After hiking at the end of 2015 the Fed has now lowered Expectations to 2 Raises in 2016

The USD recorded the worst quarterly performance since 2010 as Fedspeak and Fedfacts have clashed. The March Federal Open Market Committee (FOMC) disappointed with its dovish tone, specially after the European Central Bank (ECB) had gone all out on its quantitative easing (QE) push earlier in the month. Fed member hawkish remarks reversed the USD down trend, only to be brought down to earth after Fed Chair Yellen’s speech at Economic Club of New York.

The release of the March FOMC minutes could put further downward pressure on the USD when they are published on Wednesday, April 6 at 2:00 pm EDT. Comments from Federal Reserve Bank of Kansas City President Esther L. George will be actively searched as she was the only dissenter on the vote to hold interest rates unchanged.

Fed facts and official statements have stressed the caution with which the central bank will approach the decision to raise rates in the future. That patient stance has made the market punish the USD versus other pairs as it is unlikely there will be more than 2 rate hikes in 2016, when at the end of 2015 the expectation backed by Fed forecasts was double that.

The EUR/USD had a 0.10 percent loss in the last 24 hours. The USD advanced slightly ahead of the release of the March Federal Open Market Committee (FOMC) meeting minutes. The USD has been able to gain as investors looks for safety and close long positions ahead of the uncertain comments from Fed members on the U.S. economy and the effects of a global slowdown are having on growth.

Commodity currencies were hit by the risk off move combined with the uncertainty surrounding the energy market. The Doha summit has been mostly a source of stability for the volatile price of energy, but comments from Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC nations has raised doubts about the oil output freeze agreement to be signed on April 17. Saudi Arabia and Iran continue at the heart of the disagreement.

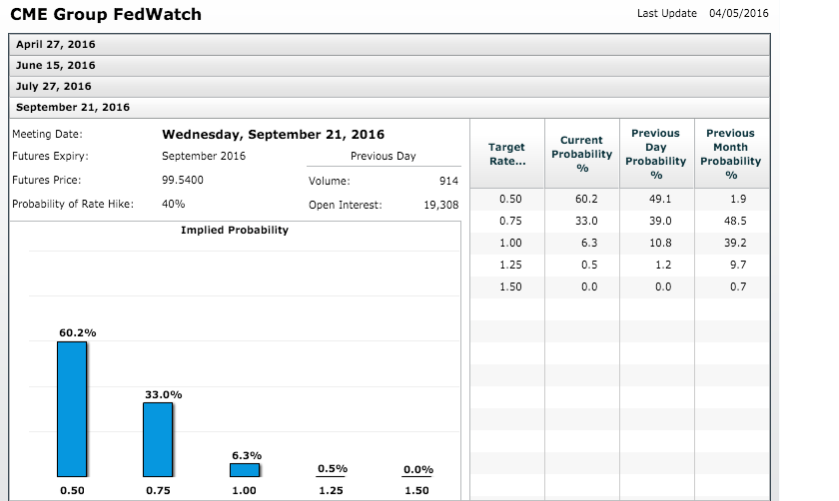

The CME Fed Watch Tool is showing that the market and the Fed agree on a limited rate hike outlook. The September FOMC is a likely candidate for a rate hike with 40 percent of a rate hike. June and December are also in the running as they feature a press conference following the publication of the Fed Funds rate statement.

The CME Fed Watch tool has a 18 percent for June and 57 percent for December. Going by past Fed behaviour June is probably too early and the central bank would be acting with a limited data set. The main challenge with September is the proximity of the November U.S. presidential election and the risk of a rate hike seen as biased to a particular candidate. December then becomes the most probably choice, but remains to be seen if the U.S. economy will be ready by then, so far the Fed can afford to be patient and has said through its member’s statements that it could let inflation run hot before raising rates.

USD events to watch this week:

Wednesday, April 6

10:30am USD Crude Oil Inventories

2:00pm USD FOMC Meeting Minutes

Thursday, April 7

8:30am USD Unemployment Claims

Tentative EUR ECB President Draghi Speaks

5:30pm USD Fed Chair Yellen Speaks

Friday, April 8

4:30am GBP Manufacturing Production m/m

8:30am CAD Employment Change

8:30am CAD Unemployment Rate

*All times EDT

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.