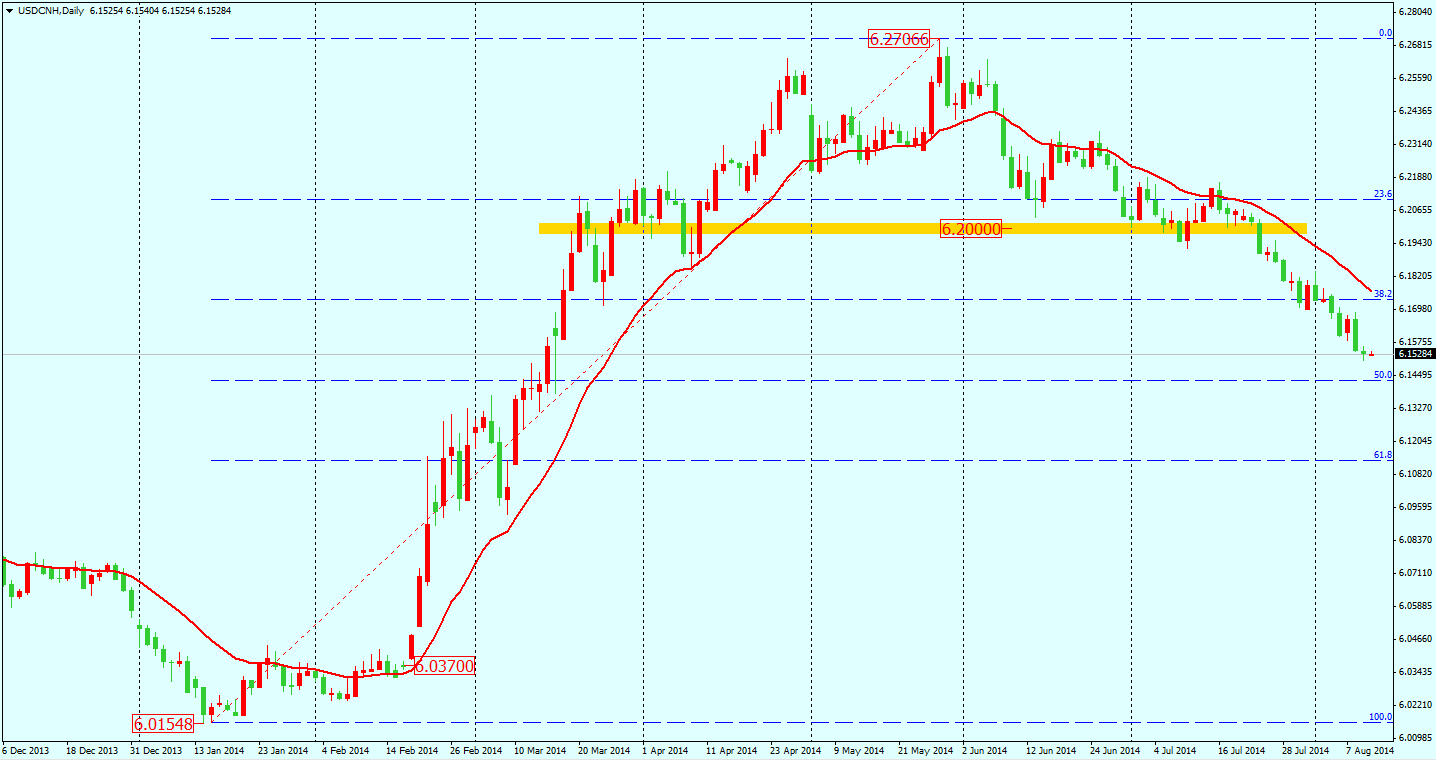

RMB continued its appreciation against the Dollar – reaching a low not seen since mid-March. Last week, China’s trade surplus rose to record levels in July, with exports surprisingly growing 14.5% year on year. The trade data suggests that the recovering international demand may offset the weak domestic consumption helping China achieve its 7.5% annual growth target growth rate. The fall of USDCNH may continue for a while as the China Central Bank has now declared it’ll quit the market operation. We have to remember though, a high growth rate in exports is hard to sustain and the appreciation of RMB may not remain for too long.

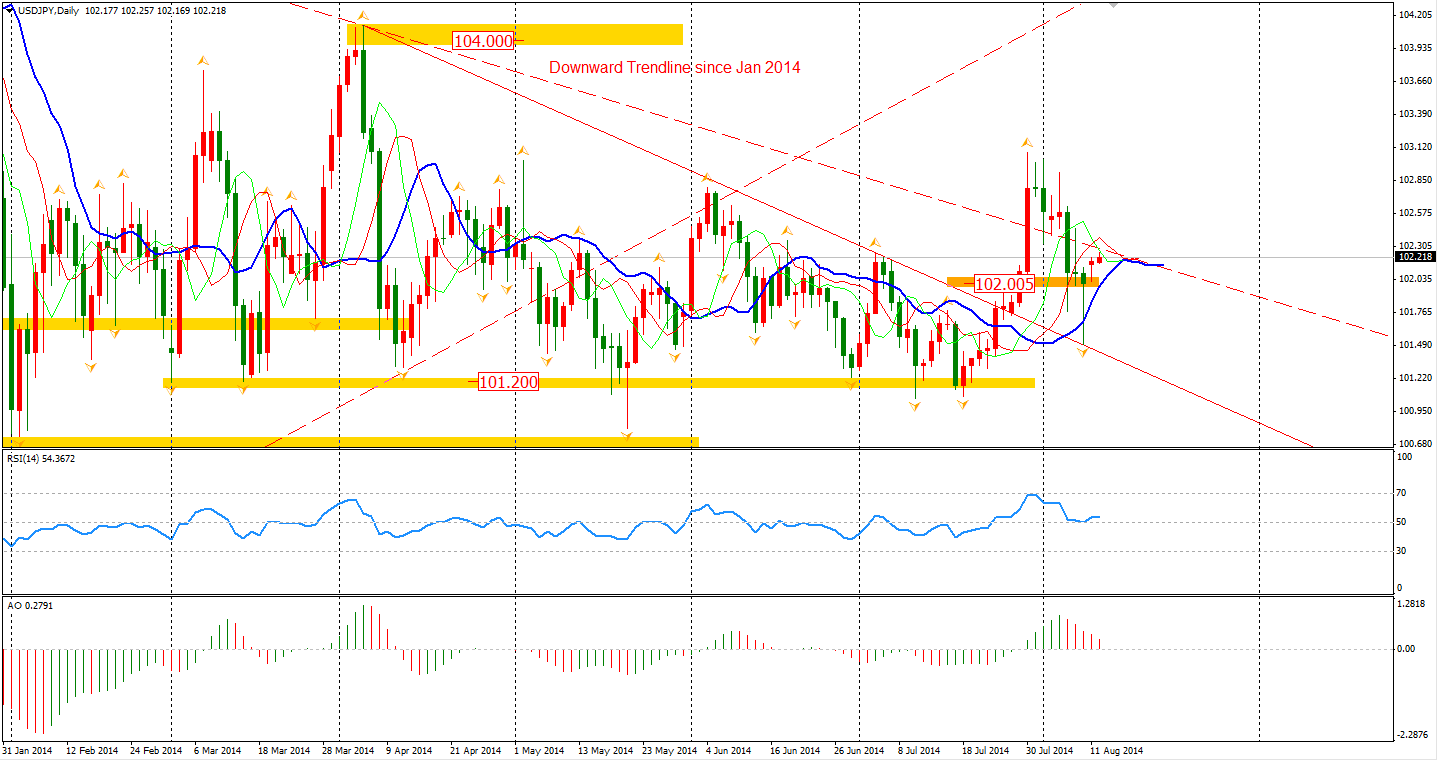

Dollar/Yen bounced slightly from the 102 integer support level, signalling that its fall may cease with the Japan Q2 GDP release is coming soon. The forecast for this GDP growth tomorrow morning is a 6.8% contraction, taking into consideration the significant impact from the recently implemented consumption tax rate raise. Investors are now expecting that the BOJ will have to introduce further monetary stimulus in the near future. These expectations will certainly weaken the Yen. Nevertheless, traders should still bear in mind the risks from geopolitical tensions.

Asian stock markets rebounded on Monday lead by the Japanese market. The Nikkei Stock Average surged 2.38% but has yet to recover from Monday’s loss. The Shanghai Composite bounced 1.38% to 2224. The Australian ASX 200 rose 0.4% to 5457. In European stock markets, the FTSE closed 1% higher, the German DAX rocketed 1.9%, and the French CAC Index surged 1.2%. U.S. stocks closed in a lightly traded session. The Dows gained 0.1% to 16570. The S&P 500 advanced 0.28% to 1937, while the Nasdaq Composite Index was up 0.69% to 4401.

On the data front, Australia NAB Business Confidence will be out at 11:30 AEST. Another data that may attract traders’ interest is the ZEW Economic Sentiment of Germany and Eurozone.

In the rest of this week we will see several data releases for GDP and Inflation from major developed nations. These economic data will provide the market with more clues on each nation’s economic current conditions and potential policies.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.