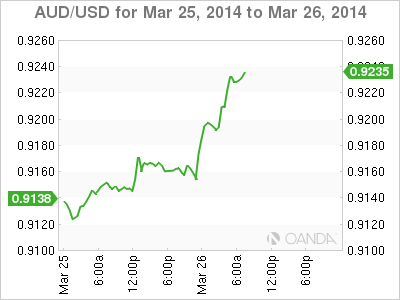

AUD/USD trades above the 0.92 line in Tuesday's European session. The Aussie received a boost after positive comments by RBA Governor Glenn Stevens. In the US, Wednesday's key release is Core Durable Goods Orders. The markets are expecting a much smaller gain than in the previous release.

RBA Governor Glenn Stevens gave an upbeat message on Tuesday and the Australian dollar responded with gains. Stevens said that the economy has improved thanks to the lower exchange rate since last April and improved global economic conditions. Stevens reiterated that low interest rates are unlikely to rise in 2014, as the RBA tries to boost consumer spending and residential construction.

US numbers were a mix on Tuesday. CB Consumer Confidence jumped to 82.3 points, easily surpassing the estimate of 78.7 points. This was the key indicator's best showing since December 2007. The news wasn't as good from the housing sector, as New Home Sales fell to 440 thousand, down sharply from the January release of 468 thousand. The reading was short of the estimate of 447 thousand. We'll get a look at Pending Home Sales on Thursday.

The US and its European allies have imposed limited sanctions on Russia after its annexation of Crimea, but are holding off on additional measures if Russia does not take further military action. The lack of a tough response from the West reflects divisions within Europe over how strong a stance to take against Moscow. Meanwhile, the Ukraine has signed an association agreement with the EU and is seeking a loan package of up to $20 billion from the IMF. Ukraine's economy has suffered badly after months of political turmoil.

AUD/USD 0.9137 H: 0.9138 L: 0.9154

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.