Gold is showing limited movement on Friday, continuing the trend which has marked XAU/USD for most of the week. In the European session, the spot price stands at $1222.41. In the US, there are two major events – Producer Price Index and the UoM Consumer Sentiment. The inflation index is expected to show a small decline, but the markets are anticipating that the consumer confidence report will continue its upward trend.

US retail sales reports, the primary gauge of consumer spending, looked sharp in November. Core Retail Sales came in at 0.5%, ahead of the estimate of 0.1%. Not to be undone, Retail Sales posted a gain of 0.7%, beating the estimate of 0.4%. This was the indicator’s strongest showing in 12 months. There was more good news on the job front, as Unemployment Claims dipped to 294 thousand, below the forecast of 299 thousand.

The euro showed little response to the ECB’s second TLTRO (Targeted Long Term Refinancing Option) on Thursday. This lending program aims to bolster the economy by increasing bank lending to the real economy. The auction in saw European banks take loans of about EUR 130 billion. Although this was higher than the September auction, which had a take-up of EUR 82 billion, the total of around 212 billion was only half of the ECB target of 400 billion. The disappointing figure means that the ECB remains under strong pressure to introduce QE early in 2015, which would likely push the euro to further lows. Meanwhile, the Eurozone continues to struggle with low inflation levels, with a senior ECB official warning of deflation dangers. Speaking in Washington on Tuesday, ECB board member Peter Praet said that falling oil prices could push Eurozone inflation into negative territory.

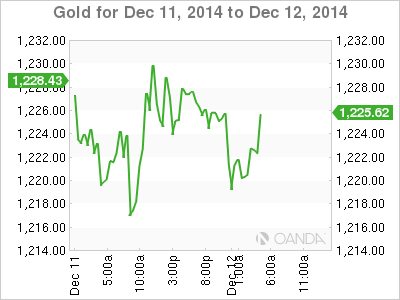

XAU/USD 1222.41 H: 1226.79 L: 1217.44

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.