There was a reduction on most of world stock indices observed on Tuesday. The U.S. Federal Reserve Chairman, Janet Yellen said that the discount rate may be increased earlier than expected. If macroeconomic indicators continue to improve. After that, the U.S. currency significantly strengthened.

As for the stock market, she noted that the assessment of individual companies may be overestimated, including small-cap, biotechnology, as well as media and social network sectors. In this regard, the Nasdaq and S&P500 fell down. The Dow Jones industrial average rose due to the good quarterly reporting and the rise in prices for the shares of JPMorgan Chase and Goldman Sachs. IBM signed a contract with Apple for supplying mobile devices to corporate clients, which led to rise in their share prices. Yesterday's economic data from the U.S. was worse than the preliminary forecasts. Retail sales in June increased less than expected. Nevertheless, a number of investment banks, including Goldman Sachs, raised the GDP growth forecasts for the second quarter to 3-3.4%. Trading volume on the U.S. exchanges was almost 13% above the monthly average yesterday. The expected news from the U.S. for today are: the PPI, expected to be released at 12-30 CET, industrial production at 13-15 CET and the Beige Book economic review at 18-00 CET. At 14-00 CET, the Fed Chairman, Janet Yellen will give another speech. However, it is unlikely to be as significant to the financial markets, as it was yesterday. In our opinion, the forecasts for the U.S. data are negative. However, stock futures indexes are traded positively. We believe that this is the reaction to the strong macroeconomic fundamentals regarding Chinese economy, as well as the good Intel reporting, released on Tuesday after the closing bell rang. The Bank of America report is expected to be released before the trades start.

European markets had the prices decreased yesterday. German macroeconomic investor’s confidence index for July (ZEW) collapsed to its lowest level since December 2012. The drop in share prices of the Portuguese Banco Espirito Santo by 14.6% added an additional negative. Some investors have suggested that its problems do affect the economy of Italy, Spain and Portugal. Today, the EU stocks are rising after the Chinese statistics release. The Chinese GDP growth in the second quarter slightly exceeded the forecasts and made 7.5%. Industrial production in June also turned out better than expected and increased by 9.2%. We do not exclude that it may help the growth in quotations of commodity futures. The European data on foreign trade are expected to be released today at 9-00 CET. The forecast is positive.

Nikkei rose slightly today within its neutral trend along with the global trend. Let us note that tonight the weekly data on investments from the Japanese Ministry of Finance is expected to strike, and the next significant macroeconomic information will be released only on July 24th.

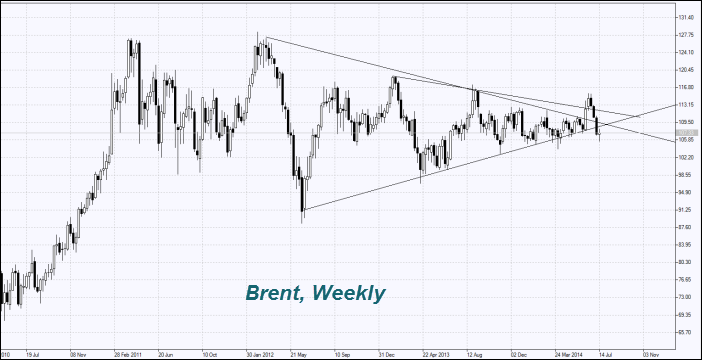

The Oil prices are corrected upward today after decline within the previous three weeks. Its consumption in China for June peaked within 17 months and showed 10.2 million barrels per day. Compared to May, it increased by 8.4%. China imported 5.66 million barrels of oil per day in June. The American Petroleum Institute expects the U.S. inventories to reduce in weekly terms by 4.8 million barrels, market participants expect a 2.75 million decline. This is an additional factor of the price growth. The official data will be released today at 14-30 CET.

The natural gas price continues to decline. The Chilean company (ENAP) stated it was going to start exporting liquefied shale gas to the U.S. starting in 2016. The response from the U.S. authorities was not received yet, but in principle the approval has been given previously. Let us note that the current decline in gas prices occurs despite the fact that its holdings in the United States are a quarter below the last year's level.

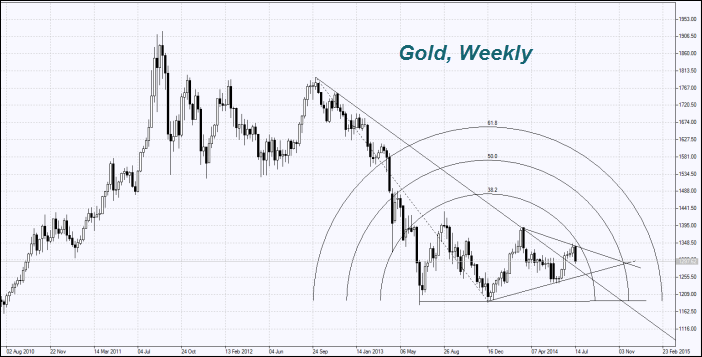

The Gold price declined significantly due to possible increase of the interest rates in the U.S. earlier than expected. Futures trading volume in the United States are below the average for 100 days by 23%.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.