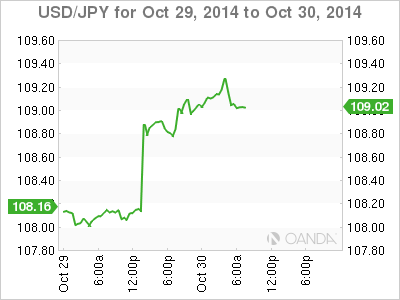

USD/JPY has moved upwards on Thursday, as the US dollar has posted broad gains following the FOMC policy statement on Wednesday. In the European session, the pair is trading just above the 109 line. On the release front, there are two major US events -GDP and Unemployment Claims. Both indicators are expected to post strong figures, so we could see the dollar post gains in the North American session. As well, Federal Reserve Chair Janet Yellen will address an event in Washington. In Japan, today’s highlights are Tokyo CPI and Household Spending.

Japanese data continues to impress this week. Preliminary Industrial Production sparkled in September, with a gain of 2.7%, compared to a reading of -1.5% a month earlier. The estimate stood at 2.3%. Earlier in the week, Japanese Retail Sales was unexpectedly strong in September, climbing 2.3%, its strongest gain since March and well above the estimate of 0.9%. There has been concern about consumer spending in Japan after the sales tax was raised in April from 5% to 8%. The government plans to increase the tax to 10%, but is wary about hurting the economy, which has been marked by modest growth. The Household Spending report later on Thursday will be an important gauge of consumer spending, a key engine of economic growth.

The US dollar posted strong gains on Wednesday, boosted by a hawkish Federal Reserve policy statement. The Fed said that the labor market is strengthening and inflation remains on target, although it did note that the labor market participation rate remains low. As expected the Fed completed the taper of its QE3 program. The asset-purchase program was initially started in 2008, at the height of the economic crisis, in order to boost a weak US economy. The termination of the QE is a symbolic step which is a vote of confidence from the powerful Fed that the US economy is on the right track.

US durable goods looked dismal in September. Core Durable Goods Orders dropped 0.2%, its second decline in three months. This was well short of the estimate of 0.5%. Durable Goods Orders followed suit with a decline of -1.3%. This was a second straight decline, and missed the estimate of 0.4%. There was much better news from CB Consumer Confidence, as the indicator climbed to 94.5 points, up sharply from 86.0 points. This easily beat the estimate of 87.4 and marked a 7-year high. An increase in consumer confidence usually translates into stronger consumer spending, which is a critical component for economic growth.

USD/JPY 109.10 H: 109.31 L: 108.84

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.