Last Update At 20 Oct 2014 00:03GMT

Trend Daily Chart

Sideways

Daily Indicators

Turning down

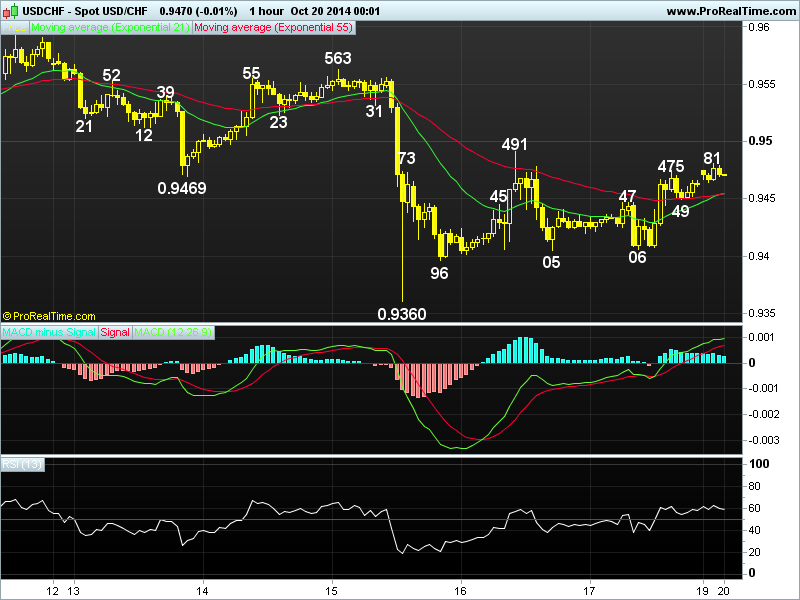

21 HR EMA

0.9455

55 HR EMA

0.9454

Trend Hourly Chart

Sideways

Hourly Indicators

Rising

13 HR RSI

58

14 HR DMI

+ve

Daily Analysis

Consolidation with upside bias

Resistance

0.9563 - Wed's high

0.9525 - 50% r of 0.9690-0.9360

0.9491 - Last Thur's high

Support

0.9405 - Last Thur's low

0.9360 - Last Wed's fresh 3-week low

0.9301 - Sep 16 low

. USD/CHF - 0.9469...The greenback also swung wildly in opposite direction to euro last week. Despite initial weakness to 0.9469 on Mon, price recovered to 0.9563 Wed but only to tank to a near 3-week trough of 0.9360 after downbeat US retail sales, price later bounced back to 0.9491 Thur n moved sideways on Fri.

. Let's look at daily picture 1st, dlr's erratic decline fm Oct's fresh 1-year peak at 0.9670 n then last week's breach of 0.9470 sup to 0.9360 confirms MT rise fm 2014 near 2-1/2 year trough at 0.8698 (Mar) has indeed formed a tempo rary top at 0.9690 n consolidation with downside bias is seen for further weakness to 0.9311, this is a 'minimum' 38.2% r of aforesaid upmove fm 0.8698, a daily close below daily sup at 0.9301 is needed to bring stronger correction twd 0.9194 (50% r). As daily technical are turning down, suggesting consolidation with downside bias is in store this week. On the upside, only a daily clsoe abv0.9563 (last week's high on Wed) wud dampen present bearish bias on dlr.

. Today, dlr's erratic rise fm 0.9360 to 0.9491 signals 1st leg of said correction fm 0.9690 has ended, abv 0.9491 wud add credence to this view n bring stronger gain to 0.9525 (50% r) but res at 0.9563 shud cap upside.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750 area as USD recovers

EUR/USD stays under modest bearish pressure and trades slightly below 1.0750 in the European session on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD drops below 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold stays near $2,310 as US yields edge higher

Following a quiet Asian session, Gold retreated slightly to the $2,310 area. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations and amounted to just 1.6% annualized in Q1-2024, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.