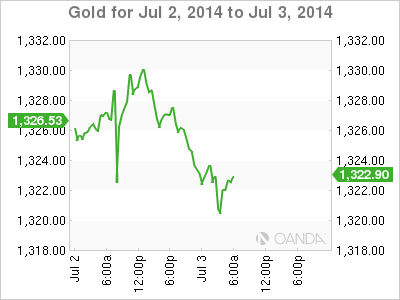

Gold prices have edged lower on Thursday, as the spot price stands at $1321.10 per ounce late the European session. It's a busy day on the release front, and we could see some movement from XAU/USD. In the Eurozone, the ECB will announce its benchmark interest rate, followed by a press conference hosted by ECB head Mario Draghi. Over in the US, employment data is in the spotlight, with the releases of Nonfarm Payrolls, the Unemployment Rate and Unemployment Claims. As well, we'll get a look at US Trade Balance.

Will the ECB take any dramatic action at its policy meeting later on Thursday? Most analysts think not, with the ECB expected to hold rates at the record low of 0.15% and maintain current monetary policy. At the June meeting, the ECB took unprecedented steps to combat low growth and inflation, including negative deposit rates. These measures were intended to boost inflation and growth levels, but that hasn't occurred, at least not yet. This was reaffirmed with the release of Eurozone Retail Sales on Thursday, the primary gauge of consumer spending. The indicator dipped to 0.0%, shy of the estimate of 0.3%.

In the US, ADP Nonfarm Payrolls was outstanding, soaring to 281 thousand, up from 179 thousand a month earlier. This crushed the estimate of 207 thousand. Will the official Nonfarm Payrolls follow suit? The markets are expecting a reading of 214 thousand, slightly below the May reading. The Unemployment Rate and Unemployment Claims are also expected to show little change. If there are any surprises from these key indicators, traders can expect some movement from EUR/USD during the day.

XAU/USD 1321.10 H: 1326.68 L: 1319.82

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.