Earlier this morning, the Fed announced that it intends to keep its benchmark rate near zero as long as inflation remains under control. There will be no change until they see consistent gains in wage growth, long-term unemployment and other gauges of the job market. The central bank maintained conservative language signalling its plans to keep short-term rates low “for a considerable time” after it ends its monthly bond purchases after its next meeting in October.

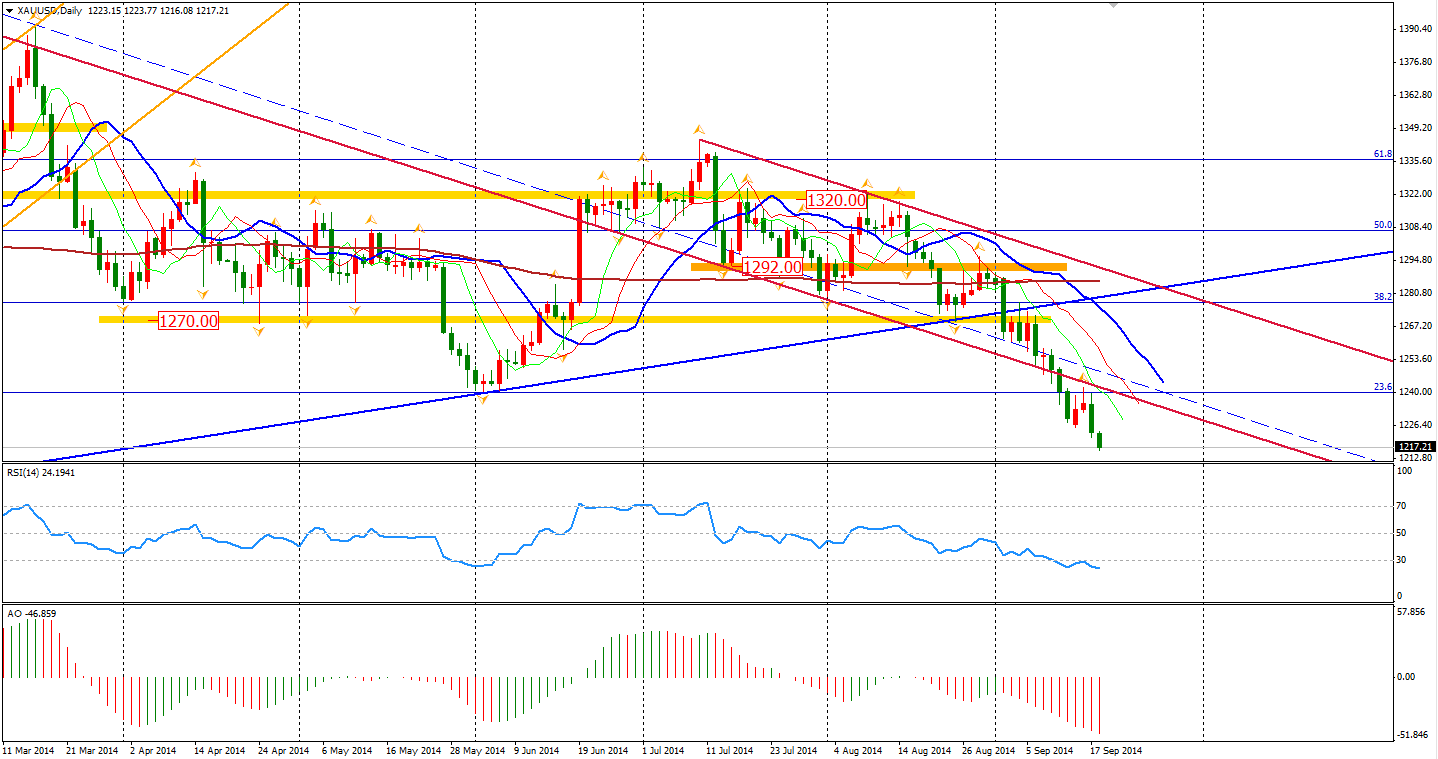

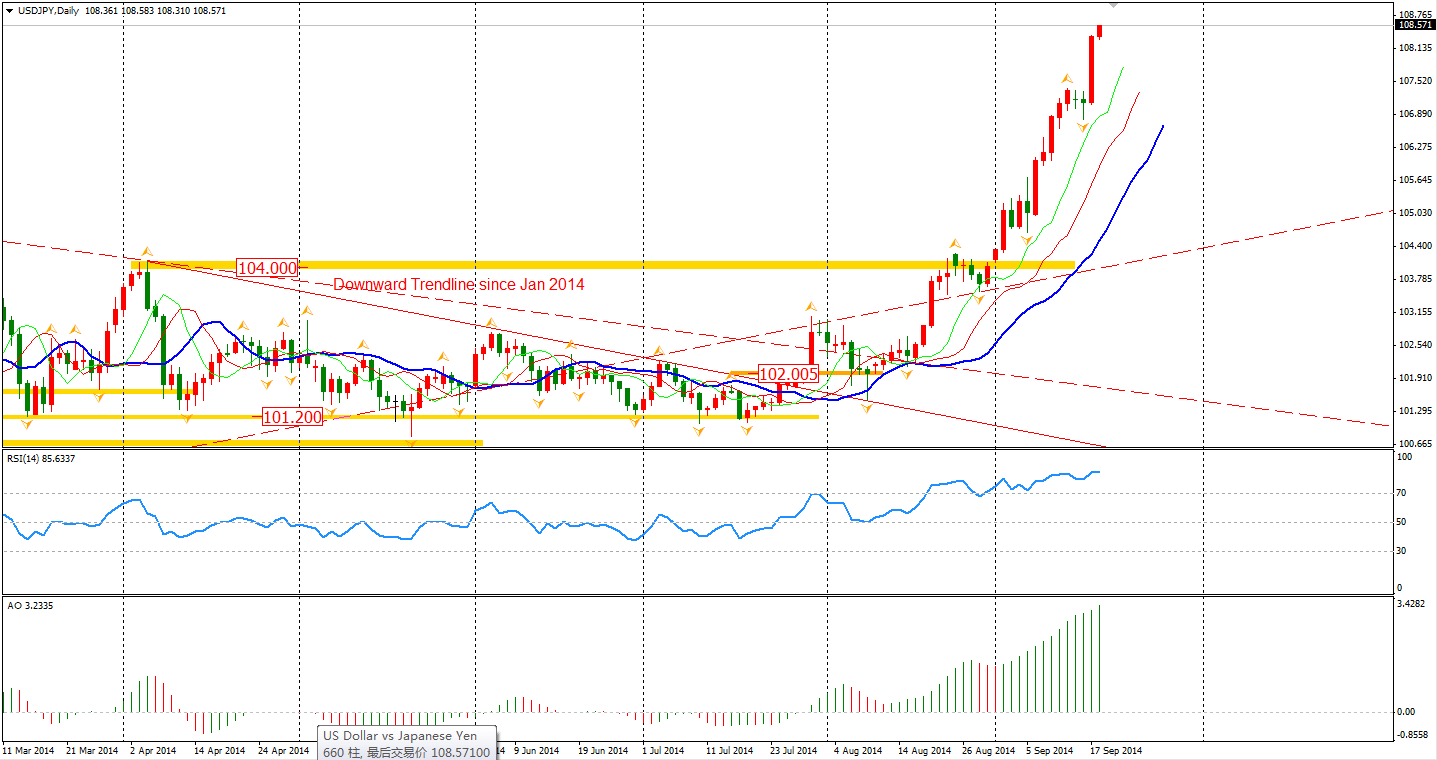

Nevertheless, the US Dollar kept its pace of ascent against other currencies, reaching a 14-month high after the release. Gold prices slumped further down and are now below $1220 per ounce.

China’s Central Bank has provided 500 billion RMB (US$81 billion) in a three-month loan to the nation’s five largest state-owned banks. The action is equivalent of a 0.5% cut in the reserve requirement ratio. The latest liquidity injection is thought as a response of recent weak economic data. It shows the monetary authority’s concern with the slowdown, especially when Fed is widely expected to quit QE and turn toward a gradual rate hike.

The industrial output expansion released last weekend was the weakest reading since the GFC. Investment and retail sales growth were also disappointing. However, Beijing shows more tolerance in this recent slowdown. In accepting that the GDP annual growth rate fell below 7.5%, it appears they are paying more attention to economic reform and liberalization which will certainly benefit China in the long term if they succeed.

With less demand for iron ore and coal from China, the Australian mining industry is suffering from the current low prices. The last time when commodity prices slumped during the GFC, Aussie/Dollar fell almost 40% to 0.60. That significant plummet is yet to happen to the exchange rate, due to the unusual operations from global central banks. However, as the Fed has pledged to normalize the monetary policy, how long will this situation remain?

The Asian stocks markets were fairly mixed yesterday before the FOMC meeting. The Shanghai Composite bounced 0.49% after the big slump on Tuesday to 2308. The Nikkei Stock Average lost 0.14%. The Australian ASX 200 dropped 0.7% to 5407. In European stock markets, the UK FTSE was down 0.14%, the German DAX gained 0.3% and the French CAC Index rose 0.50%. U.S. stocks closed slightly higher on FOMC dovish statement. The S&P 500 rose 0.13% to 2001.57. The Dows gained 0.15% to 17157, while the Nasdaq Composite Index was up 0.21% to 4562.

On the data front, UK Retail Sales will be released at 18:30 AEST. U.S. Building Permits and Unemployment Claims will be at 22:30. Philly Fed Manufacturing Index will be at midnight. However, the most watched event will undoubtedly be the Scottish Independence Vote, which may stir huge volatility in the Sterling and Euro. Investors should be wary of this risk.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.