic market recovery, especially in the depressed mining industry.

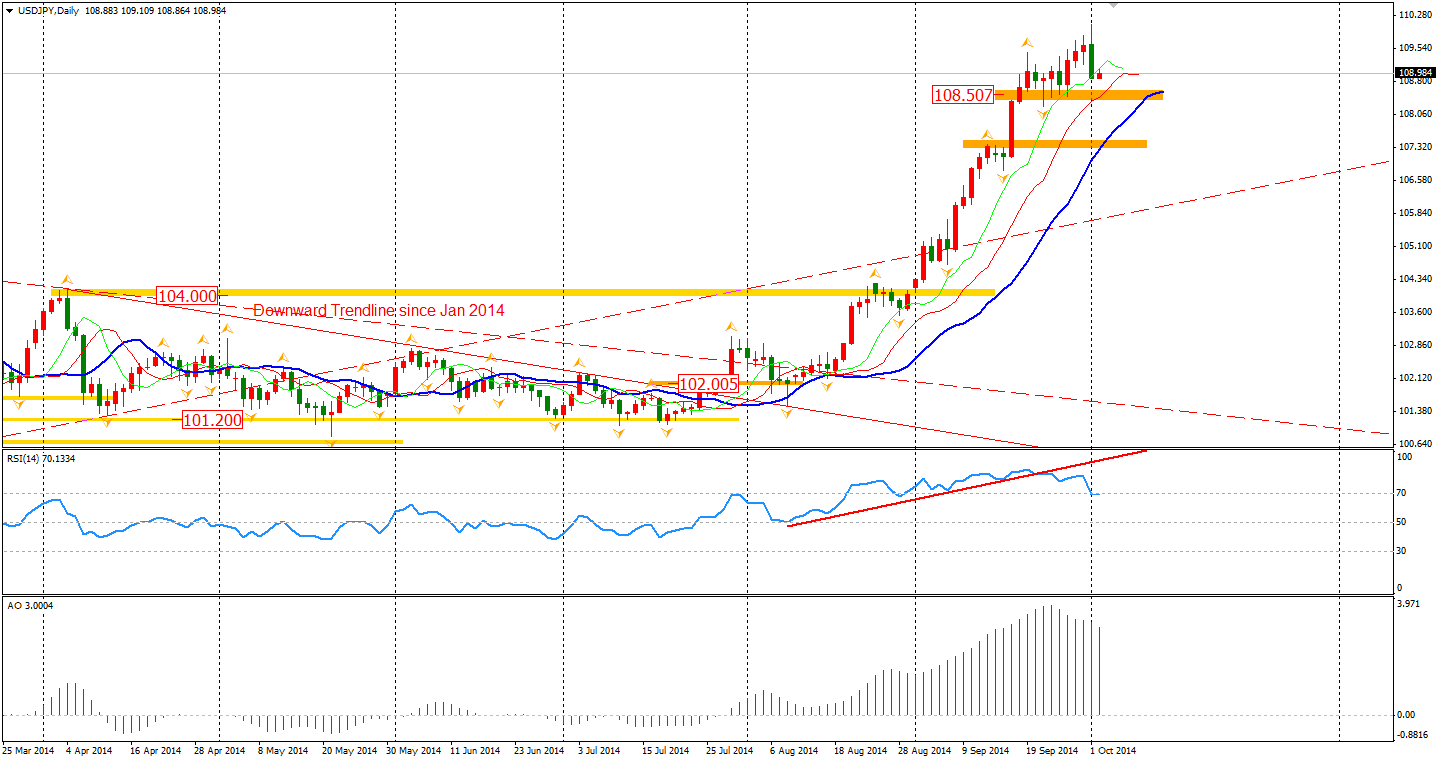

In the Asian trading session, another unmissable moment came from the Dollar/Yen. The dollar rose above 110 yen for the first time since August 2008. These two currency pairs reached the technical targets that we had forecasted a month ago. This meeting of targets suggests that the trend may be close to the end for now. The Dollar/Yen later fell from the 110 level and slumped to a 108.90 finish earlier today.

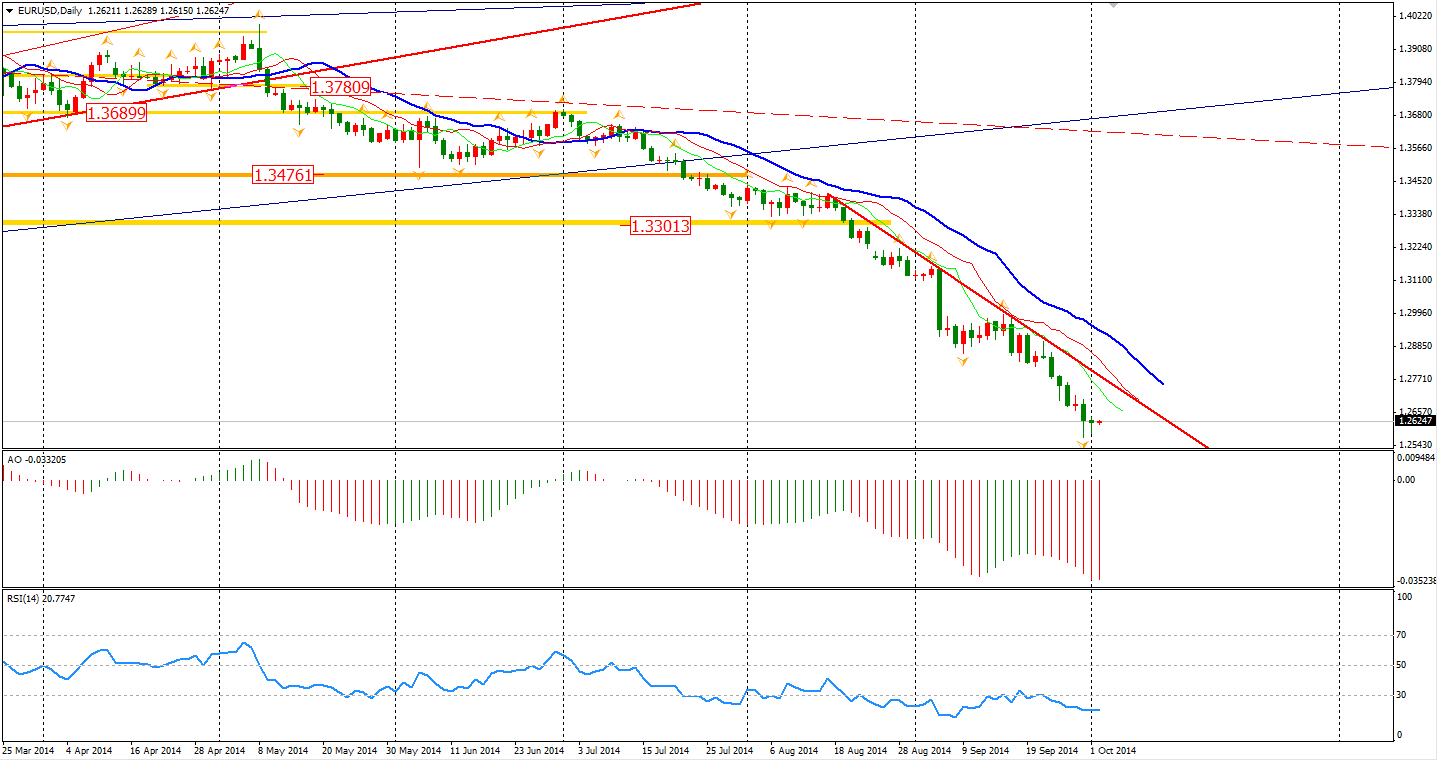

Similar worrisome signs are showing in Europe as well. Eurozone factories expanded at the slowest pace in 14 months, with manufacturing contracting in Germany, France, Austria and Greece. The figure has added extra pressure on the ECB to make moves on averting deflation. However, it seems like market participants are waiting for the decision tonight, and the Euro/Dollar consolidated near its recent lows of around 1.26.

The Asian stock markets were mixed on Wednesday as the Chinese markets were closed for the ‘golden week’ holiday. The Nikkei Stock Average lost 0.56%. The ASX 200 bounced 0.78% to 5334. In European stock markets, the UK FTSE was down 0.98%, the German DAX slumped 0.97% and the French CAC Index lost 1.15%. U.S. stocks slumped on downbeat economic data. The S&P 500 lost 1.32% to 1946. The Dow edged down 1.40% to 16805, while the Nasdaq Composite Index dropped 0.1.32% to 4422.

On the data front, Australia Building Approvals and Trade Balance will be released at 11:30 AEST. The UK Construction PMI will be at 18:30. ECB monetary decision will be released tonight and the US weekly Unemployment Claims will be at 22:30.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.