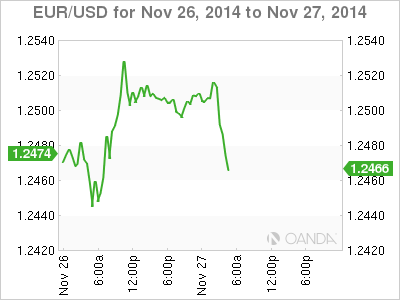

EUR/USD is showing little movement on Thursday, as the pair trades in the mid-1.24 range. US markets are closed for Thanksgiving, so traders can expect thin trading during the day. On the release front, German Unemployment Change beat expectations with a reading of -14 thousand. Spanish CPI declined by 0.4%. Later in the day, Germany releases Preliminary CPI, a key event which could affect the movement of EUR/USD. The markets are anticipating a flat reading of 0.0%.

The US released a host of key data on Wednesday and the numbers were weak across-the-board. Unemployment Claims jumped to 313 thousand, its highest level since mid-September. Core Durable Goods Orders declined 0.9%, its third decline in four readings. The estimate stood at 0.5%. New Home Sales fell to a 3-month low, dropping to 458 thousand. This was short of the estimate of 471 thousand. Pending Home Sales was no better, declining by 1.1%, well off the estimate of 0.9%. There was better news from UoM Consumer Sentiment, which posted a fourth straight gain, rising to 88.8 points. However, this was short of the estimate of 90.2 points. Despite the disappointing numbers, the euro was unable to make inroads against the dollar.

German indicators continue to point upwards. Unemployment Change came in at 14 thousand, much stronger than the estimate of -1K. Ifo Business Climate rose to 104.7 points in November. Importantly, this reading snapped a streak of six straight declines. ZEW Economic Sentiment jumped 11.5 points, crushing the estimate of 0.9 points. This strong optimism is somewhat puzzling, given that inflation and growth levels in the Eurozone’s largest economy remain weak. At the same time, increasing confidence in the German economy could translate into stronger German numbers, which would help boost the ailing Eurozone.

EUR/USD 1.2474 H: 1.2525 L: 1.2465

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.