Gold is showing little movement on Monday, as the spot price per ounce stands at $1231.50. On Sunday, the ECB released the results of its stress tests of European banks and the results were considered positive overall. In the US, today’s highlight is Pending Home Sales. The markets are expecting a strong improvement, with an estimate of 1.1%.

On Sunday, the ECB released the results of its stress tests of European banks. The exercise marked a comprehensive and rigorous review of the health of 130 European banks. No German or French banks failed the test, but the third largest Italian lender, Banca Monte Paschi, posted a capital shortfall and will have to explain to the ECB how its plans to eliminate the shortfall. The ECB is trying to restore confidence in the European banking sector and encourage more borrowing and spending on the part of consumers and businesses.

In the US, last week’s jobless numbers were softer than expected. Unemployment Claims rose to 284 thousand, much higher than the previous reading of 264 thousand, and above the estimate of 269 thousand. However, the markets were not overly concerned, as the four-week average, which is less volatile than the weekly release, dipped to 281,000, a 14-year low. Meanwhile, weak inflation levels continue to point to slack in the economy. On Wednesday, this trend continued with soft consumer inflation numbers. CPI and Core CPI both posted small gains of 0.1%.

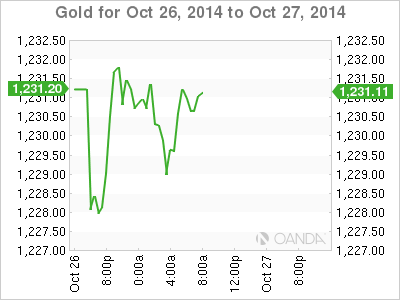

XAU/USD 1231.50 H: 1231.98 L: 1228.06

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

Bitcoin price drops, but holders with 100 to 1000 BTC continue to buy up

Bitcoin price action continues to show a lack of participation from new traders, steadily grinding south in the one-day timeframe, while the one-week period shows a horizontal chop. Meanwhile, data shows that some holder segments continue to buy up.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.