EUR/USD is under pressure on Wednesday, as the pair trades in the mid-1.34 range in the European session. The euro has slipped to its lowest level since November, and has slipped over 200 points in July. The violence in Gaza and Ukraine, weak Eurozone data and talk of a rate hike in the US have helped to bolster the US dollar at the expense of the euro. Will the downward trend continue? On the release front, it’s another quiet day, with just two releases on the schedule. Eurozone Consumer Confidence has been weak, and little change is expected in the June release. In the US, the sole is event is Crude Oil Inventories.

US numbers were a mix on Tuesday. Inflation numbers continue to struggle, as Core CPI posted a paltry gain of 0.1%, shy of the estimate of 0.2%. The key index has looked anemic in 2014, with its highest gain this year at just 0.3%. CPI was bit stronger, as it gained 0.3% last month, matching the forecast. Meanwhile, Existing Home Sales jumped to 5.04 million, surpassing the estimate of 4.94 million. This was the best showing we’ve seen since October, and follows a disappointing release from Housing Starts, which was published last week.

Geopolitical tensions are bad news for the markets, which crave stability. With violence continuing in Ukraine and Gaza, nervous investors have rallied around the safe-haven US dollar at the expense of other currencies, including the euro. In Ukraine, the downing of a Malaysian Airlines jet, apparently by pro-Russian separatists, has seriously frayed relations between the West and Russia, which have already been strained since the latter annexed Crimea. Fighting continues between the separatists and Ukrainian forces in Eastern Ukraine. The Europeans are threatening stronger sanctions against Russia, and escalating tensions within Europe does not bode well for the euro. In the Middle East, the fighting in Gaza between Hamas and Israel has intensified, as Israel presses on with a land offensive and casualties rise on both sides. Meanwhile, the international community is intensifying efforts to broker a cease-fire, but in the meantime the fighting continues.

Try as it might, the ECB can’t seem to coax much inflation out of the Eurozone economy. Eurozone CPI, the primary gauge of consumer inflation, remained unchanged in June, posting a gain of 0.5%. This is well below the central bank’s target of 2%. Germany, the Eurozone’s largest economy, is also suffering from weak inflation. PPI came in at a flat 0.0%, and the manufacturing inflation index has failed to post a gain in 2014. Faced with weak inflation and growth levels in the Eurozone, the ECB will be under pressure to take some action at its August policy meeting.

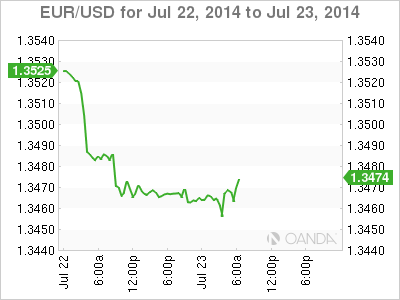

EUR/USD for Wednesday, July 23, 2014

EUR/USD July 23 at 9:25 GMT

EUR/USD 1.3464 H: 1.3473 L: 1.3455

EUR/USD Technical

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.