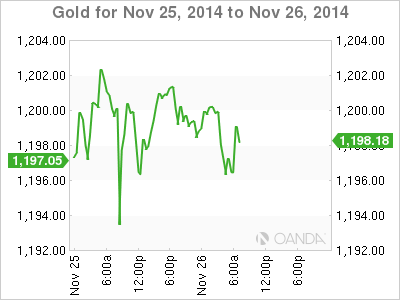

Gold is stable on Wednesday, as the spot price stands at $1196 per ounce. On the release front, there are a host of key US events ahead of the Thanksgiving holiday on Thursday. These include Core Durable Goods Orders, Unemployment Claims, UoM Consumer Sentiment and New Homes Sales.

US economic growth continues to rack up impressive numbers, posting an excellent gain of 3.9% in Q3, well above the estimate of 3.3%. This followed a gain in Q2 of 4.2%, which also beat the estimate. This was the strongest two-quarter performance since 2003, and has raised expectations about the Fed raising rates in the first half of 2014. The other key release, Consumer Confidence, was unexpectedly soft, dropping to 88.7 points. This was well off the estimate of 95.9 points.

German confidence indicators continue to point upwards. Ifo Business Climate rose to 104.7 points in November. Importantly, this reading snapped a streak of six straight declines. ZEW Economic Sentiment jumped 11.5 points, crushing the estimate of 0.9 points. This strong optimism is somewhat puzzling, given that inflation and growth levels in the Eurozone’s largest economy remain weak. At the same time, increasing confidence in the German economy could translate into stronger German numbers, which would help boost the ailing Eurozone.

XAU/USD 1198.54 H: 1201.29 L: 1195.08

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

Fed statement language and QT strategy could drive USD action – LIVE

The US Federal Reserve is set to leave the policy rate unchanged after April 30 - May 1 policy meeting. Possible changes to the statement language and quantitative tightening strategy could impact the USD's valuation.

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.