Last Update At 18 Sep 2014 00:35GMT

Trend Daily Chart

Down

Daily Indicators

Rising fm o/s

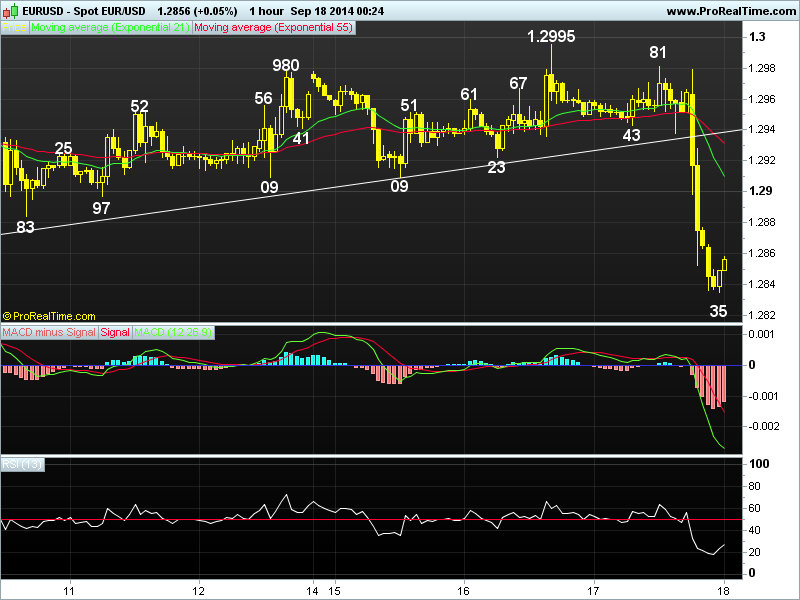

21 HR EMA

1.2910

55 HR EMA

1.2935

Trend Hourly Chart

Down

Hourly Indicators

Rising fm o/s

13 HR RSI

28

14 HR DMI

-ve

Daily Analysis

Resumption of MT downtrend

Resistance

1.2943 - Y'day's Euroepan morning low

1.2909 - Last Fri's n Mon's low

1.2860 - Last Tue's low (now res)

Support

1.2835 - Intra-day low (Australia)

1.2772 - 61.8% proj. of 1.3221-1.2860 fm 1.2995

1.2745 - Apr 2013 low

. EUR/USD - 1.2858... Despite euro's brief bounce fm 1.2943 to 1.2981 in NY morning after the release of lower-than-expected US CPI data, the single currency nose-dived to 1.2898 after the release of dovish Fed's policy statement n price later weakened to a fresh 14-month trough of 1.2835 in Australia.

. Looking at the hourly n daily charts, y'day's of last Tue's 1.2860 low to 1.2835 confirms MT downtrend fm May's 2-1/2 year peak at 1.3995 to retrace entire LT rise fm 2012 bottom at 1.2042 (Jul) has once again resumed n further weakness to 1.2790/95 is now envisaged after minor consolidation, however, as the hourly oscillators' readings are in oversold territory, reckon 1.2788, being 61.8% proj. of intermediate fall fm 1.3221-1.2860 measured fm 1.2995 wud limit downside n yield a much-needed rebound later. Looking ahead, euro is poised to re-test of previous daily sup at 1.2745 (Apr 2013) later this month n only abv 1.2909 signals at temp. low is made n may risk stronger retrace. twd 1.2985/95.

. Today, in view of abv bearish analysis, selling euro on intra-day recovery is the way to go as 1.2880/90 shud cap upside, however, profit shud be taken on subsequent decline.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.