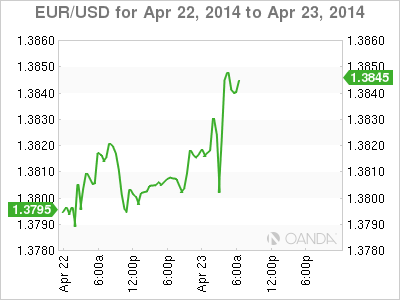

EUR/USD has posted gains in Wednesday trading, as the pair has climbed to the mid-1.38 range in the European session. Eurozone and German PMIs beat their estimates, although the French releases fell short of expectations. In economic news, Eurozone and German PMIs beat the forecast, but French PMIs did not keep pace, missing expectations. In the US, today's major event is New Home Sales. The markets are expecting a stronger March reading from the key indicator.

US inflation levels have been lukewarm, but so far the Federal Reserve has done little more than point out that it would like to see inflation move closer to the Fed's target of 2%. The House Price Index, a gauge of activity in the housing sector, rose a respectable 0.6% last month, matching the forecast. It's a different tale in the Eurozone, where inflation continues to be persistently low and there is real concern about deflation, which could inflict serious damage on the fragile Eurozone economy. The ECB has balked at taking any action to deal with inflation, but its hand may be forced if inflation levels don't show some life.

The markets haven't reacted to events in Ukraine so far, but that could change if the violence in the east of the country worsens. Russian President Vladimir Putin has threatened to act on his "right" to invade Ukraine, and has also given the country an ultimatum regarding its gas debt. The gas supply from Russia to western Europe is in danger, and if the situation spills out of control, we could see a sharp response from the markets. US Vice-President Joe Biden is in Kiev for a symbolic visit. The West doesn't have many cards to play against Russia, so every move by Putin will be scrutinized and could impact on the markets.

EUR/USD 1.3842 H: 1.3855 L: 1.3801

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.