LocalMonero exchange shuts down as crypto privacy services dwindle

Peer-to-peer trading platform for privacy coin Monero (XMR $128) has shuttered its services effective immediately, adding to the recent wave of crypto privacy closures and arrests.

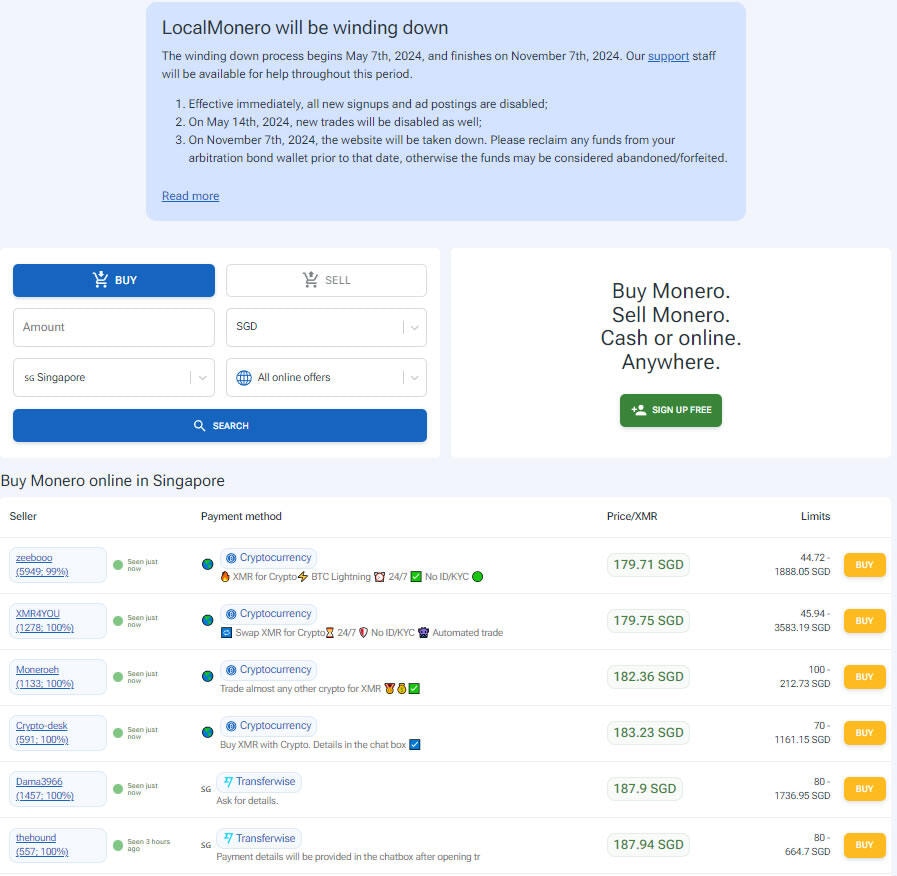

On May 7, LocalMonero announced that, effective immediately, all new signups and advertisement postings for Monero trades are disabled. On May 14, the platform will disable the trading of the privacy-focused crypto asset.

The firm cited “a combination of internal and external factors” but did not reveal the specific reasons for its closure.

It added that on Nov. 7, the website will be taken down and advised users to reclaim any funds from their wallet prior to that date, otherwise, they may be considered abandoned.

The P2P Monero trading platform, which was launched in 2017 as the XMR equivalent of LocalBitcoins, acknowledged that the Monero ecosystem has matured a lot over the years.

The team added that the imminent launch of decentralized exchanges such as Haveno and Serai, and a recently announced privacy update called Full-Chain Membership Proofs (FCMPs), gives them confidence that Monero’s future is bright, “with or without our platform.”

Screenshot of closure notice on localmonero.co.

The move has been seen by some as yet another blow to privacy coins and protocols following Kraken’s termination of support for Monero for its customers based in Ireland and Belgium in April and recent legal action against Tornado Cash.

Privacy Advocate “Seth For Privacy,” said it was an “incredibly sad day,” in a post on X on May 7. He added that LocalMonero has been “a cornerstone of the no-KYC Monero ecosystem” and there is no direct fiat to XMR alternative today.

He said that although the platform did not provide a reason, users could speculate.

Feels like we're deep in the trenches of an all-out anti-privacy crypto war right now.

Privacy coins and services have been targeted in recent months by global finance regulators. In April, the co-founders of crypto mixer Samourai Wallet were arrested on charges of money laundering.

Other privacy services such as Wasabi CoinJoin and Trezor Coinjoin were also recently shuttered by their founders as the privacy crackdown intensified.

However, it may not be as clear-cut as that. Ethereum privacy protocol Railgun contributor Alan Scott Jr. told Cointelegraph in early May that intelligence agencies may not be as anti-privacy protocols as many believe.

“Their concern is the potential problems around impeding their ability to catch bad actors,” he said at the time referring to agencies such as the FBI.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.