Key Highlights

A recovery in the EURUSD pair failed this past week, as the pair started to trade lower once again.

There was a support trend line formed on the hourly chart of the EURUSD pair, which was broken to help sellers gain control.

Euro Zone Manufacturing Purchasing Managers Index (PMI) will be released by the Markit Economics today, which is forecasted to remain stable at 52.3.

In New Zealand, the Visitor Arrivals released report was by the Statistics New Zealand today, which pointed an increase of 8.9% in October 2015.

EURUSD Technical Analysis

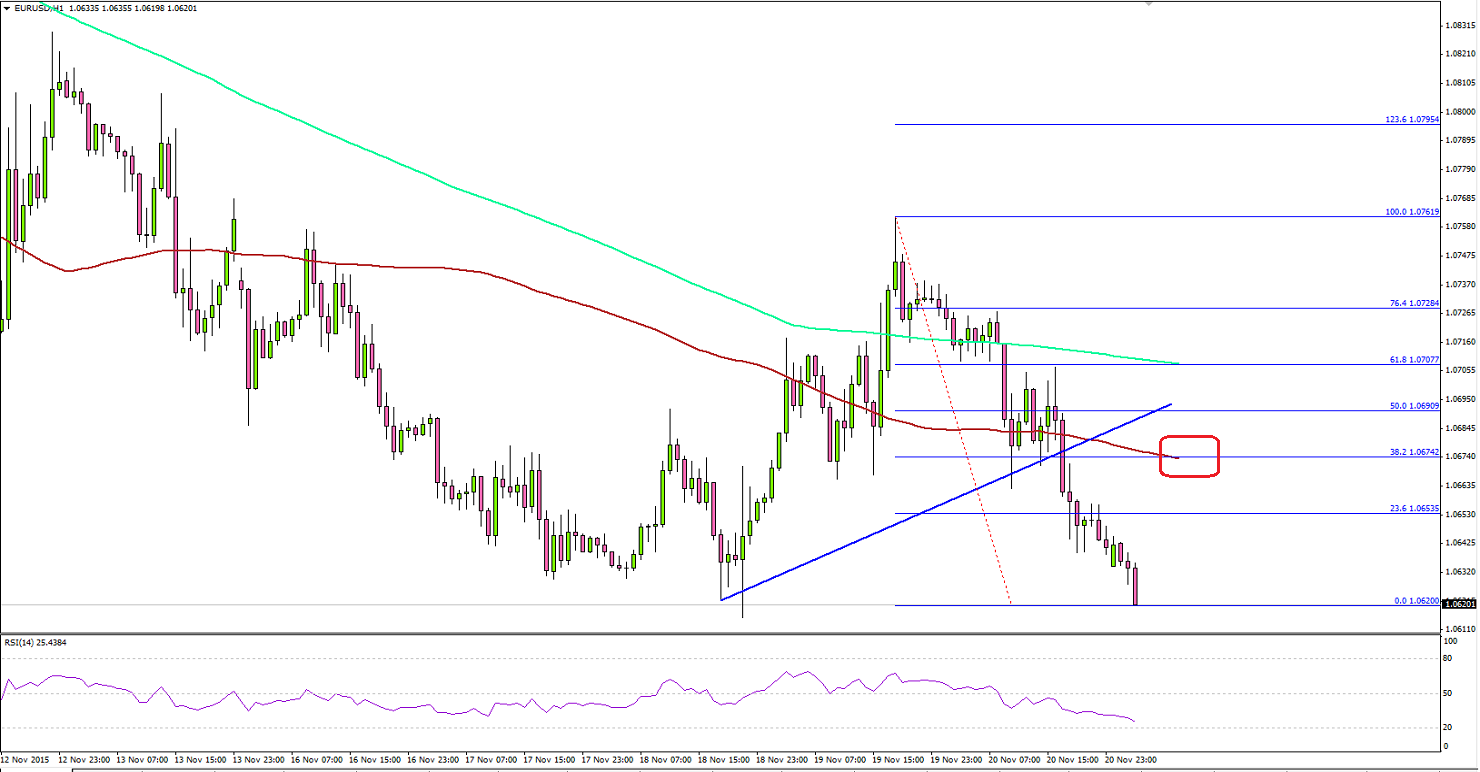

The EURUSD pair managed to climb higher this past week towards 1.0760 where it failed completely and started to move lower again. There was a bullish trend line formed on the hourly chart of the EURUSD pair, which was broken recently. The point to note is the fact that the pair settled below the 100 and 200 hourly simple moving average, which is a strong sell signal.

The pair is currently trading near the last swing low of 1.0600-20. A break below it may take the pair further lower may be towards 1.0580. On the upside, the 100 hourly MA can be seen as a major resistance moving ahead that might prevent the upside if the pair corrects higher in the short term.

Euro Zone Manufacturing and Services PMI

Today, the Euro Zone will witness a lot of economic releases, including the Euro Zone Manufacturing Purchasing Managers Index (PMI) (captures business conditions in the manufacturing sector) by the Markit Economics. The forecast is lined up for no change in the PMI from 52.3 in November 2015. Any miss in the result may impact EURUSD pair and might take it lower in the short term.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.