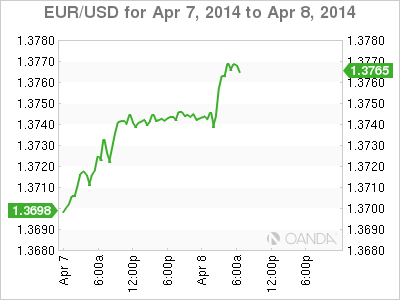

EUR/USD continues to post gains on Tuesday, as the pair is trading in the mid-1.37 range in the European session. The euro received some support after ECB policymakers said non-conventional easing measures are remain on the table. In economic news, the French trade deficit narrowed last month, dropping to its lowest level in over three years. In the US, today's highlight is JOLTS Job Openings. The markets are expecting a slight improvement in the March reading.

It was more of the same from the ECB last week, as the central bank stood pat and did not make any moves, despite serious worries about weak growth and low inflation. On Tuesday, ECB policymaker Yves Mersch said that ECB officials were working on a QE scheme in order to combat deflationary pressures, but there was no immediate need for such a program. Meanwhile, Bundesbank President Jens Weidmann said that monetary policy alone will not solve the Eurozone's economic problems, saying that political leaders must undertake fiscal and other reforms.

German data continues to beat expectations, as the Eurozone's largest economy continues to post respectable numbers. Industrial Production dropped to 0.4%, down from 0.8% a month earlier, but this edged above the estimate of 0.3%. Last week, German Retail Sales, Unemployment Change and Factory Orders all beat their estimates, as the German economy appears to be moving in the right direction.

The Eurozone continues to struggle with weak inflation and a high euro, so there has been pressure on the ECB for some time now to take action. However, on Thursday the ECB opted to stand pat. The central bank kept interest rates at the ultra-low level of 0.25% and ECB chief Mario Draghi said that monetary easing remains a possibility, but clearly the ECB is in no rush to make any moves.

EUR/USD 1.3767 H: 1.3738 L: 1.3674

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.