The U.S. economic data on Monday helped the USD strengthening. The increased volume of retail sales in March by 1.1 % was found the maximum for 2.5 years. The growth of this indicator excluding gasoline was 1.4 % and it is the largest in 4 years. Growth of the U.S. Dollar Index (USDIDX) yesterday and could be more significant. However, this did not happen, as market participants have not raised the consensus forecast for the U.S. GDP growth in the first quarter yet. This figure will be released on April 30 and it is expected to be only 0.5 % after rising by 2.6% in the fourth quarter. Today at 16:30 CET, we will see the U.S. inflation data for March. We believe that the projections can be positive for the U.S. Dollar. It grows this morning. Today at 16-45 CET, the first speech of the week by the Fed Chairman, Janet Yellen will be held and the second one will be tomorrow.

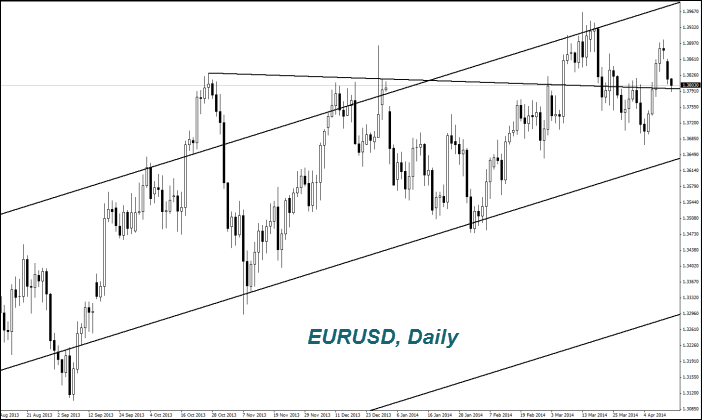

Euro (EURUSD) demonstrated weakening (fall in the chart) after the statements by the ECB head, Mario Draghi on possible beginning of the QE new phase (money issue). Today at 13-30 CET, the ZEW index of economic activity in the EU and Germany for April and the Eurozone trade balance for February will come out. In our opinion, the preliminary forecast is positive. If European investors do not submit unjustified negative emotions over Ukraine. Their opinion is taken into account while the ZEW index gets compiled.

The Japanese Yen (USDJPY) remained stable thanks to the head of the Bank of Japan, Haruhito Kuroda that stated there are no plans for additional measures to mitigate the monetary policy (higher emissions). Recall that the sales tax was increased from 5% to 8% on April 1. A significant part of market participants believed that Japan will still increase the emission volume in order to support their major corporations and increase inflation to the target level of 2% later this year. Recall that the next BOJ meeting will be held on April 30. Tomorrow morning at 8:30 CET we will see the Industrial Production for February and the regular BOJ press conference is to be held at 10-15 CET.

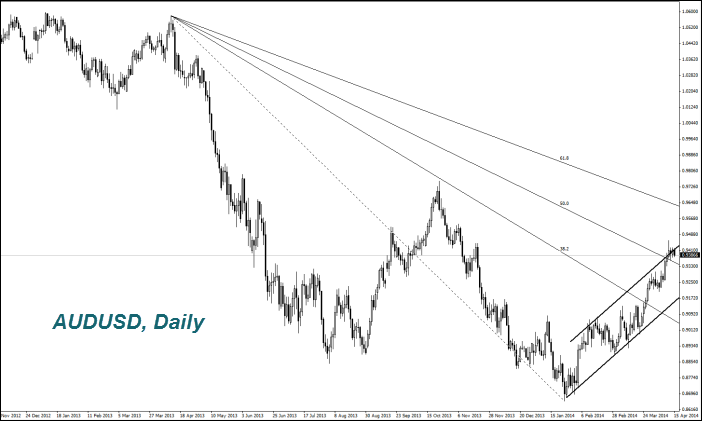

The Australian Dollar (AUDUSD) slightly decreased, which means its weakening. Thus investors reacted to the early April RBA meeting minutes publication. They assumed that the current level of low interest rates at 2.5% will be kept for a long time. The economic slowdown in China may be additional negative factor for Aussie as China the main trading partner of Australia.

Tomorrow at 6-00 CET we will find out about Chinese GDP for the first quarter. Its growth is expected to slow down to 7.3 % yoy from 7.7% in the fourth quarter. The GDP growth qoq may slow down to 1.5% from 1.8%. This morning, we observed the negative economic information about reducing the yearly volume of new loans from the People's Bank of China by 19% and the minimal growth of the money supply. After this, the forward contracts on the Yuan fell to the lowest level of eight months. We recommend following the Chinese statistics to those traders who trade commodity futures. The weak data may trigger a downward correction.

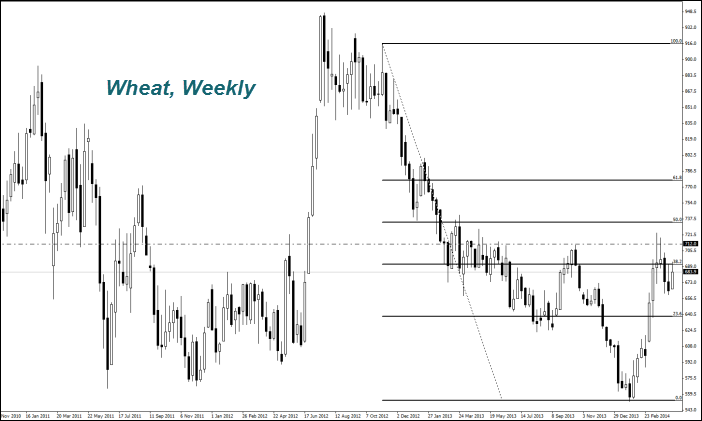

The Wheat prices increased, as new Ukrainian authorities are poorly financed farmers in conditions of aggravation of the political situation in Ukraine. Another negative factor was the drought. Agritel lowered the wheat harvest forecast in Ukraine for this year by 1.6 million tons to 18.4 million tons and in by 1.8 million tons to 48.1 million tons for Russia (due to the drought).

The Corn prices fell slightly. There was 3% of the new crop seeds planted at the end of last week in the United States. This coincides with the USDA prediction in spite of the cold weather. If the weather conditions get improved planting seeds can be up to 10% of the daily total.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.