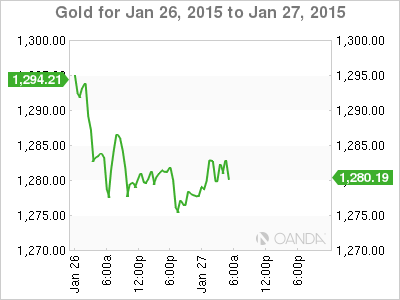

Gold has stabilized on Tuesday, following strong losses a day earlier. In the European session, the metal trades at a spot price of $1279.71. It’s a busy day in the US, with three key events on the calendar – Core Durable Goods Orders, CB Consumer Confidence and New Home Sales.

Greek voters went to the polls on Sunday and gave a sweeping mandate to the far-left Syriza party. Syriza ran on a platform of ending the crushing austerity scheme which Greeks have endured as part of the €240 billion bailout negotiated between and the EU, ECB and IMF. Predictably, the euro fell immediately after the election results, slipping to the 1.11 line. However, the common currency has recovered nicely, gaining about 100 points on Monday and continuing to move upwards on Tuesday.

Syriza’s win certainly throws a monkey wrench into the Greek bailout program, but the new Greek government is likely to negotiate a deal with Greece’s creditors. A Greek exit from the Eurozone may make for interesting headlines, but such a scenario is extremely unlikely. Indeed, Greek Prime Minister-elect Alexis Tsipras has promised to keep Greece in the Eurozone. Still, there remains plenty of uncertainty as to what will happen with the bailout plan, so traders can expect events in Athens to have a strong impact on the currency and commodity markets.

The Federal Reserve starts a two-day meeting on Tuesday and will release a policy statement on Wednesday. The Fed is expected to continue to counsel patience regarding an interest rate hike, and persistently weak inflation means the Fed can take its time before having to make a monetary move. The markets will be combing through the statement and any clues as to the timing of rate hike could have a strong effect on gold prices.

XAU/USD 1279.71 H: 1283.90 L: 1272.47

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.