U.S markets are closed today for Thanksgiving and will shut early tomorrow. Despite the shortened trading week, dealers and investors have had a plethora of U.S data to consider that could convince an undecided Fed member to shift allegiance.

Yesterday’s U.S durable goods data was better than expected (+0.5% vs. -0.3%), while U.S personal spending missed estimates (+0.1% vs. +0.3%). Perhaps the most significant news yesterday came from the Atlanta Fed (who consistently provide comments around various in-house models). They have lowered their Q4 U.S GDP outlook by -0.4% to +1.8%, citing weakness in real consumer spending. Consumer confidence numbers earlier this week would suggest that U.S retailers are looking forward to a harsh holiday season.

The Fed’s December token hike is +73% priced in: Despite the Fed’s employment mandate looks pretty solid – the market is anticipating another firm non-farm payroll (NFP) print on Dec 4 (+200k and +5% unemployment rate) – it was always going to be up to U.S inflation that will dictate the pace of rate normalization. Growth in yesterday’s November Core-PCE reading (the Fed’s favorite inflation barometer) would have more or less sealed the deal for a December rate hike, but the lower core reading continues to leave an element of doubt in the outcome. Not surprisingly U.S inflation remains suppressed by lower energy costs (similar to every G10 economy). Despite the Fed repeatedly stating that they will look past lower inflation from lower energy prices, fixed income dealers continue to price in an element of doubt. Aside from geopolitical risks, it makes next weeks U.S employment numbers that more important.

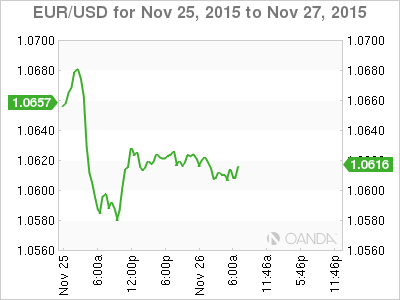

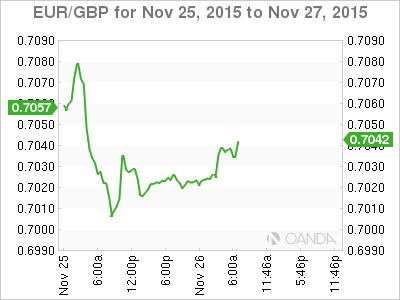

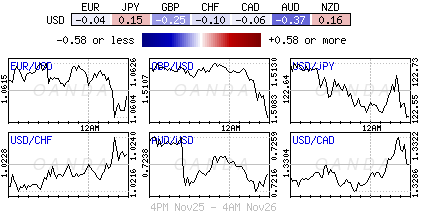

Markets betting ECB will act aggressively at its Dec 3rd meeting: Speculation of further easing from the ECB next week is keeping pressure on the EUR (€1.0600) as well as bond yields. The event risk is if Draghi and company does not act boldly enough next Thursday. As of this morning, the market is pricing that the ECB will cut the deposit Rate by -15bps (+90%), yesterday those odds were trading around +65%. Dealers expect the ECB to also increase its monthly QE by €10-15b from its current +€60b, and up the extension on purchases to March 2017 from September 2016. If the Euro policy makers are seen as too passive, the market will be unwinding a large percentage of their current EUR ‘short’ position. Complicating matters will be the ‘long’ dollar position who will want to book profits after the Fed announcement on Dec 16.

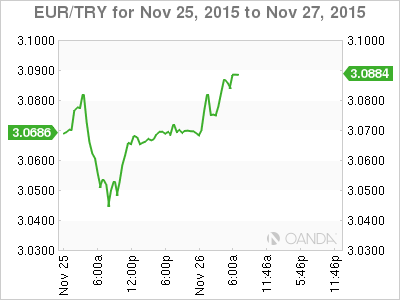

Geopolitical risks contained for now: The Turkey situation appears to have been contained now that Russia has publically indicated that they have no plans to wage war. But true too diplomatic form, Russia will not allow the incident to pass without some sort of response- Russian natural gas deliveries to Turkey have been suspended. Despite Turkey’s central bank keeping rates on hold for a ninth consecutive month early this week, TRY continues to trade under pressure.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.