Until last week, the USD has risen six weeks in a row, which is its longest appreciation since February, 2013. With Fed’s rate hike expectation having been mostly reflected in the price, will this week extend the count to seven consecutive weeks?

All major currencies rebounded against the Dollar yesterday. Commodity currencies like the Aussie and Kiwi were stronger than European ones.

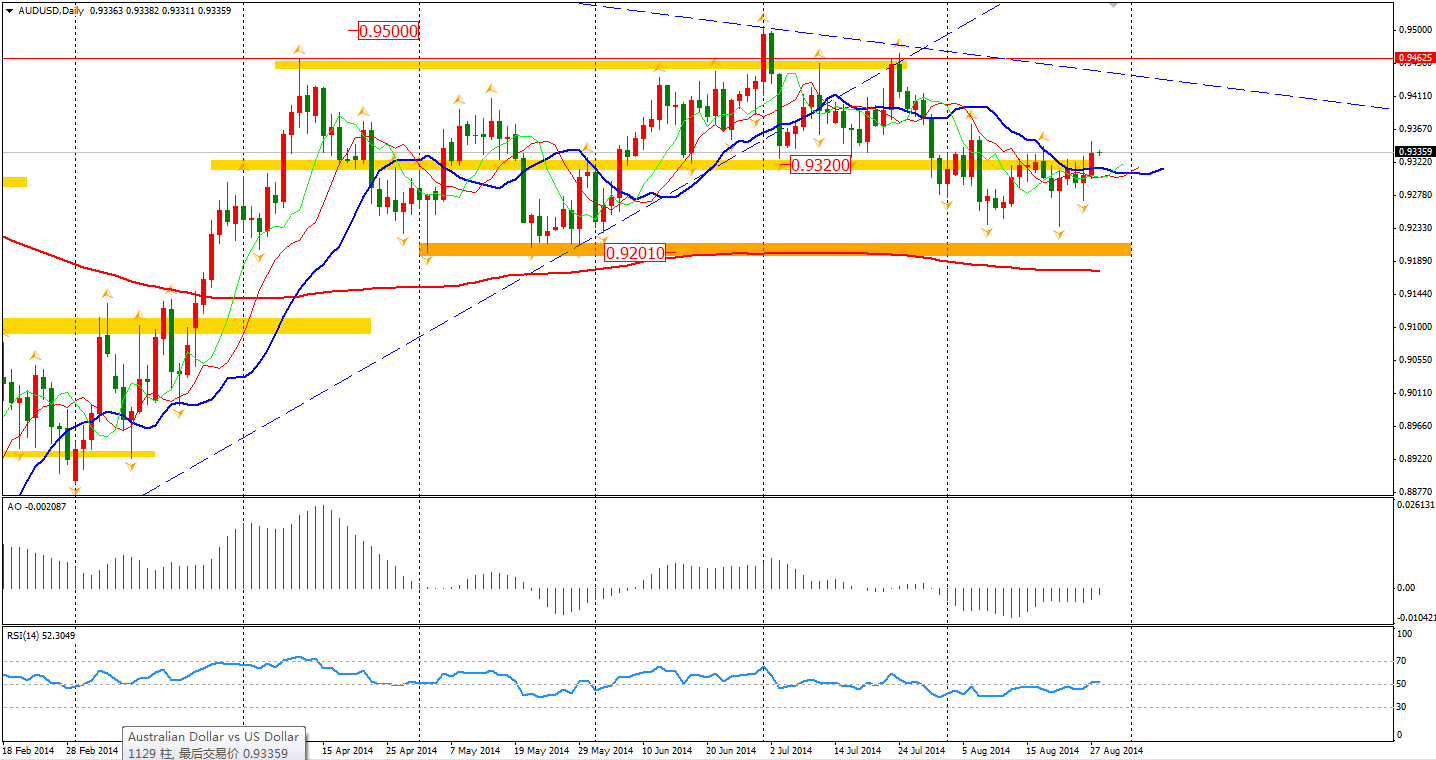

The Aussie jumped up and broke last week’s high of 0.9350 against the Dollar. The pair was supported in recent days as other currencies fell. Two failed attempts on breaking the 0.9240 support and the RSI standing upon 50 is giving us indications that the Aussie may be ignoring the subduing effect of a head-and-shoulders pattern to surge back to the upper boundary of 0.95 again.

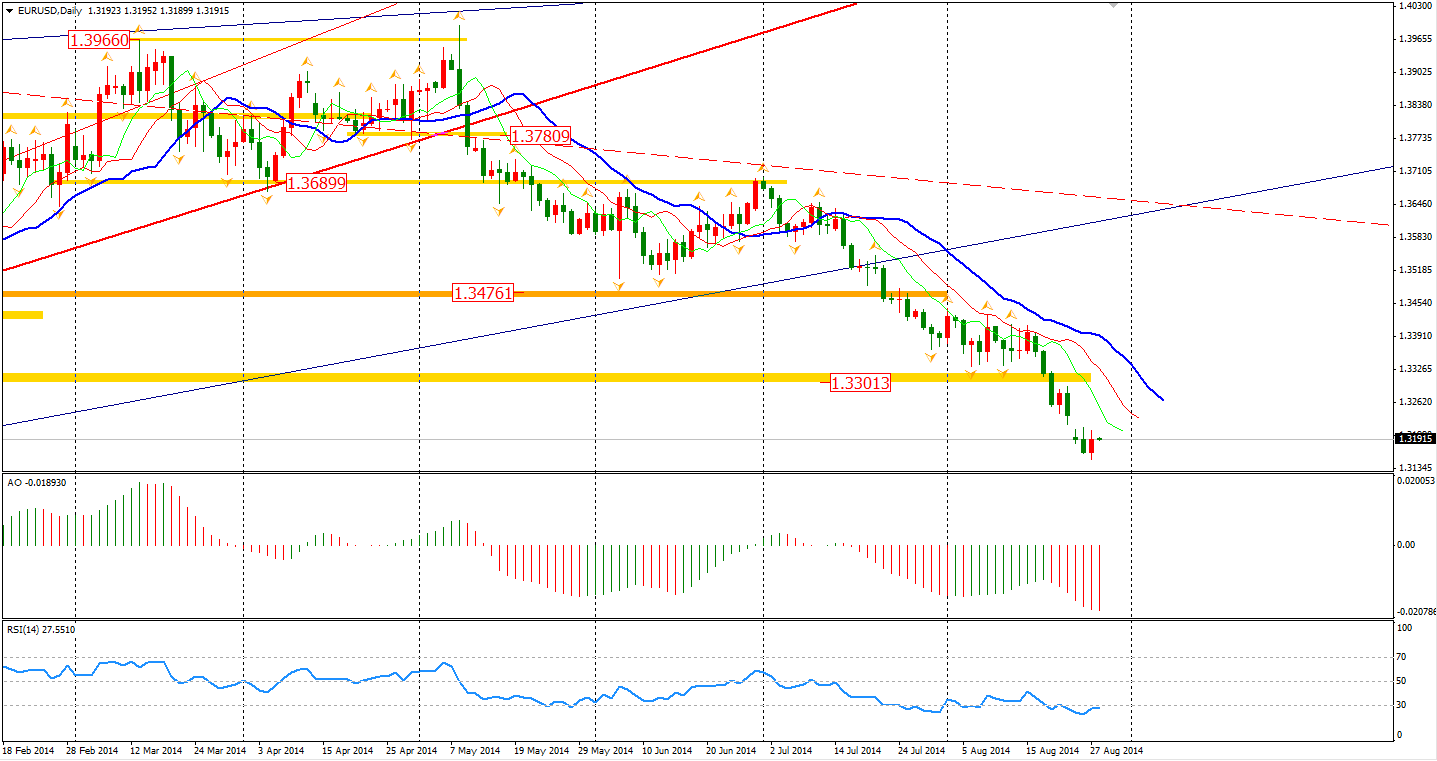

On the other side of the planet, the Euro was still struggling languishing on whether the ECB will bring about new stimulus measures in next week’s meeting. The ECB has assigned BlackRock to be its advisor on the ABS purchase program, which has somewhat confirmed speculations that further easing will be announced next week. Having said that, Reuters has contacted certain ECB sources who maintain that the committee may not act before a further decrease on the Eurozone inflation rate. The Euro surged to a level above 1.32 on this news, but fell again afterward.

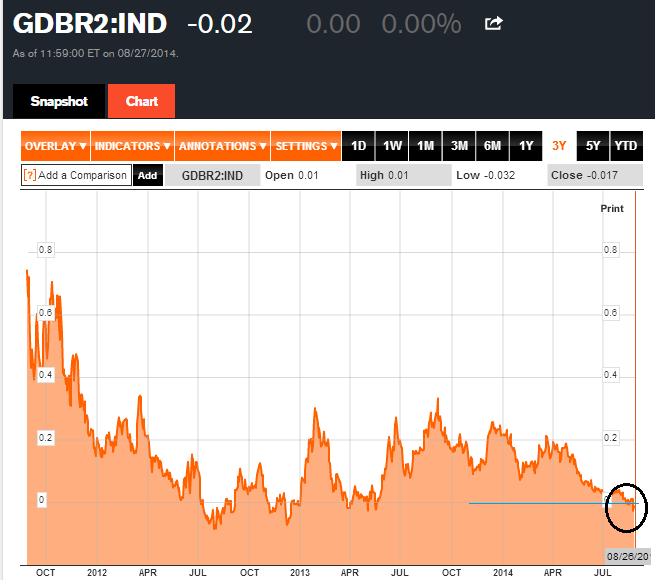

Whether it will happen in the next meeting or not, the timing may already too late. The market has come out of their bubbled outlook of Eurozone. The German 10-year Bund yield has reached a record low 90.5 bp and yields of German bonds within 3 years have fallen into negative area – revealing an extreme pessimism in the market.

Most Asian stocks markets closed slightly higher. The Shanghai Composite edged 0.11% up to 2209. The Nikkei Stock Average gained 0.09%. The Australian ASX 200 was up 0.24% to 5651. In European stock markets, the UK FTSE rose 0.05%, the German DAX lost 0.14% and the French CAC Index was lifted by 0.1%.

U.S. stocks closed with little changes. The S&P 500 closed at 2000.12, still at record high but the trading volume hit recent lows, revealing traders are lacking of confidence on further rise. The Dows gained 0.09% to 17122, while the Nasdaq Composite Index was down 0.02% to 4569.

On the data front, Australian Private Capital Expenditure will be released at 11:30 AEST. Traders should look to the U.S. Unemployment Claims and Prelim GDP at 22:30 AEST . Also, Pending Home Sales will be out at midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.