The euro is flat on Thursday, as EUR/USD trades at the 1.13 line in the European session. On the release front, German Preliminary CPI will be released later in the day. The markets are braced for a sharp decline of 0.8%. German Unemployment Change matched the forecast, with a drop of 9 thousand. In the US, today’s key events include Unemployment Claims and Pending Home Sales.

On Wednesday, the Federal Reserve reiterated that it would be “patient” regarding the timeline for a raise in interest rates, which have been close to zero since 2008. However, the Fed also noted that the US economy was expanding at a “solid pace” and this vote of confidence helped the dollar post sharp gains against the euro. The markets expect the Fed to raise rates sometime during the year, so the “Fed rate watch” is sure to continue, as the markets look for clues as to when the Fed will make a move.

German confidence indicators continued to point upwards in January. GfK German Consumer Climate improved to 9.3 points, edging above the estimate of 9.2 points. The key indicator has now risen for four consecutive releases, as the German consumer remains optimism. This follows an excellent business confidence report. German Ifo Business Climate rose for a fourth straight month, hitting 106.7 points which matched the estimate. This marked a six-month high.

Earlier in the week, US durable good reports disappointed, as Durable Goods Orders plunged 3.4%, marking a 4-month low. There was no relief from Core Durable Goods Orders, which declined by 0.8%, its fifth drop in six readings. The markets had expected gains from both indicators. There was much better news later in the day, as CB Consumer Confidence jumped to 102.9 points, crushing the estimate of 95.3 points. New Home Sales followed suit, rising to 481 thousand, well above the forecast of 452 thousand.

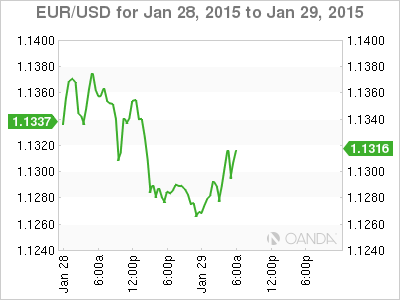

EUR/USD 1.1318 H: 1.1327 L: 1.1261

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.