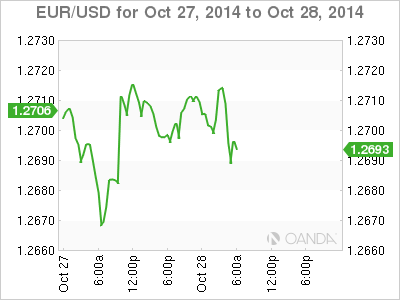

EUR/USD continues to show little activity on Tuesday, as the pair trades slightly below the 1.27 line in the European session. On the release front, German Import Prices beat the estimate with a gain of 0.3%. In the US, there are two key events on the schedule – Core Durable Goods Orders and CB Consumer Confidence. So we could see some stronger movement from the pair following the release of these events in the North American session.

German Ifo Business Climate continues to weaken, as the indicator dipped to 103.2 points in September. This was short of the estimate of 104.6 points and marks the sixth straight release that the indicator has lost ground. German GDP contracted in Q2, and another contraction in Q3 would indicate a recession in the Eurozone’s largest economy. German growth has been hurt as exports have been hit by EU sanctions against Russia, weak Eurozone demand and slower growth in China, Germany’s third largest trading partner.

On Sunday, the ECB released the results of its stress tests of European banks. The exercise marked a comprehensive and rigorous review of the health of 130 European banks. No German or French banks failed the test, but the third largest Italian lender, Banca Monte Paschi, posted a capital shortfall and will have to explain to the ECB how its plans to eliminate the shortfall. The ECB is trying to restore confidence in the European banking sector and encourage more borrowing and spending on the part of consumers and businesses.

In the US, the Federal Reserve wraps up a two-day meeting on Wednesday with the release of a policy statement. The Fed is expected to wind up QE, and if policymakers delay this move, the dollar will likely take a hit against its major rivals. The markets will also be looking for hints regarding the timing of a rate hike, which is expected sometime in 2015. Traders should treat this release as a market-mover which could have a significant impact on the direction of EUR/USD.

EUR/USD 1.2688 H: 1.2719 L: 1.2686

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.