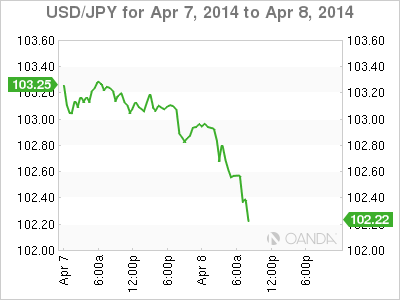

The Japanese yen continues to rally, as USD/JPY has dropped into the low-102 range. The yen got a boost from comments by Bank of Japan head Governor Haruhiko Kuroda, who said that a planned sales tax increase would not require further stimulus. The Japanese currency has now gained about 160 pips against the dollar since Friday. On the release front, Japanese Current Account matched the forecast and Economy Watchers Sentiment easily beat the estimate. In the US, today's highlight is JOLTS Job Openings. The markets are expecting slight improvement in the March release.

The BOJ concluded a two-day meeting on Tuesday, and as expected, the central bank stated it was maintaining its monetary base at an annual level of 60-70 trillion yen each year. The government raised the sales tax last week, which will help reduce the country's massive debt but also is likely to slow down the economy. However, BOJ Governor Haruhiko Kuroda said that there is no need to add stimulus at present, and the yen responded by continuing its rally. There is a strong likelihood that the Bank could introduce further easing in July, when the government is expected to introduce measures to stimulate the economy.

On Friday, all eyes were on US Non-Farm Payrolls, one of the most important economic indicators. The indicator rose nicely last in March, climbing to 192 thousand, compared to 175 thousand a month earlier. However, the markets were looking for more, with the estimate standing at 199 thousand. Unemployment Claims also fell short of the estimate, as it remained unchanged at 6.7%. Although these numbers were not as strong as hoped, the Federal Reserve is expected to continue trimming QE when it meets at the end of April. These tapers mark a vote of confidence in the US economy by the Federal Reserve, and are dollar-positive.

USD/JPY 102.23 H: 103.07 L: 102.12

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.