Review

Norges Bank deliverd as expected - no news. We maintain our BUY recommendation.

The rhetoric from Norges Bank yesterday was clear. It did not want to deliver any kind of surprises or to point out a direction for the market. Everything was carefully considered and almost boring.

NOK appreciated marginally on the announcement. This was probably due primarily to a, by now, latent fear of disappointments from Norway, and we therefore saw a small and shortterm relief.

We are now looking forward to the announcement of inflation data on 11 November. It may turn out being very decisive for the outcome of the interest-rate meeting on 5 December.

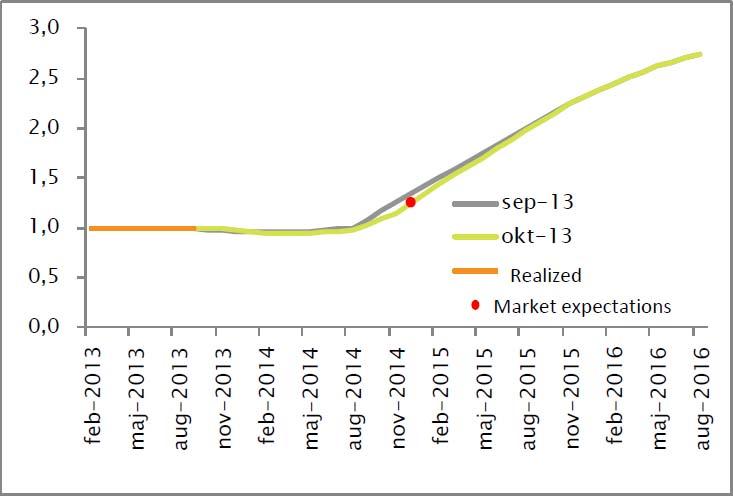

Riksbanken deliverd as expected - no news. We maintain our BUY recommendation You could almost think that Riksbanken and Norges Bank had spoken to each other before their interest-rate meetings. At least, there was no ammunition for neither 'bulls' nor 'bears'. Fair is fair, Risksbanken actually delivered a very, very small downgrade its the interest-rate path, but we almost needed a microscope to see this change.

Riksbankens interest rate path vs market expectations

SEK appreciated marginally on the announcement. Today, consumer and industrial confidence indicators will be announced. They may trigger some movement in SEK. On Monday, retail sales will be announced.

Europe: PMIs were a huge disappointment. We have not seen this for a long time.

Our macroeconomists' interpretation is that: "The upturn is both uncertain and fragile. We expect very modest growth in both Q3 and Q4".

Despite the poor data the trade-weighted EUR closed the day in positive territory!

The US: PMI declined to 51.1 against the estimate of 52.5. Weakening of USD.

Although ISM is still the most fluctuating indicator from the industry, EURUSD rose yesterday by approx. 30 pips on the announcement of the poor data. The data support the analysts (including Jyske Bank) that recently adjusted their expectations of a QE scaling down to March 2014. Falling PMI data (or ISM on 1 Nov.) are, however, often noted by the equity market, as these early indications are some of the best indicators for the companies' future conditions.

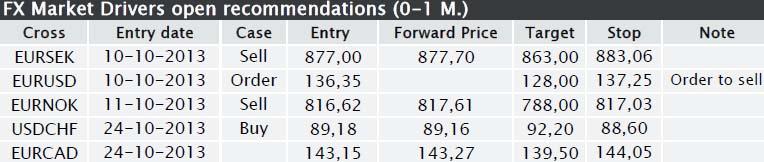

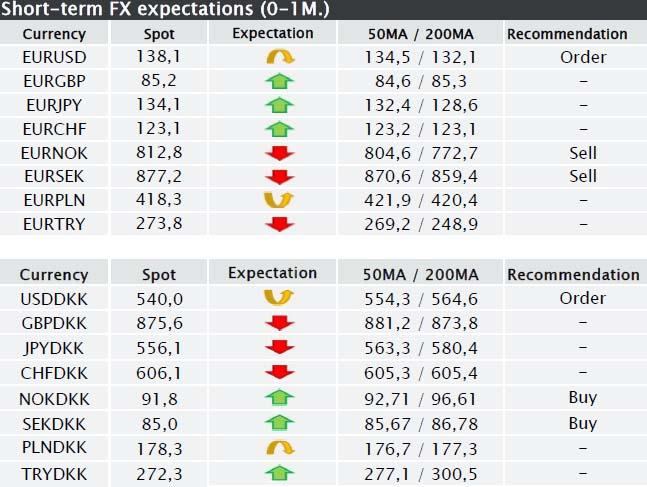

EURUSD (ORDER): We recommend a sell order at 136.35 with a close stop loss at 137.25.

The market is currently hunting a level of 138.50, where there are reports of stops and option barriers. USD remains very vulnerable.

The current levels have previously marked the line in the sand for when European politicians and the ECB have focused on EUR. The ECB will hold its interest-rate meeting on 7 November. It is very likely that there will be comments about the currency. We saw this in February 2013, when EURUSD traded at a maximum of 137.11 and when the trade-weighted EUR was also below its current level.

Our 3M price target of EURUSD will be raised in the next issue of Spot On. The ECB (or massive share price declines) is to 'save' the dollar over the next 2-3 months. There will be no new and vital news from the US until we enter 2014.

Support: 136.40, 134.50, 132.10 (200MA).

Resistance: 138 and 140.

USDCHF (NEUTRAL to BUY): We recommend investors to BUY and to take profit at 92.20. Stop-loss at 88.60.

Based on a technical analysis, USDCHF is attractive - we are close to a critical level of support. The illustrated RSI divergence supports that the movement is oversold and that a correction is imminent. The question is of course whether we will see a downward breach with a significant movement beforehand (remember stop/loss).

USDCHF

EURNOK (SELL): We recommend investors to sell EURNOK. We have adjusted stop/loss to 817.03.

Yesterday's interest-rate meeting was close to being boring. This did not affect NOK significantly in either way. Liquidity is still very low in NOK. Higher liquidity seems to an increasing degree to be a prerequisite of an appreciation of NOK. Inflation data on 11 November may turn out being very decisive for the outcome of the interest-rate meeting on 5 December.

EURSEK (SELL): We recommend that investors sell EURSEK with take-profit at 863.00.

S/L at 883.06. Like Norges Bank, Riksbanken delivered a non-event. Only a very small reduction of the interest-rate path was announced. Generally, the picture was unchanged for SEK. The short-term trading range is 873-883 and there is currently no indication of a breach. Today's confidence data may trigger some fluctuation, but it requires decent surprises to see a breach of 873-883. On Monday, retail sales will be announced.

Support: 873 and 859-860 (200 MA)

Resistance: 883 and 890

Today’s events:

09:15 SEK: Industrial and consumer confidence (expectations: 96.2 and 98.5, respectively)

10.00 DEM: Ifo index (estimates: 104.5 for index of expectations (last time: 104.2); 111.4 for current situation (last time: 111,4)

10.30 GBP: GDP Q3 (estimate: 0.8%, last time: 0.7%)

16.00 MXN: Interest-rate meeting (we expect an interest-rate cut of 25bp to 3.5%)

Chart of the day: EUR trade weighted index at the highest level since 2011

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.