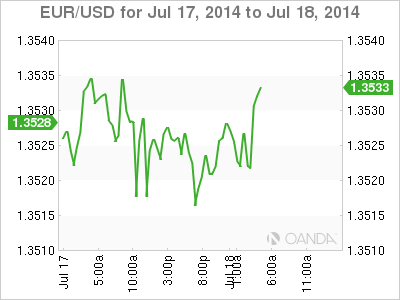

EUR/USD is stable on Friday, as the pair is trading in the mid-1.35 range in the European session. On the release front, Eurozone Current Account softened in June and was well short of the estimate. Over in the US, Preliminary UoM Consumer Sentiment is today's major event. On Thursday, US data was mixed. Unemployment Claims looked sharp, and the Philly Fed Manufacturing Index soared last month. However, Building Permits and Housing Starts softened in June.

US Unemployment Claims dropped slightly to 302 thousand, beating the estimate of 310 thousand. This figure marks a seven-week low, as the economy continues to churn out impressive employment data. With Janet Yellen telling Congress that a rate hike could be pushed forward if inflation and employment data exceeds expectations, improving employment data will put more pressure on the Fed to raise rates. At the same time, the housing sector is struggling, and Building Permits fell to 0.96 million, its lowest level since January. The markets had expected a much stronger reading, with an estimate of 1.04M. Housing Starts followed suit, coming in at 0.89 million, compared to an estimate of 1.02 million. Finally, the Philly Fed Manufacturing Index sparkled, jumping to 23.9 points, well above the estimate of 15.6 and its best showing since February 2011.

Federal Reserve Chair Janet Yellen concluded two days of testimony on Capitol Hill on Wednesday, testifying before the House Financial Services Committee. Yellen declined to answer questions about when the Fed would begin to raise rates, but she did acknowledge that most economists expect the Fed to make a move in the third quarter of 2015. On Tuesday, the dollar moved higher when Yellen said that the economy still required monetary stimulus, but rates could increase sooner than expected if inflation and job numbers improved more quickly than anticipated. The Federal Reserve's asset purchase program (QE) has flooded the economy with over $2 trillion, keeping interest rates at ultra-low levels, but the Fed has been trimming the program since last December, when it stood at $85 billion/month. Currently, the Fed is pumping $45 billion/month into the economy, and the next taper is expected in August, with plans to terminate QE in October.

Eurozone CPI, the primary gauge of consumer spending, remained unchanged in June, posting a gain of 0.5%. This matched the estimate, and EUR/USD did not react to the reading. Core CPI, which excludes volatile items, looked even better, climbing 0.8%. This also matched the forecast. Meanwhile, German ZEW Economic Sentiment, a highly regarded survey of institutional investors and analysts slipped to 27.1 points, short of the estimate of 28.9 points. The indicator has been falling steadily since last November, when it was above the 60-point level. The June figure is the weakest we've seen since November 2012. Eurozone ZEW Economic Sentiment brought no relief, as it plunged to 48.1 points, down from 58.4 a month earlier. The estimate stood at 62.3 points. These weak numbers have further raised concerns about the health of the German and Eurozone economies, and the euro could lose more ground.

EUR/USD 1.3519 H: 1.3540 L: 1.3513

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.