The Japanese yen is listless on Monday, as the pair trades slightly above the 104 line in the European session. On the release front, Tertiary Industry Activity disappointed, coming in at -0.1% in July. Consumer Confidence showed little change, missing expectations. In the US, there are no economic releases to start off the week. The sole US event on Monday is a speech by Federal Reserve Governor Stanley Fischer, who will speak at a conference in Tokyo.

Japanese releases started off the week with disappointing numbers. Tertiary Industry Activity, an important manufacturing indicator, posted a decline of 0.1%, short of the estimate of a 0.2% gain. This weak reading was a sharp drop from the strong gain of 0.9% a month earlier. Elsewhere, Consumer Confidence came in at 41.5 points, short of the forecast of 42.3 points. The good news is that the indicator has moved upwards for three consecutive months. We'll get a look at the BOJ minutes on Tuesday.

US releases enjoyed a solid week, led by the IMS Non-Manufacturing PMI and Unemployment Claims. The PMI, which measures the strength of the services sector, climbed to 58.6 points, a ten-month high. Unemployment Claims dropped to 289 thousand, beating the estimate of 305 thousand. The four-week claims average, which is less volatile than the weekly count, dipped to 293,500, its lowest level since February 2006. The improving labor market points to a growing economy, and the dollar has gained broad strength thanks to solid economic data.

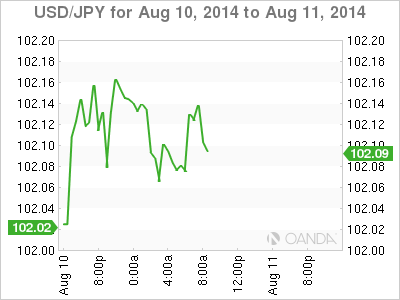

USD/JPY 102.13 H: 102.19 L: 102.02

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.