EURUSD traded above 134.50 yesterday.

No fundamental events prompted the movement; rather it was speculative movements targeted at taking stops above 134.20. Over the evening/night, the cross-rate dropped back towards 134. It is crucial that today remains below 134.50 - closing above this level (at 22.00) is most likely to change our short-term view. Today's minutes from the recent FOMC meeting will be essential. If our expectations are met (please see below), USD should strengthen (signal about phasing out in September of USD 10bn distributed equally between government bonds and mortgage bonds).

The EU: Merkel and Schaeuble disagree on Greece.

Merkel finds that Greece should manage without renewed support. Finance minister Schaeuble estimates that Greece needs a new rescue package. Jyske Bank expects that Greece will receive a new rescue package within the next year, which will put a slightly negative pressure on EUR.

Japan: central bank governor Kuroda promises to speed up relaxations.

Kuroda continues with verbal intervention. Tonight he announced that if the domestic economy weakens slightly, BoJ will not hesitate to launch further relaxations to boost the economy further.

Turkey: the Central bank (CBRT) once again hikes its rate to strengthen TRY.

CBRT raised the short-term lending rate by 50 bps. from 7.25% to 7.75%. CBRT maintained the discount rate and the deposit rate. Thus, the interest rate is a clear signal that CBRT maintains focus on supporting TRY so the pace of the currency depreciation will not be too fast.

Today's main event: minutes from the FOMC interest rate meeting in the US.

The minutes from the FOMC meeting, which will be released at 20:00, will be crucial for the short-term trend of EURUSD.

Market consensus is that FOMC will provide some obvious clues on phasing out in September or December. Two circumstances will affect USD:

Will a phasing out materialise? And will the amount be higher or lower than USD 10bn? Will the phasing out be distributed over both mortgage credit and states?

If these questions can be answered in the affirmative, US yields are most likely to increase and USD to strengthen.

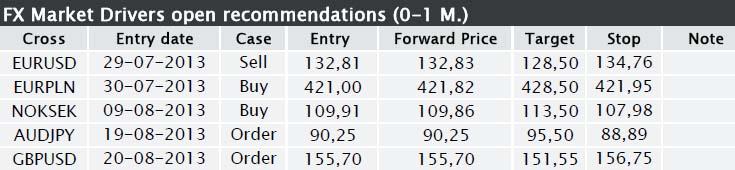

Recommendations:

EURUSD (SELL): we recommend investors to SELL and to take profit at 128.50, and place stop loss orders at 134.76.

Slightly surprisingly, the recent volatility in the financial markets has only had a moderate effect on EURUSD. We expect to see the resistance level at 132.00-132.50 again before the end of the week, if the current concerns among investors gain momentum.

NOKSEK (BUY): we recommend investors to BUY and to take profit at 113.50 and stop loss at 107.98.

GDP was a great disappointment and sent down NOK against most currencies.

NOKSEK fluctuated more than 1.50% and closed the day at 108.90. On closer investigation of the sub-indices of GDP, they do not appear quite as negative on the surface. But all things being equal, the surprise adds negative pressure on the market rate and, consequently, lower NOK for the short-term.

NOKSEK

We restate our BUY recommendation for NOK against SEK, and we still see good long-term value in selling EURNOK (buying NOKDKK).

GBPUSD (SELL ORDER): SELL at 155.70. Take/profit at 151.55. Stop/loss at 156.75.

Much positive news has been discounted in GBP. Yet, we see a rather actual risk that the Bank of England will at its next interest-rate meeting attempt to send signals which should keep down interest rates - this will depreciate GBP.

If we look at the so-called "Surprise Index", we are at the top (indicators have been positive surprises). We have often seen that very high levels in the Surprise Index are followed by negative surprises because analyst expectations are too high and unrealistic - the UK economy still faces very large challenges.

Due to these two elements in combination we see value in an early sale of GBPUSD. Renewed risk aversion, if any, will also put pressure against the downside of GBPUSD.

Support: Slight support at 156.08 and then 153.50-154.23.

Resistance: 156.73 and then 157.52 and 159.10.

EURPLN (BUY): We recommend investors to buy EURPLN with take/profit at 428.50 and stop/loss at 421.95.

Although EURPLN rarely considers the 50- and 200-day moving average, the cross rate has presently been caught between two strong technical levels. Since July we have not seen a breach neither to the upside nor to the downside. This indicates that investors are beginning to attach more importance to them than is usually the case.

Hence, we can now use them as indicators of when EURPLN will again begin to trend either higher or lower. A breach above 426 gives expectation of continued trade towards 430-35.

A breach below 417.50 will give rise to expectations of additional falls to the 412-14 range.

EURPLN

AUDJPY (BUY ORDER): Winner of the month? Take/profit at 95.50. Stop/loss at 88.89.

AUDJPY turned round due to the higher risk aversion, and we are now far away from our recommended entry level. We restate our buy order. The cross rate should not be bought until at/above 90.25.

Today’s events

20:00 USA: Minutes from the latest FOMC meeting.

China: Tonight, PMI data for industry will be released.

Chart of the day: EURUSD

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.