Again, geopolitical tensions became the focus of the market. Russia has declared intentions of sending humanitarian convoy to eastern Ukraine, which is suspected by Western nations as a pretext for invasion, mirroring the way Russian troops entered Georgia in 2008. Kiev is refusing any trucks entering the border unless monitored by Ukrainian government. Relief came with the news that Russia and Ukraine has reached an agreement whereby the Red Cross will be passing over the humanitarian supplied once meeting the convoy at the border.

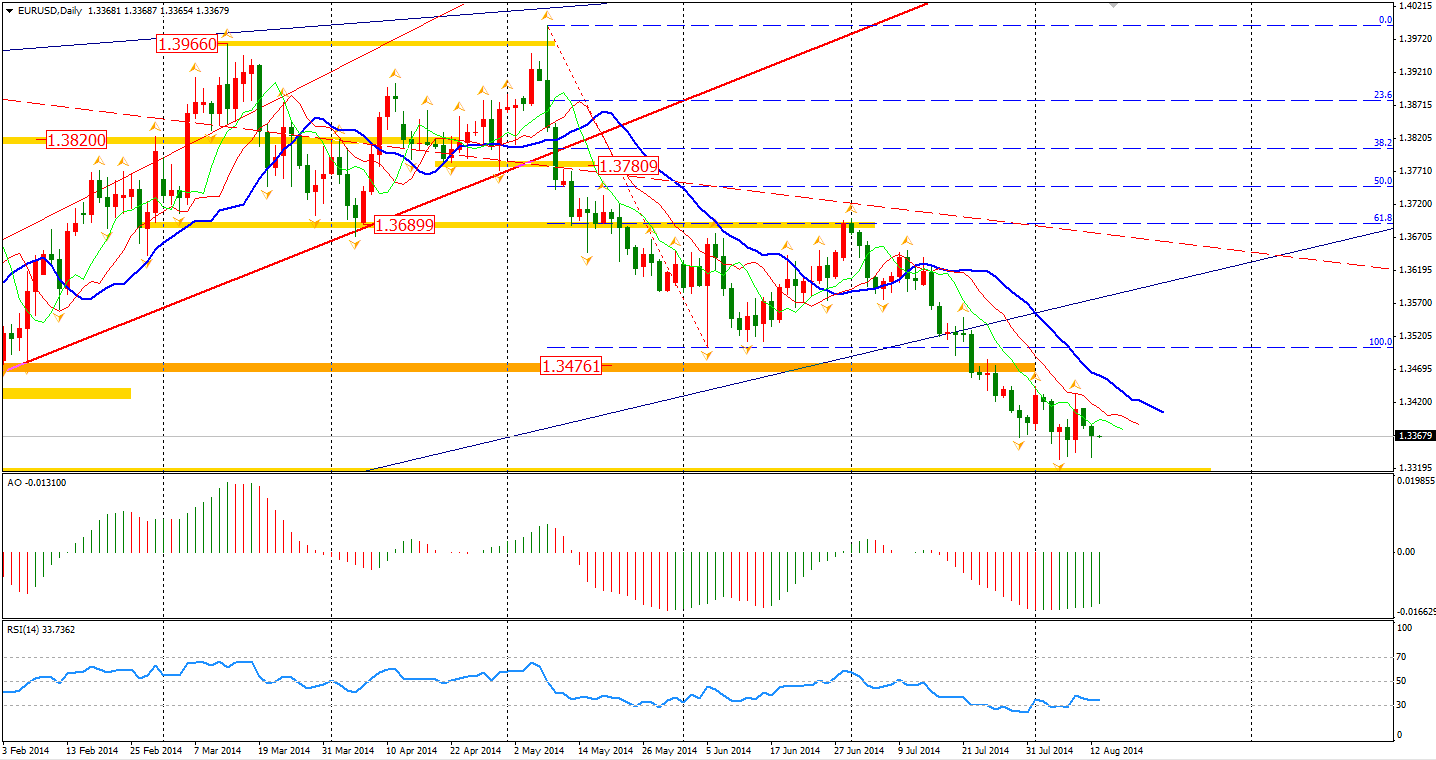

The escalating tension has pared the Euro near to its 9-month low 1.3335 on Tuesday. German ZEW Economic Sentiment fell to 8.6, the lowest level since December 2012, and well below the expected 18.2. German companies’ willingness to invest appears to be hurt by the tensions between EU and Russia.

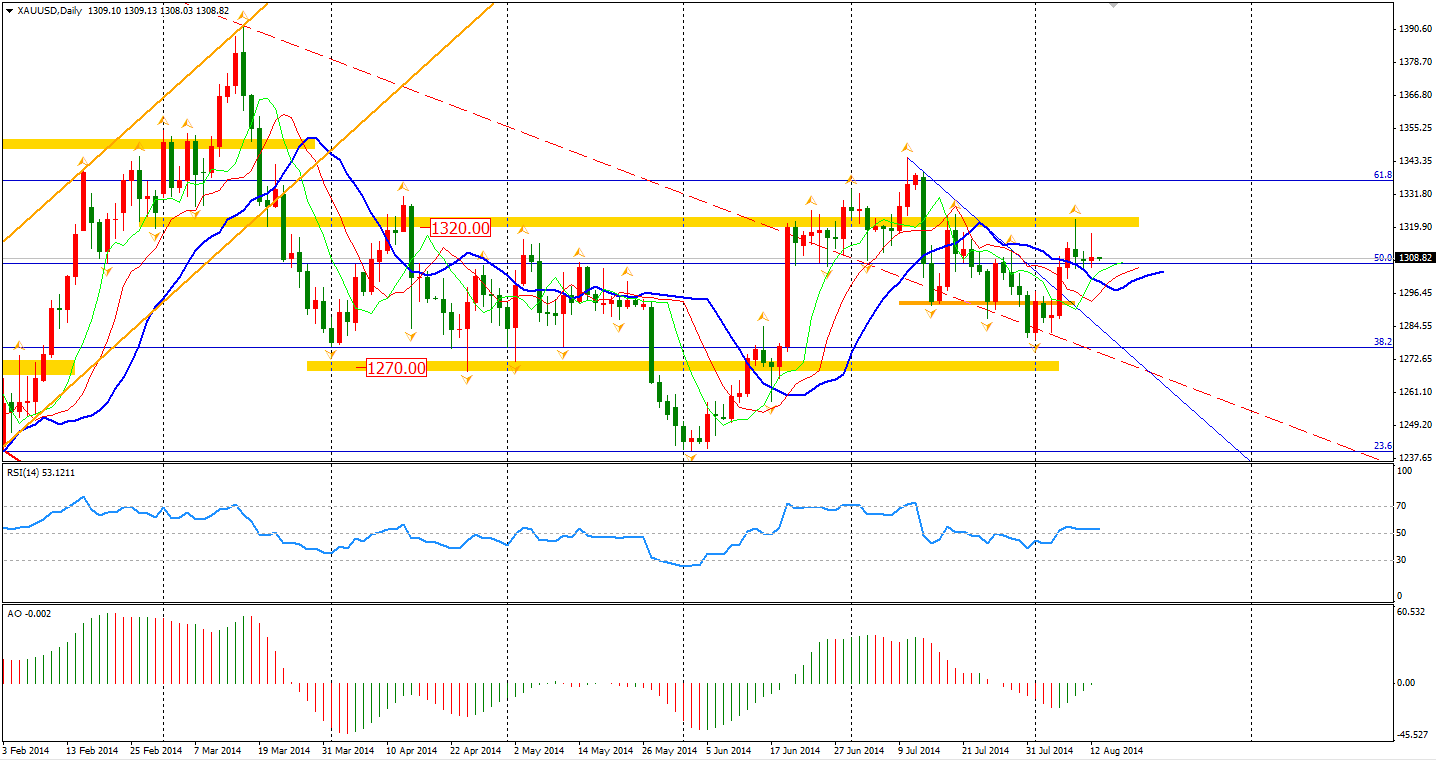

Meanwhile, Israel and Hamas has failed to make any progress on a truce in Gaza. The news touched the nerve with the market. Gold surged to $1317 per ounce from the day low at $1305, but it then erased all gains in the second half of U.S. session. If the insurgencies worsen in Ukraine or Middle East in next few days, the resistance level of $1320 still can be tested.

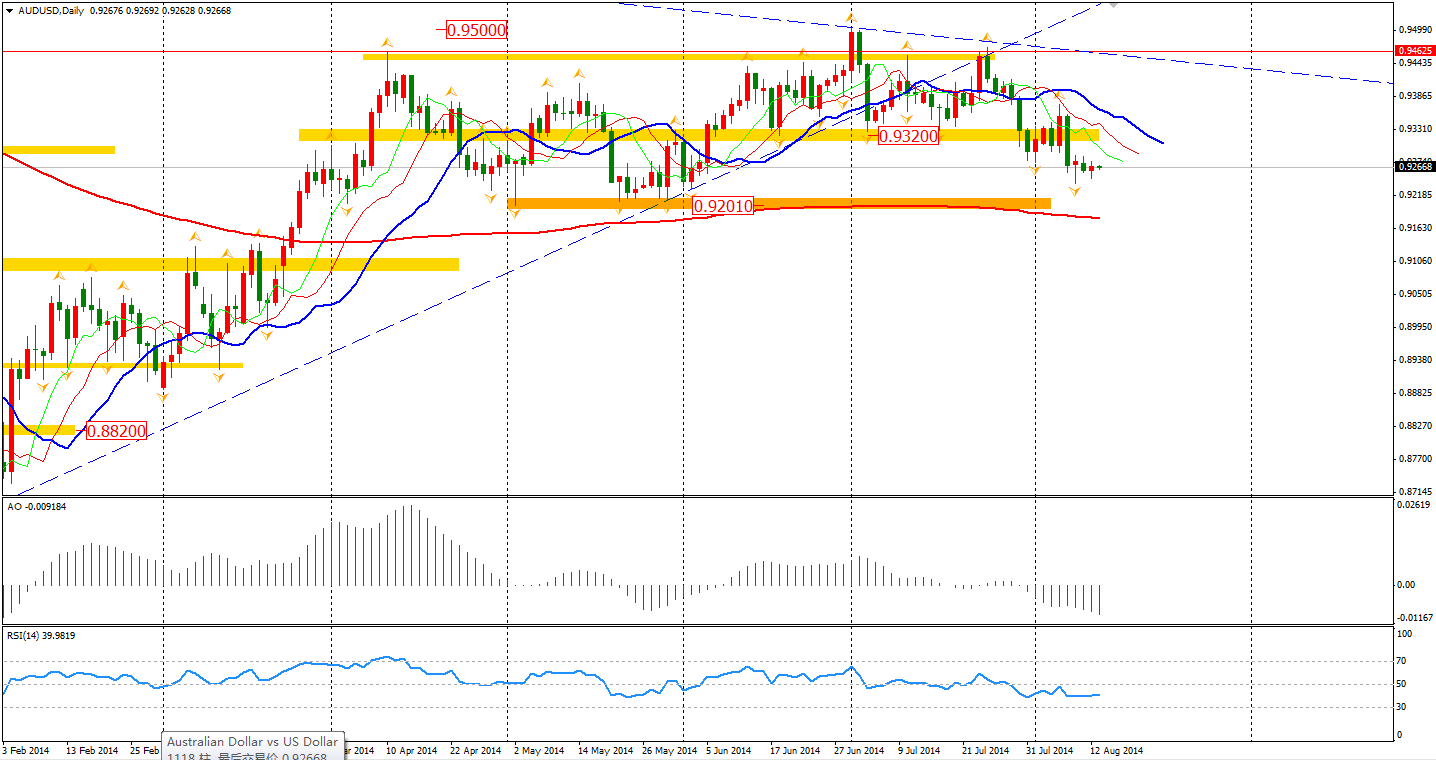

The Aussie gained some support from the upbeat NAB Business Confidence which was 11 against an expected 8. However, the data is hard to maintain at this level and provide little help for the currency. The Aussie Dollar kept its weakness under 0.93 at the expectation of RBA’s rate cut decision increasing amongst the market. According to the CFTC data, the bearish position of the AUD has reached its highest level since January after the unemployment rate surprisingly rose to 6.4%, which was even higher than the U.S. current level. We can maintain a bearish outlook of Aussie Dollar.

The Asian stocks markets had mixed results yesterday. The Nikkei Stock Average rose 0.2% while the Shanghai Composite edged 0.14% lower to 2222. The Australian ASX 200 surged 1.34% to 5530 as Business Confidence reached its 10-month high. In the European stock markets, the FTSE closed flat, the German DAX slumped 1.21%, and the French CAC Index lost 0.85%. U.S. stocks closed slightly lower. The Dows closed flat at 16560. The S&P 500 dropped 0.16% to 1934, while the Nasdaq Composite Index was down 0.27% to 4389.

On the data front, Japan Q2 GDP will be out at 9:50 AEST. Australian Westpac Consumer Sentiment and Wage Price Index will be released shortly after. Also, in the afternoon, China major economic data like Industrial Production will be published. UK’s job market data is at 18:30 and US Retail Sales will be at 22:30 AEST.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.