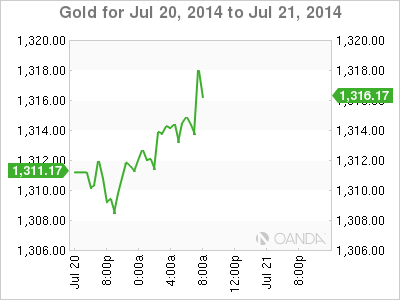

Gold prices have moved slightly higher on Monday, as fighting rages in Gaza and tensions increase in Ukraine. In the European session, the spot price stands at $1316.03 per ounce. On the release front, there are no US releases on the schedule. Last week ended on a sour note as the UoM Consumer Sentiment remained steady in June, but fell short of the estimate.

International trouble spots are bullish for gold, and events in Ukraine and Gaza have led to nervous investors seeking the safe-haven precious metal. Last week's downing of a Malaysian Airlines jet, apparently by pro-Russian separatists, has seriously frayed relations between the West and Russia, which have already been strained since the latter annexed Crimea. The Europeans are threatening stronger sanctions against Russia in response to the downing of the Malaysian jet. Meanwhile, the fighting in Gaza between Hamas and Israel has intensified. Casualties have been mounting on both sides, as the fighting enters its third week.

On Friday, US Consumer Sentiment remained steady at 81.3 points, but this was well below the estimate of 83.5 points. A day earlier, Unemployment Claims dropped slightly to 302 thousand, beating the estimate of 310 thousand. This figure marks a seven-week low, as the economy continues to churn out impressive employment data. With Janet Yellen telling Congress that a rate hike could be pushed forward if inflation and employment data exceeds expectations, improving employment data will put more pressure on the Fed to raise rates.

Federal Reserve Chair Janet Yellen concluded two days of testimony on Capitol Hill last week. Yellen declined to answer questions about when the Fed would begin to raise rates, but she did acknowledge that most economists expect the Fed to make a move in the third quarter of 2015. On Tuesday, the dollar moved higher when Yellen said that the economy still required monetary stimulus, but rates could increase sooner than expected if inflation and job numbers improved more quickly than anticipated. The Federal Reserve's asset purchase program (QE) has flooded the economy with over $2 trillion, keeping interest rates at ultra-low levels, but the Fed has been trimming the program since last December, when it stood at $85 billion/month. Currently, the Fed is pumping $45 billion/month into the economy, and the next taper is expected in August, with plans to terminate QE in October.

XAU/USD 1316.63 H: 1318.40 L: 1307.40

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.