The Bank of Canada (BoC) held the benchmark interest rate at 0.50 percent in the first policy meeting of the year. The market expectations for a rate cut had accelerated given the rapid decline of oil prices and the weakness of global stock markets. The Canadian dollar had followed the price of oil on a downward move and it was speculated that the BoC could cut rates to get ahead of the market. The Canadian government on Tuesday had given no details on the first budget of the Liberal government putting the spotlight squarely on the central bank. BoC Governor Stephen Poloz returned the favor as he specifically mentioned that the bank will await the fiscal boost before it intervenes to further stabilize the Canadian economy.

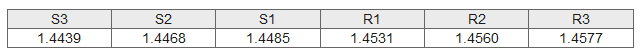

The announcement of a lack of rate change managed to reverse the upwards trend of the USD/CAD that was on its way to break above 1.4690 and ended up trading below the 1.45 price level after the speech of Governor Poloz and a recovery of oil prices. West Texas oil had another volatile day as concerns about oversupply remain. The price fell below $26.70 prompting commodity currencies to tumble, but it managed to recover to near $28. In the last 24 hours oil still was 1.89 percent lower, with no signs of potential price stability out of the Organization of the Petroleum Exporting Countries (OPEC) members or U.S. shale producers.

The USD/CAD fell 0.51 percent as the Canadian dollar appreciated thanks to the rhetoric of the Bank of Canada. The market’s focus is now on the March budget to be delivered by the Liberal government. The campaign that won them the election stressed investment that would boost growth but put Canada on a deficit. As it turns out the Conservative government was already at a deficit, so its just a question of how much stimulus does Prime Minister Trudeau is willing to inject to help Canada withstand the heavy headwinds it faces. Governor Poloz said that the BoC was considering a rate cut, but will also be awaiting the effect of fiscal policy before committing to another rate cut.

USD/CAD Technical

Canada continues to be close to a recession and the central bank opted to wait as market conditions deteriorated too quickly to evaluate if the factors are permanent or temporary. The BoC has a limited runway of cuts it can make, and although it has hinted at unconventional policies it is awaiting the unveiling of the Government’s fiscal package which could be quite significant.

The Bank of Canada reduced growth forecasts for 2016 from 2 percent down to 1.4 percent given the rout in commodity prices and the failure of exporting industries to increase output to offset the losses. The central bank does remain optimistic in the long term as the 2017 forecast was only downgrades slightly from 2.5 percent o 2.4 percent.

CAD events to watch this week:

Friday, January 22

8:30am CAD Core CPI m/m

*All times EST

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.