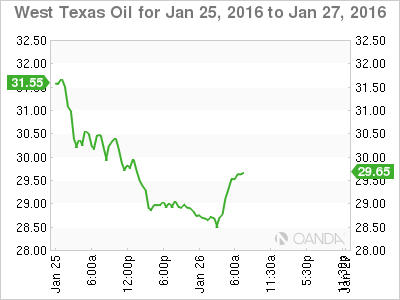

It’s the same story, but a different day. The direction of crude oil prices continues to drive capital markets. The black stuff is on the cusp of relinquishing the latter half of last week’s gains ahead of tomorrow’s Federal Open Market Committee (FOMC) announcement and crude oil inventories report (WTI-$29.80, Brent $29.90).

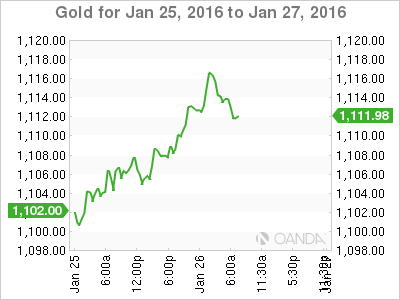

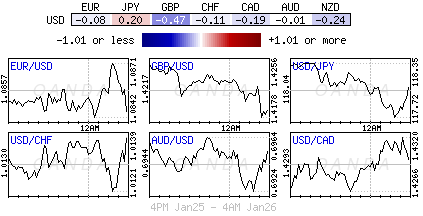

Market risk aversion sentiment has again sent both the Euro and Asian bourses lower for the second consecutive day on China growth concerns. In the overnight session, the Shanghai composite has fallen -6.5% – it’s lowest level since December 2014. Investor’s flight to quality is putting further pressure on U.S treasury yields (10’s +1.99%). Even investors expecting a protracted period of low growth and low inflation are gravitating towards the middle of the U.S yield curve. Investor fear is successfully dragging gold higher ($1,115), and the reason for another round of flows into the carry-related FX pairs. The EUR/USD tested €1.0874, while USD/JPY fell to ¥117.65 before consolidating their moves heading in the North American session.

Federal Open Market Committee (FOMC)

U.S fixed income dealers have only 24-hours left to ponder the fallout of these volatile global markets, plummeting oil prices and heightened fears of a Chinese slowdown will have on the Fed’s previously stated intentions to continue raising rates this year. Most onlookers have tended to agree with the Fed that the U.S slowdown is but a temporary dip, driven largely by specific drags on the manufacturing sector. Nevertheless, there seems to be genuine market nervousness that the recent underperforming U.S data, aside from the labor market, could be deeper than first thought. The struggles from oil output, foreign demand and the rising strength of the U.S dollar are proving to be more negative on U.S growth. The Atlanta Fed’s GDPNow has been falling and now reports that U.S GDP Q4 2016 growth rate was only +0.7%. This implies that U.S underlying growth rate in the economy running at about +1.0-1.5%, down from +2.5% eight-months ago. With numbers like this there is nothing to fear about tomorrows announcement. Market consensus expects that this meet come’s too soon for the Fed to admit anything positive or negative from last months ‘token’ hike.

To many, the idea of four further quarter point increases in U.S interest rates this year is starting to look very questionable in light of capital markets recent plummeting moves. In reality, no one seems concerned about this FOMC meet; it’s been viewed as a non-event in which Ms. Yellen is genuinely buying some time to prove that their “temporary blip” belief is correct. Even U.S money markets are unphased by this meet. Looking at their yield curves they do not expect another Fed hike until H2 and that could even be a stretch.

Is Gold Behaving Like It Should?

The yellow metal ($1,115) seems to be finally doing what it is suppose to do. After the Fed’s first-rate hike in nearly a decade last month, gold’s role as an indicator for monetary policy has been diminished. This is allowing the precious metal to return to its traditional role as a “haven.” Because the precious metal does not offer any typical return, like interest, it usually underperform against other interest bearing assets. For most of 2015, dealers thoughts on the timing of the Fed’s first-rate increases tended to dominate the direction of commodity prices. But in 2016, it may be a different story.

Despite the recent market turmoil, the metal’s recent price moves remain limited. Many would argue that gold’s uptick in price has more to do with asset reallocation (selling equities to buy gold) rather than a sustained commodity bull run. Thus, the “bull” skeptic continues to look for signs of support and that too may come from China.

Remember, there is always a natural demand for gold ahead of Lunar New Year (Feb 7-13). One needs to gage investor demand after the event to decide if this market appetite for the precious metal is real or not!

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.