It was another quiet Monday for the FX markets with traders sitting still. Russia and the Ukraine, in a meeting mediated by Germany and France, have appeared to have made some progress. Neither side intends to escalate the situation and all have sought to play down the importance of the Friday’s incident. We will have to see if the recent updates on the “dozen civilians dead” said to have been attacked in an aid convoy by pro-Russian rebels will escalate tensions.

The FX maybe still but stocks have surged suggesting those markets’ fears are easing. European stock markets rebounded, the FTSE gained 0.78%, the German DAX surged 1.68%, and the French CAC Index advanced 1.35%. U.S. stocks also showed relief. The Dows closed 1.06% higher at 16838. The S&P 500 edged 0.85% higher to 1971, and the Nasdaq Composite Index was up 0.97% to 4508.

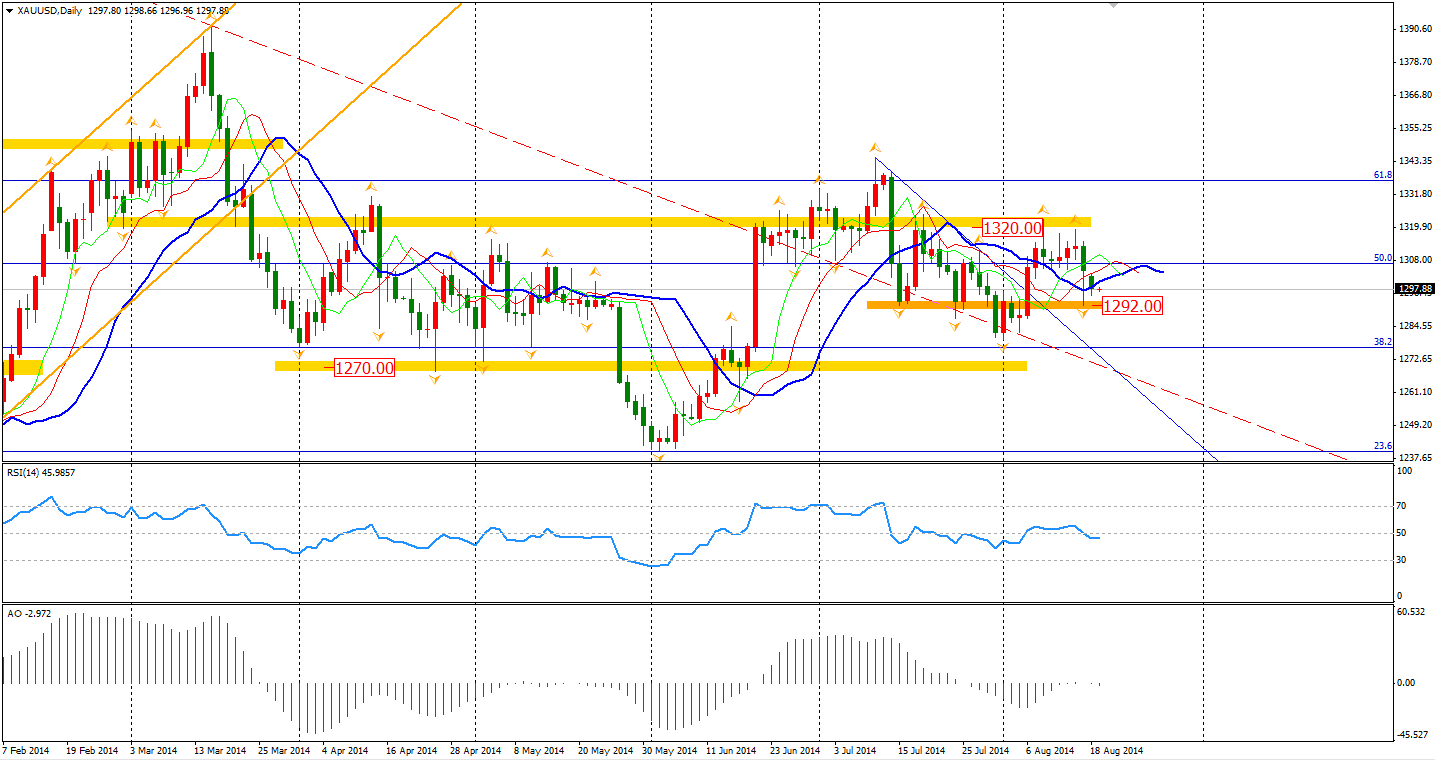

Friday’s incident may have made investors rush to safe haven assets, yet this run has seemed to ease yesterday. Gold, slightly fell to $1297 per ounce remaining in the sideway from $1292 to $1320.

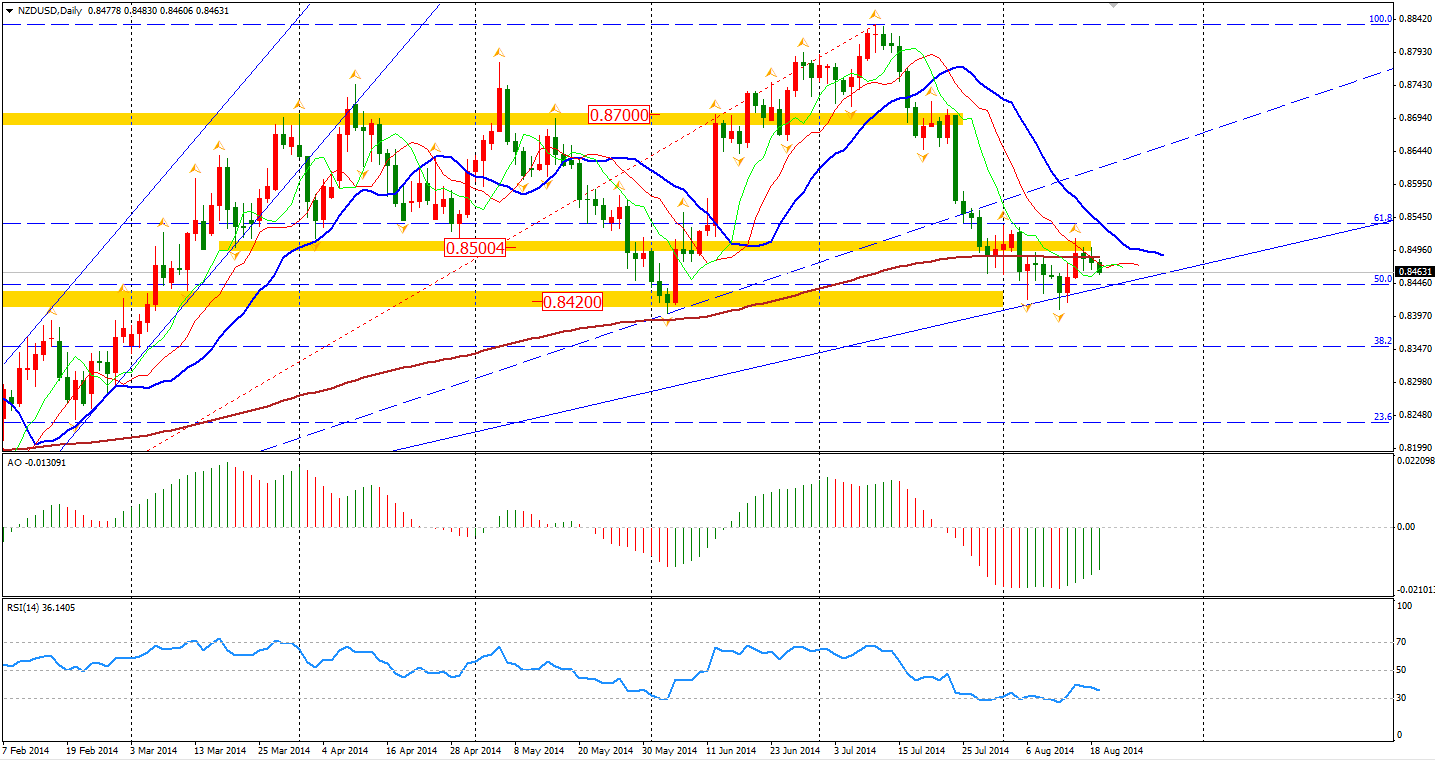

In the Southern hemisphere, the Kiwi Dollar continued its weakness against the background of geopolitical fears. The Reserve Bank of New Zealand has fulfilled half of its 2% interest rate raising plan, but in the most recent month, its currency has erased half of the gains against the Dollar since this year began. Carry trade may not be a good strategy during this unstable geopolitical environment. This may also explain why the Euro refuses to fall below 1.33 and why the NZD can hardly rebound. The NZDUSD is currently suppressed by a 200-day MA and 0.85 integer level, but supported by a bullish trendline formed from last July. Upward breakout may have more chances and it will be an entry sign of bulls.

Asian stock markets also edged slightly higher yesterday, led by the Mainland China market. The Shanghai Composite gained 0.57% to 2239, the Nikkei Stock Average closed flat and the Australian ASX 200 rebounded 0.37% to 5587.

On the data front, Australia Monetary Policy Meeting Minutes will be out at 11:30 AEST. UK inflation data will be at 18:30 AEST. Investors will also watch U.S. Building Permits and CPI are at 22:30 AEST.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.