Review

The US: Political deadlock

The political tug-of-war about the temporary budget in the US continues. Both the Republicans and the Democrats continue to make demands that are unacceptable by the counterparty. Deadline for a agreement is then night between Monday and Tuesday. If no agreement is reached, about 800,000 public-sector employees will be sent home. This will result in a intensive media debate and therefore the disagreement may generate risk aversion in the financial market for almost a week.

This morning Jyske Bank's macro-economists assess that there is a high probability that the disagreement will continue. What will this mean to the FX markets:

We have seen initial movements in the form of strengthening of CHF and JPY. This indicates that the financial market will move into safe havens if we see a 'partial close-down of government'.

If this movement continues, we will see further strengthening of CHF, JPY and GBP, and EM and commodity currencies will weaken. The strongest reaction will be seen in the equity market.

Italy: Political deadlock

It does not happen that often that we can 'recycle' such a apt headline. On Saturday, five ministers from Berlusconi's centre-right party chose to resign from the coalition government. This means that President Napolitano is forced again to form a new temporary coalition government, which in turn means that the efforts to introduce reforms in Italy will - at best - be put on hold. To the financial market this means that the rating agencies will focus on Italy, and the probability of yet another downgrade will increase. Hence Italy will be at risk of being rated below an A category, and therefore it will be increasingly costly for the Italian banks to obtain funding, even from the ECB.

The government crisis means that EURCHF will fall as investors tend to seek to CHF in the event of crises in the euro zone. Depending on the degree to which Napolitano succeeds in forming a government, also EURUSD will be affected and the cross rate may fall down 132- 133.

The Fed: The market expects that Yellen will be appointed new Fed chief late this week. The appointment will offer EURUSD some additional support.

Today's chart: The political deadlock in both the US and Italy sends both USDCHF and EURCHF markedly lower. The breakdown below the trend line is pronounced and leads to expectations that 121.50-80 will be seen again.

Recommendations:

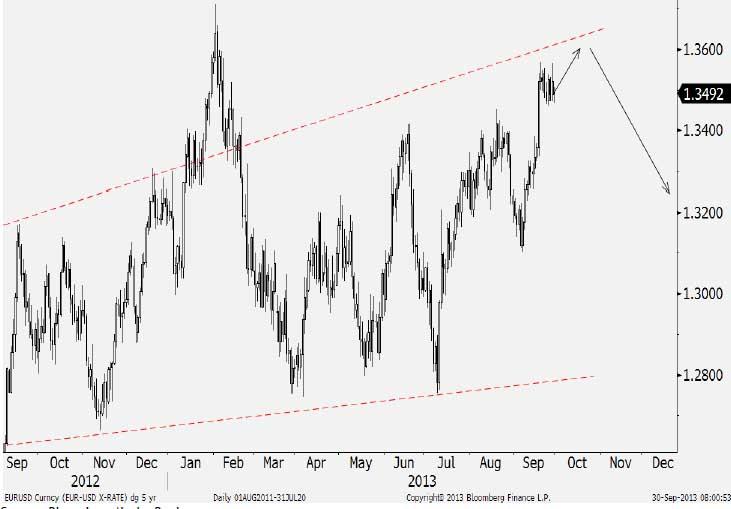

EURUSD (NEUTRAL): Poor economic indicators and fiscal political tug-of-war will delay a scaling down of QE to December.

The likelihood of a scaling down of QE in October decreases day by day. Labour market data have been good but data for the housing market have generally disappointed. As one of the Fed's major concerns is weakness in the housing market, it gradually seems more unlikely that we will see a scaling down of QE already in October.

EURUSD

In the short term (0-1M): EURUSD is still consolidating above the important level at 134,10-134.50. As long as we are here, the pressure will be strongest to the upside with an increased likelihood that the budget crisis will push USD 1 - 1.5% lower and hence send up EURUSD towards 135-136.

In the long-term (3-12M): Our macro economists still expect that the US economy will perform relatively well and that the interest-rate hikes will be implemented earlier in the US than in Europe. In this perspective, the long-term USD case is intact despite higher uncertainty about expectations due to higher dependence on data.

Support: 134.50, 131.73 (200MA). A breakout will result in a strong movement. 130.21 and subsequently 127.50.

Resistance: 135.69 and 137.11. Subsequently 140.00.

EURSEK (NEUTRAL): The interest-rate market signals caution

The interest-rate market has lowered its expectations so they practically are in line with those of the Riksbank - this comes as a surprise and maybe it is a bit too cautious. the current yield spread points to a stronger SEK.

If EURSEK increases to the level at about 880, we will consider it a most attractive level to sell at, both in the long as well as the short term. We believe in a narrow trading range in the 1-month term as focus is moving away from Scandies again.

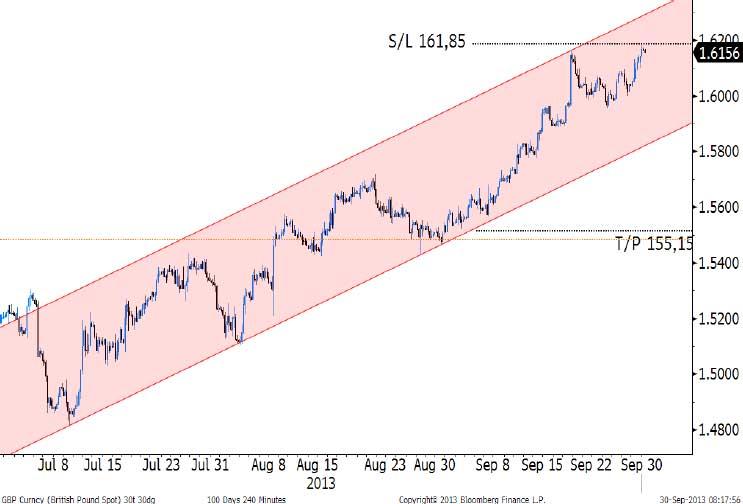

GBPUSD (SELL): We recommend investors to SELL with take/profit at 155.15. Stop/loss at 161.85.

The market is in a strong upward trend and, among other things, the budget crisis in the US continues to cause USD to fall against GBP. Currently the cross rate is technically overbought, and at the same time the economic indicators in the UK are beginning to offer disappointments. Hence there is scope for a correction of the upturn since June. We expect a movement down to at least 158.50. Adjust stop/loss to entry when we see trade below 158.25.

GBPUSD

EURNOK (NEUTRAL): Paper-thin liquidity and central banks are selling out.

We maintain our recommendation to BUY NOK.

EURTRY (BUY put spread): BUY a put spread, strikes at 264.50 and 259.00. Expiry on 24/10/2013.

Our recommended put spread has moved rather far away from the spot rate. Today the strategy only costs 0.25% of the invested amount. If you want to make it more "updated", you can make the following put spread:

- BUY put option, expiry 24-10-2013, strike 2.69

- SELL put option, expiry 24-10-2013, strike 2.63

- Price: about 0.52% of the invested amount. You have the opportunity of a gain of 6 figures (2.2%) against paying 0.52%. Risk/reward: Slightly above 1:4.

Today’s events

10.00 NOK: Retail sales (estimate: +0.9%, last time: -1.3%)

03:00 CHN: PMI industry (it is expected that NBS will be 51.2; last time: 51.1)

If the PMI data in China disappoint in the currently nervous market, equities will fall and offer support to CHF, JPY and GBP.

Chart of the day: EURCHF

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.