European bourses are expected to open moderately higher on Monday following a mixed end to trading on Friday and concerning trade figures from China over the weekend. The trade balance figures were the first of a number of Asian data releases this week that markets are likely to take a particular interest in.

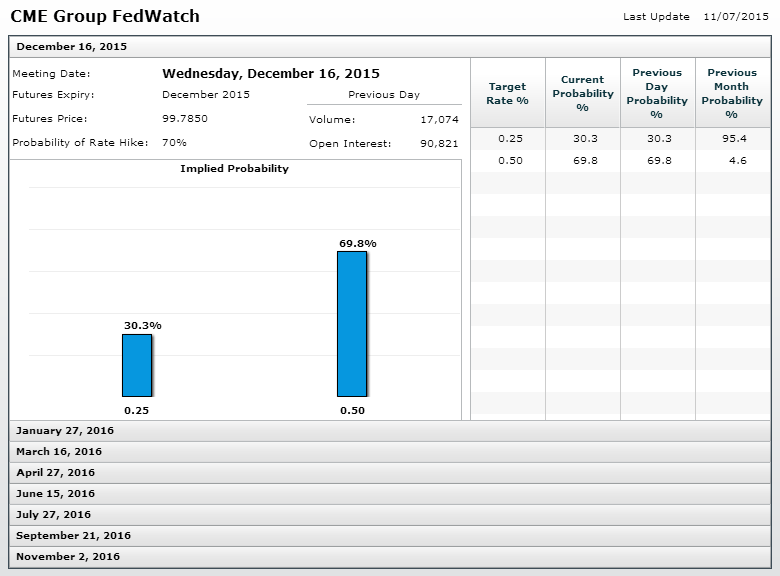

Friday’s U.S. jobs report was much stronger than the markets were anticipating which dramatically increased the chance of Federal Reserve tightening at the December meeting, according to Fed Funds futures. The probability of a rate hike now stands at around 70%, up from around 58% ahead of the report and 35% prior to the meeting a couple of weeks ago. With only a couple of notable pieces of data coming from the U.S. this week, we could see focus shift to emerging markets and how they are coping with the increased probability of a rate hike, especially when we’re simultaneously getting reports on the regions cooling economies.

Source – CME Group

Back in August, fears over a rate hike sent emerging markets into a frenzy and while the result of this was hopefully that a rate hike is now already priced in, we can’t write off the possibility that more panic will ensue. Moreover, Friday’s jobs report did not just prompt an increased pricing in of a December rate hike, we also saw the odds for a second hike in April rise quite significantly as well. The prospect of recurring hikes could be what makes emerging market investors nervous once again.

Many markets in Asia are in the red at the start of the week but there’s no sign yet of panic. More importantly, Chinese indices are currently performing very well which at least for now may help ensure some stability. Although as we’ve seen on many occasions in the past, that can change in a heartbeat so we shouldn’t get complacent.

Another poor batch of trade data overnight appears to have done nothing to shake investor confidence in China, despite a significant drop in both imports and exports being behind the record trade surplus. Other countries in the region haven’t shaken this off so well given that they depend heavily on China for trade but maybe the possibility of more stimulus from the People’s Bank of China on the back of this is enough to keep investors happy. I’m sure this will be tested more than enough this week with inflation, industrial production, fixed asset investment and retail sales data all to come.

In Europe we’ll get the latest trade data from Germany which should shed further light on how the slowdown in emerging markets and weaker demand in China is impacting the country’s exporters. We’ll also get the latest Sentix investor confidence reading which is expected to rise slightly to 13.2.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.