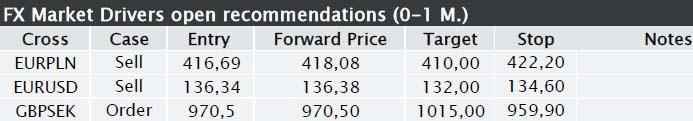

Review:

JAPAN: Japan’s finance minister Aso confirmed that Japan has no immediate plans of buying foreign government bonds to weaken JPY further. Also, he rejected the rumour that Japan will change the central-bank act. Both announcements fuelled the ongoing JPY consolidation. EURJPY weakened by almost 0.5%.

EURJPY has scope for a weakening towards the 123-124, which we expect will take place over the coming week. RSI and MACD are both pointing downwards and confirm the scenario.

EURGBP: The consolidation phase continues until we see a significant breach.

A breach below 85.40 will result in downward pressure towards 84.

A breach above 86.66 will result in upward pressure towards 87.20-88.

We expect the downside to come into play within about a week.

EURTRY: is once again trading on the bottom of the trend channel where the cross has been since July 2012. A breach below 234.50 is estimated to be a significant breach and will result in a sales pressure towards 232. In the short term it is difficult to imagine that the cross will move considerably lower, until EURUSD starts to breach significantly downwards.

(See the section on EURUSD overleaf).

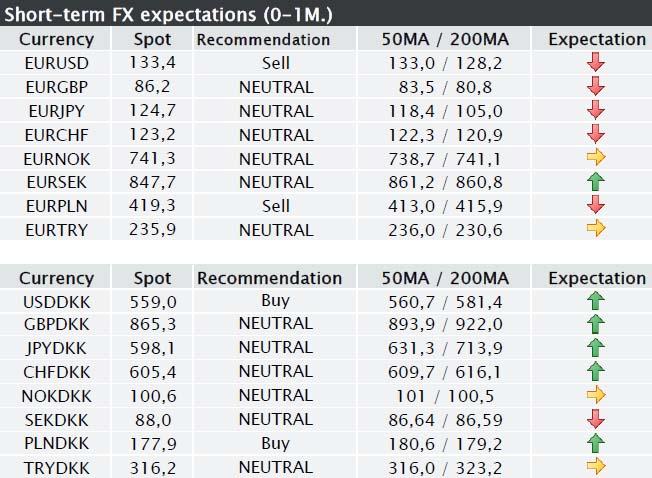

Market sentiment: The consolidation phase continues.

In our view the ongoing consolidation phase in the financial market will most likely continue for some time yet. Investors have started to question whether everything is just fine and whether the current peak levels of risky assets can be justified.

Currently, investors have a relatively good ‘gut feeling’, and setbacks will thus be utilised to buy extra shares. It requires a period with poor economic indicators or extraordinarily unexpected negative events before investors will sell shares to a high degree.

There are a string of negative triggers in March, April and May. This is one of the reasons why we expect the sun to shine on USD in the spring and, thus, offer a trend change to EUR.

Today’s events:

09:30 Sweden: Consumer prices and unemployment

11:00 Germany: ZEW

00:50 Japan: Trade balance

EURUSD (SELL): We recommend to take profit at 132,00. Stop/profit adjusted to 134.60.

What will trigger the next major movement?

EURUSD is on a 7–8-month uptrend. On the downside, the trend will not be broken until 131.70. Calm markets without any major surprises will maintain this uptrend. We anticipate a movement towards the bottom at 132-133. We do not expect to see a significant breakout to the downside until the spring of 2013. The breach may risk to come as a surprise, this may happen if especially equities and metals are sold off in a solid movement. (This has long been one of our risk scenarios, and we pay extra attention in this respect in the coming weeks).

EURUSD

Resistance and support:

- Downside: 133.06, 131.85 and 130.

- Upside: 133.89 and 135.20.

GBPSEK (NEUTRAL): We recommend a buy order at 970.5.

Stop-Loss at 961.5.

GBP is strongly oversold, and in our view there is a limit to the appreciation of SEK. Courageous investors may begin at the present level.

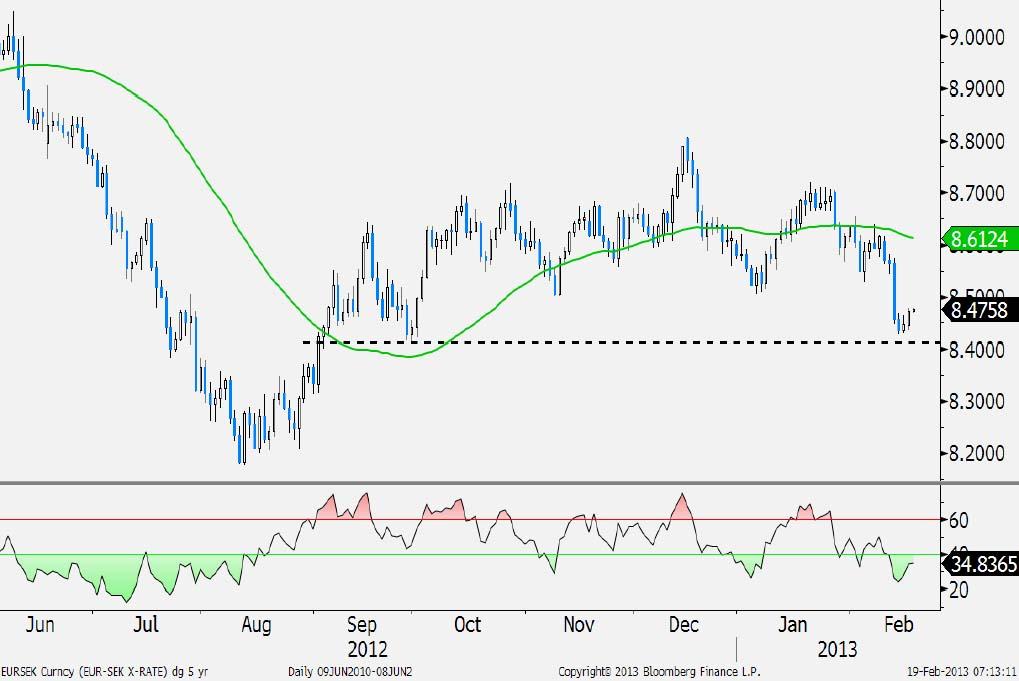

EURSEK (NEUTRAL): If we are to choose sides in EURSEK, it would definitely be short-term buy of EURSEK. RSI as well as MACD have turned around in favour of a buy. If the market manages to close above 847 toady, it will be the third day on end, which is a good setup for a stronger buying interest. The chart shows that as long as the rate is trading above 841.25 (the dotted line), there is basis for a continuation of the trading range of 841 - 87. If, on the other hand, the market closes below 841, we will see strong pressure down to the 820s. A breach above 851 is expected to result in additional buying pressure.

We point out that CPI will be released today, which has previously been a market driver.

The case fits in well with our positive view of GBPSEK.

EURSEK

EURJPY (NEUTRAL): Logical movement of JPY after G20.

The G20 meeting did not result in any pressure on Japan to put an end to its depreciation of JPY. Hence, the G20 countries have approved that EURJPY and USDJPY can continue the uptrend. Still, Jyske Bank anticipates that Japanese ministers’ rhetoric will become more hesitant which will contribute to EURJPY not breaching the 128-30 level.

Last night, the Japanese finance minister specified that Japan will not initially set up a fund for the purchase of foreign bonds in order to force JPY lower.

Official sources confirm that after Friday’s meeting between the Japanese Prime Minister Abe and the US President Obama a new governor of the Bank of Japan will be appointed.

If Mutu is appointed, we expect to see a slight appreciation of JPY in its wake. If, on the other hand, Iwata or Kurodo are appointed, we see probability of a depreciation of JPY.

EURJPY resistance and support:

- Downside: 122.90-123.40. Strong support at 120.90. Then 117.25.

- Upside: 126.10 and then 127.71.

Chart: SP 500

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.