Things look promising for the US economy with consumer confidence returning to levels before the GFC. Yesterday, the U.S. CB Consumer Confidence Index hit highs not seen since October 2007. The data was 90.9 against a forecasted 85.5 and a previous 86.4. The Dollar was inspired and was stronger across the board after the release.

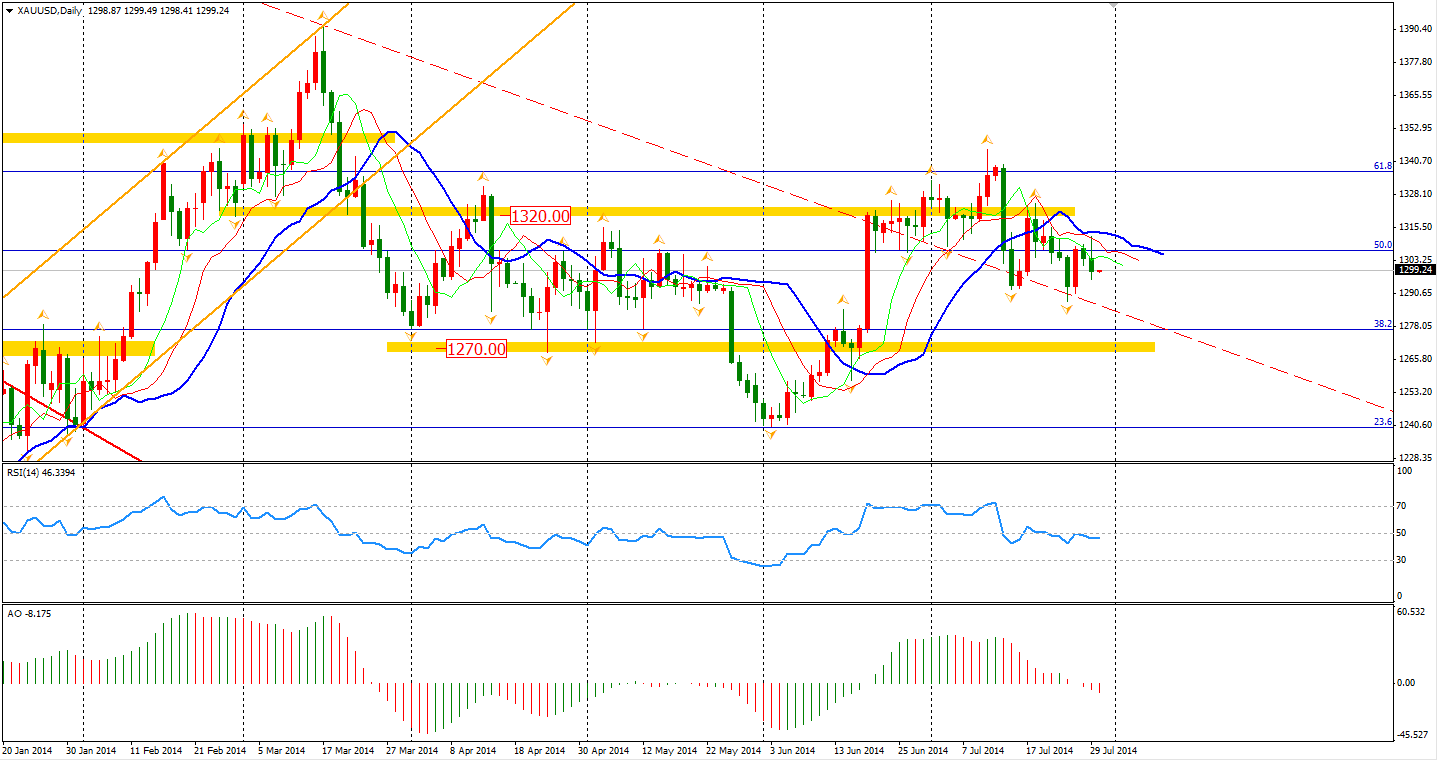

Gold prices crashed through the $1300 integer level, suggesting weakness may continue even though there are no signs of relief from either the Ukraine or Gaza.

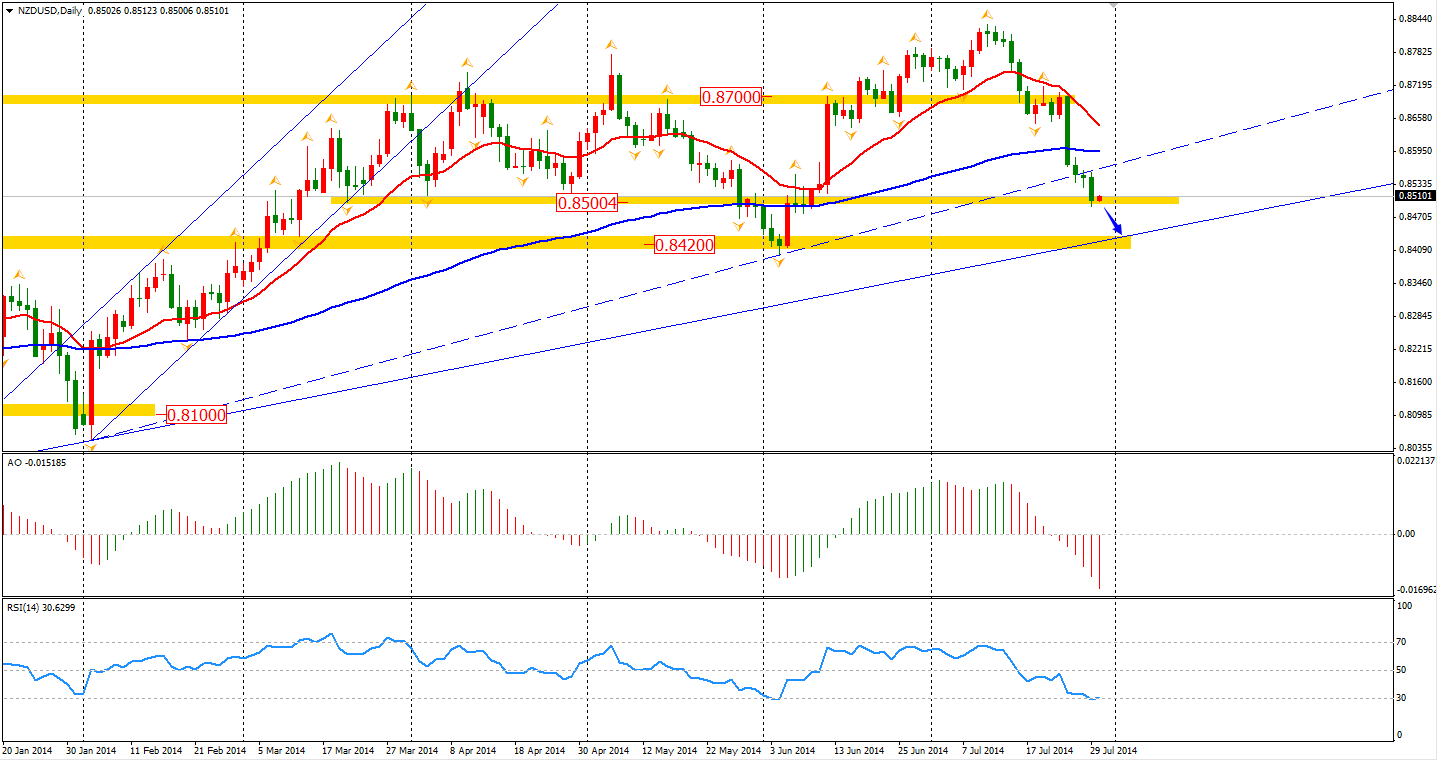

The Kiwi Dollar pared to 0.85 yesterday with news from major New Zealand dairy producer Fonterra with expectations that milk prices will fall in the near future. Looking at it technically, the exchange level has moved to its former support level, and will probably test June’s low at 0.84 and the upward trendline started from August 2013. However, the fundamental condition is in the New Zealand Dollar’s favour. The highest interest rate in the developed world will certainly attract more funds to purchase at its low level.

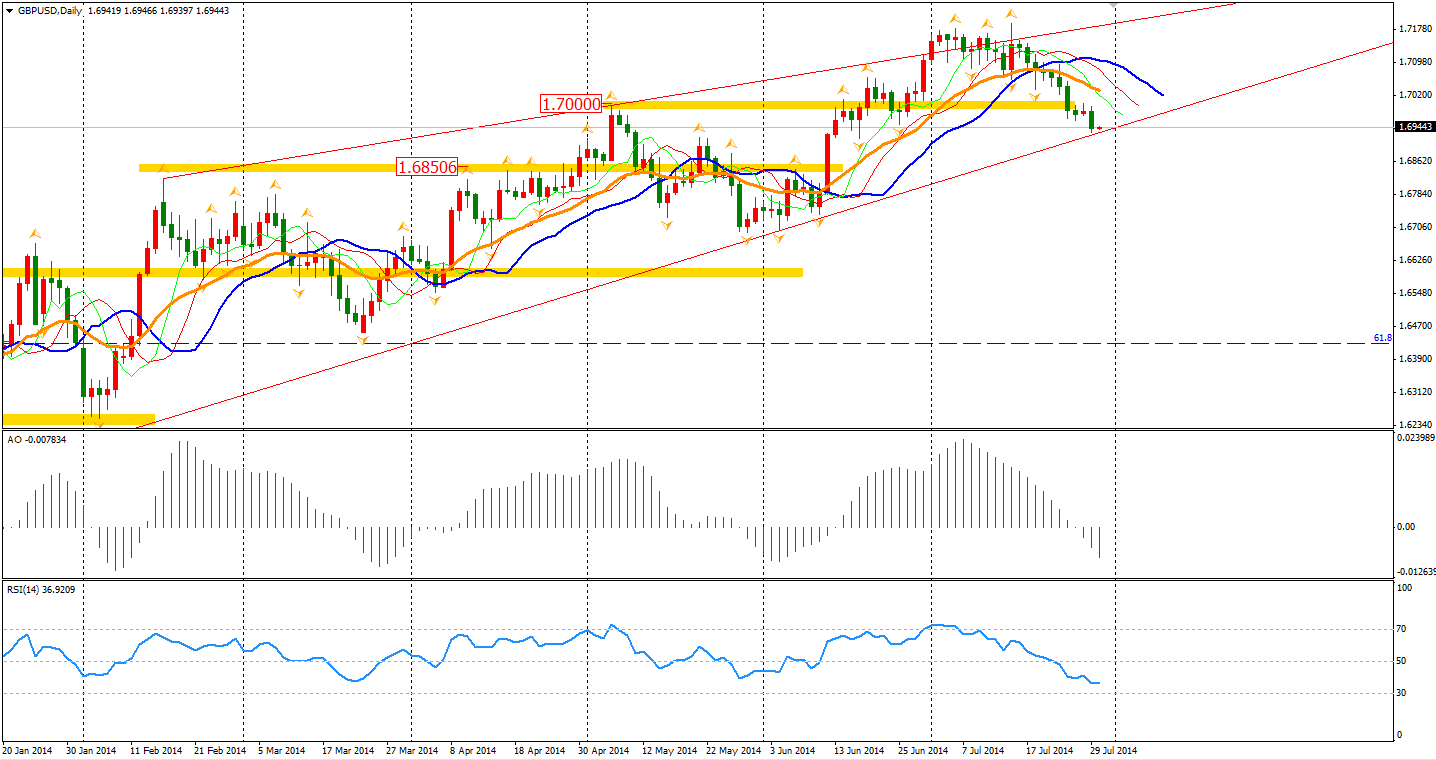

UK’s Mortgage Approvals surprisingly increased to a four-month high. Yet the data still did not improve the weakness of the sterling. The Pound/Dollar broke support of a 50-day MA right after it hit the day’s high at 1.6994. Since this July, upbeat data like CPI, unemployment rate and GDP all failed to push sterling to a newer high against the Dollar. It is reasonable to speculate the bullish trend of Pound will ease in the short term.

Asian stocks moved higher, as earnings reports in Japan and Australia were better than expected. The Shanghai Composite rose 0.24% to 2183 whilst the Nikkei Stock Average gained 0.57% and the ASX 200 advanced 0.20% to 5588. In the European stock markets, the FTSE closed 0.29% higher, the DAX rose 0.58%, and the French CAC advanced 0.48%. The U.S. closed slightly lower whilst the U.S. and EU makes decisions to adopt a new round of sanctions on Russia. The Dows lost 0.42% to 16912. The S&P 500 edged 0.45% lower to 1970, while the Nasdaq Composite Index was down 0.05% to 4443.

The all-important U.S. data is coming tonight. ADP Non-Farm Employment Change will be released at 22:15 AEST. GDP will follow 15 minutes after and the FOMC Statement will be out at 04:00 tomorrow morning.

MXT Global Pty Ltd ACN 157 768 566 AFSL 428901. Trading derivatives and forex carries a high level of risk to your capital and should only be traded with money you can afford to lose. Ensure you read our FSG, PDS and Terms & Conditions, and seek independent advice, to fully understand the risks, before deciding to enter into any transactions with MXT Global. The general information on this website is not directed at residents in any country or jurisdiction where such distribution or use would contravene local law or regulation.

Company disclaimer for reports:

#The views and content above are Anthony Wu's own and do not reflect the views of MXT Global.

The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and not as investment advice.

MXT Global does not warrant the completeness, accuracy or timeliness of the information supplied, and shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content.

No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.#

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.