Key Highlights

Aussie Dollar rocketed higher during the Asian session, as the employment report released in Australian was better-than-expected.

Australian Employment Change released by the Australian Bureau of Statistics came in at 42.0K in May 2015, compared to the expectation of 11.0K.

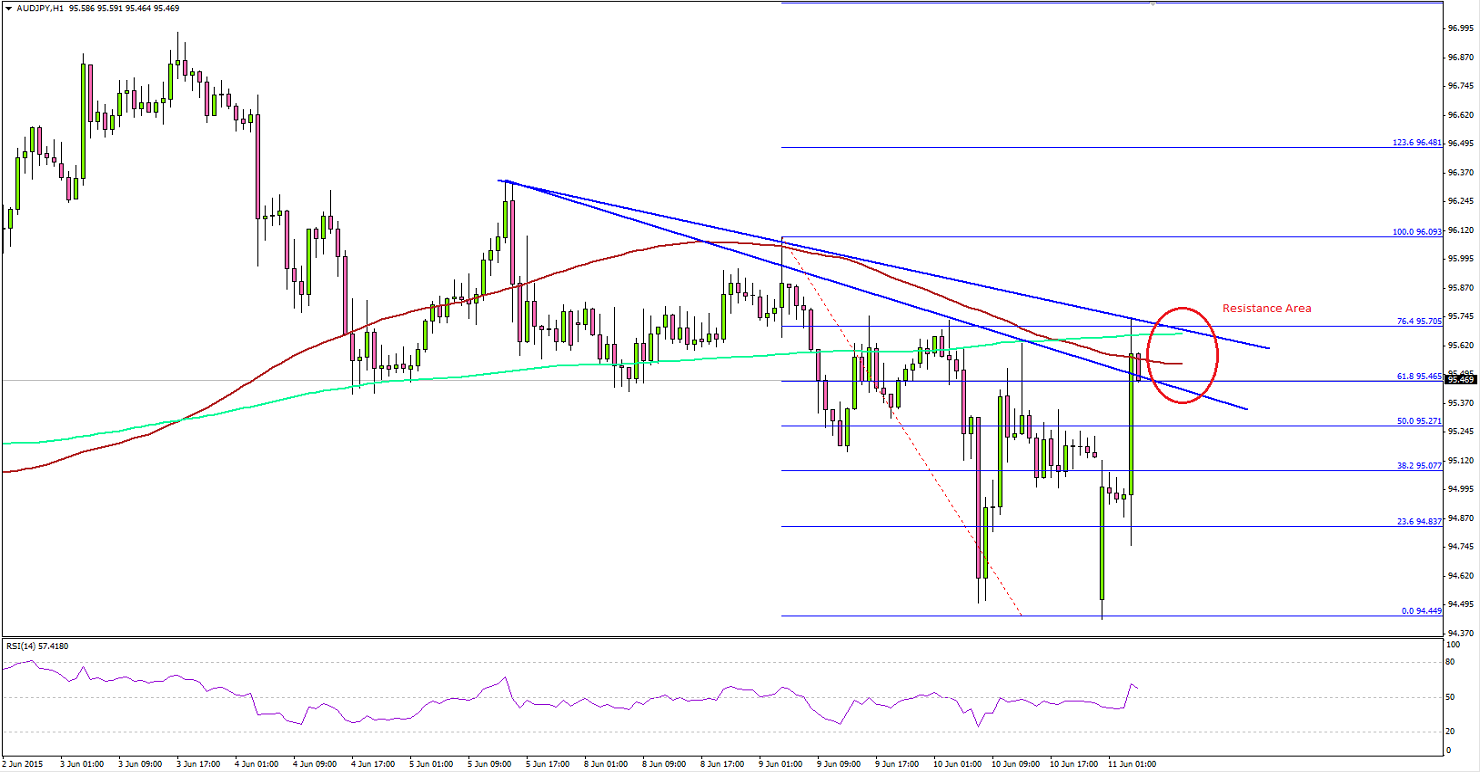

AUDJPY pair surged higher after the report was published, but facing an important resistance area.

AUDJPY – Technical Analysis

As mentioned the AUDJPY pair traded higher, and moved by more than 50 pips to trade near a monster resistance area. There is a critical confluence area formed around 95.50-70, as there are many hurdles around the mentioned area. The 100 hourly simple moving average (SMA), 200 SMA, a couple of bearish trend lines and the 76.4% Fib retracement level of the last drop from the 96.09 high to 94.44 low are positioned around a same area. In short, buyers might face a tough time to take the pair higher moving ahead.

If the AUDJPY pair settles successfully above the 95.70 level, then there is a chance of it moving towards 96.00. On the downside, the 95.40 level can be seen as an immediate support area, followed by 95.10. The hourly RSI is above the 50 level, which is a bullish sign in the short term.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD grinds higher toward 1.0900, Fedspeak eyed

EUR/USD is edging higher toward 1.0900 early Monday, helped by a better market mood. The pair also draws support from softer US Dollar and US Treasury bond yields, awaiting Fedspeak amid light European trading.

Gold price rises to a new record high, escalating geopolitical tensions in focus

Gold price gains momentum on Monday. The yellow metal hit a record high near $2,441 during the Asian session on Monday amid renewed hopes for interest rate cuts from the US Federal Reserve and rising geopolitical tensions in the Middle East.

GBP/USD advances to near 1.2700 due to rising expectations for Fed rate cuts in 2024

GBP/USD extends its gains for the second consecutive session, trading around 1.2710 during the Asian hours on Monday. A weaker US Dollar supports the pair. The Pound Sterling may face a challenge as the BoE is expected to deliver 60 basis points rate cuts in 2024.

Week Ahead: Ethereum and DeFi to come under spotlight this week Premium

Bitcoin’s attempt at a comeback has stirred the pot, causing altcoins to become volatile again. With the US Securities and Exchange Commission set to make its decision on Ethereum ETFs this week, some sectors of altcoins might see higher liquidity and volatility than others.

Will they/won’t they cut rates as commodity prices in focus

What a difference a couple of days make. One day stock markets are making record highs and banking on rate cuts, the next stocks are giving back gains and rate cut expectations are being pared back.