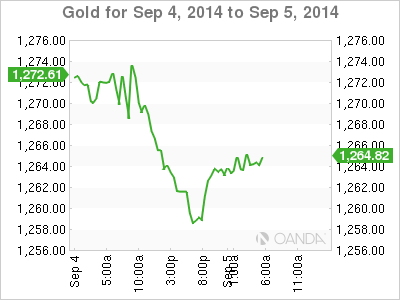

Gold prices have moved slightly higher on Friday, after opening the day near 3-month lows against the US dollar. In the European session, the spot price stands at $1265.72 per ounce. There was dramatic news on Thursday, as the ECB announced broad cuts to interest rates and plans to introduce quantitative easing. On Friday, US employment reports are in the spotlight, with the release of Nonfarm Employment Change and the unemployment rate.

After months of fighting in eastern Ukraine between government forces and pro-Russian fighters, Ukrainian President Petro Poroshenko on Wednesday announced a cease-fire in eastern Ukraine. Whether the latest attempt at a truce will last, however, is questionable, as the fighting continues. Russia has denied assisting the rebels, but both Ukraine and NATO have said that Russian forces are actively involved in the fighting. The crisis has severely strained relations between the West and Russia, and if the situation deteriorates, gold prices could move higher.

It's no exaggeration to state that Thursday was a shocker, as dramatic monetary action by the ECB sent the euro reeling below the 1.30 level. The markets had not expected any change to interest rates, but the ECB took the axe for the second time in three months, cutting the benchmark rate to a record low of 0.05%, down from 0.15%. As well, the deposit facility rate was lowered to -0.20% from -0.10% and the marginal lending rate dropped to 0.30% from 0.40%. ECB head Mario Draghi had more in store, saying that the central bank plans to implement an asset purchase program (QE). Draghi didn't elaborate, saying the ECB would provide more details in October. The interest rate cuts and QE scheme are intended to bolster anemic growth in the Eurozone and combat the growing threat of deflation.

US employment numbers were a disappointment on Thursday. ADP Nonfarm Payrolls slipped to 204 thousand last month, marking a 3-month low. This was well off the estimate of 218 thousand. Unemployment Claims edged higher to 302 thousand, above the estimate of 298 thousand. Will the official Nonfarm Payrolls follow suit with a weak reading? Last month's release missed expectations, and if the key indicator repeats with another weak reading, the high-flying US dollar could lose ground.

XAU/USD 1264.88 H: 1265.72 L: 1258.43

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.