EUR/USD is calm on Wednesday, as the pair trades in the mid-1.13 line in the European session. On the release front, there are no economic events out of the Eurozone, but ECB head Mario Draghi will testify about the ECB Annual Report in the European Parliament. In the US, Federal Reserve head Janet Yellen continues a second day of testimony in Congress. The US will release New Home Sales, with the markets expecting a softer reading in the January report.

Janet Yellen testified before a Senate committee on Tuesday, saying that the Fed was “unlikely” to raise interest rates in the next few months, given current economic conditions. Her remarks seemed aimed at quelling rising speculation about a rate hike sometime in mid-2015, which has helped boost the US dollar’s performance against its major rivals. Yellen noted that the continuing growth should lead to the unemployment rate continuing to fall. The Fed Chair will resume testimony before the House Financial Services Committee on Wednesday, but it’s not likely that Yellen will say anything that could shake up the markets.

On the Eurozone front, Greece’s list of economic reforms was accepted by the country’s creditors on Tuesday, paving the way for an extension of the bailout for another four months. The Greek government has promised to continue with privatization plans and to meet budget targets. Still, the extension is a stop-gap measure and with sharp differences remaining between Greece and its creditors, the bailout crisis is far from over.

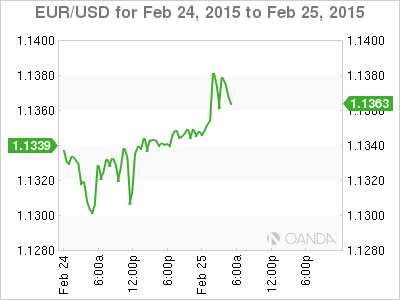

EUR/USD 1.1348 H: 1.1388 L: 1.1339

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.