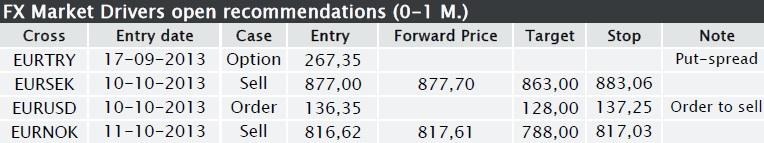

Review

Non-farm payroll came out at 148,000 against the expected level at 180,000. This was a major disappointment for the market. Jyske Bank's economists covering the US conclude: A somewhat disappointing job report and particularly job growth in the private sector has fallen quite considerably over the past three months. It is of some concern as it may reflect the businesses' disappointment about weak sales growth.

The report differed so much from consensus that the market could not ignore it.

- The equity market (SP500) increased.

- USD, JPY and CHF fell fairly much.

- The market rates of majors fell.

- Ironically, risk appetite sharpened.

The reason for this - ironic - reaction was that investors very fast discounted a high probability that the Fed will delay its scaling down of QE.

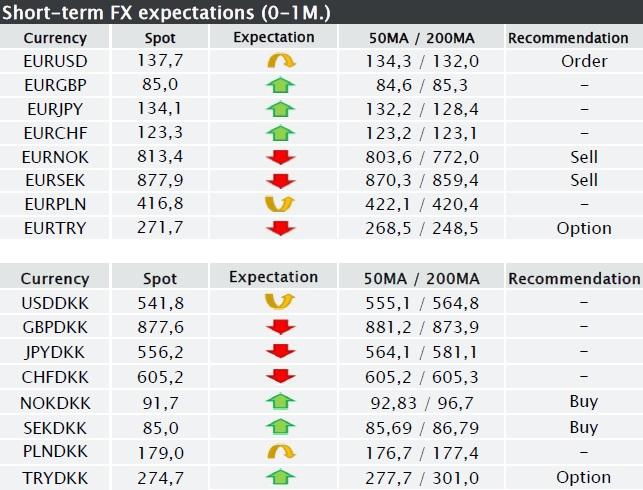

Changes in USD expectations

As the probability that the Fed will postpone its scaling down of QE increases, we will also postpone our expectations of the coming USD strengthening. After yesterday's weak report, there is a high probability that EURUSD will continue up towards 139-140 over the period until the end of the year.

We have on several occasions emphasised that our expectations of a strengthening of USD depends very much on a self-sustaining recovery in the US in combination with the Fed's launch of scaling down of its most favourable monthly QE. The reasons why the scaling down will result in a strengthening of USD are:

- yields in the US will begin to increase relative to the euro zone

- willingness to invest/investment flow will benefit the US

- due to the scaling down, less USD will be in circulation. The ECB will continue to pursue a MOST relaxed monetary policy for quite some time.

Today's chart

There is still scope for a small decline in US yields over the coming period. If that happens, USD will still be an attractive funding currency and hence we may easily see negative pressure on USD over the last quarter of the year.

EURUSD (ORDER): We recommend a sell order at 136.35 with a close stop loss at 137.25.

The short-term view of EURUSD has taken a beating.

The risk scenario of a strengthening of EURUSD towards 139-140 has now begun to materialise. The weak job report from the US - in combination with Dagong's downgrade of the credit rating of the US - triggered the current strengthening of EURUSD.

EURUSD

Now the pressure will continue to the upside until we see a breakout below the dotted red trend line at 136.40. A new round of corrections of US equities may trigger such a movement. The reason is that - when we analyse the technical undertones in the equity market - we get the impression that the long-lasting and constant upturn is about to be fully played out this time around.

In respect of EURUSD, there is a strong likelihood that the spot market will attempt to go for the stop loss levels that have been built up in the range of 138-138.50. If EURUSD is pushed above 138, we expect a subsequent solid consolidation phase.

In the short term, the following levels are of importance:

Support: 136.40, 134.50, 132.10 (200MA).

Resistance: 138 and 140.

EUR/NOK(SELL): We recommend investors to sell EURNOK. We have adjusted stop/loss to 817.03.

As EUR/PLN falls, we will continue to lower the S/L level.

Norges Bank will have its interest-rate meeting on Thursday. It may be interesting and will undoubtedly affect NOK.

We maintain our recommended sell (for the short term (0-1M) as well as for the long term (1-6M)).

NOK has been under pressure lately, among other things due to low liquidity - when trading picks up again, we expect to see NOK strengthen.

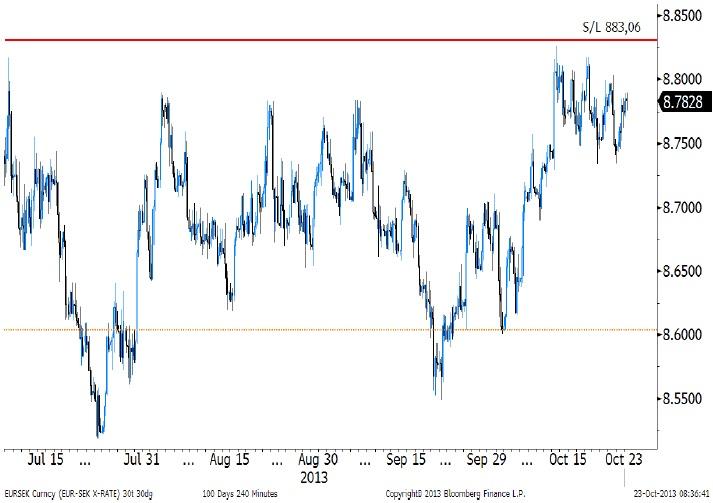

EURSEK (SELL): We recommend that investors sell EURSEK with S/L at 883.06.

As in Norway, there will also be an interest rate meeting in Sweden on Thursday. No major adjustments are expected on the part of the Riksbank. The interest rate path of the Riksbank matches the expectations of the interest-rate market more or less.

EURSEK

As yields in the US and the UK and the euro zone fall back, we see growing momentum in demand for SEK (and to a lesser degree for NOK). Particularly hedge funds are again taking advantage of the increasing interest rate advantage as well as the relatively low level.

The interest rate meeting and the release of producer prices on Thursday may be events triggering a new round of SEK purchases. When EURSEK closes below 873, we expect further increasing momentum where 860 will offer the first major level of resistance.

Support: 859-860 (200 MA)

Resistance: 883 and 890.

Chart of the day: US 10-year government bond yields

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.