Risk-aversion heightened after No win

Greek/EU Political Jousting dictates proceedings

Euro Capital market fallout contained

- Investors look to Central Banks for guidance

Capital Markets were expecting a narrow ‘Yes’ victory in Sunday’s Greek referendum, the restart of negotiations with its creditors and likely end to PM Tsipras Syriza government.

Instead investors are faced with a resounding ‘No’ vote victory (61.3% to 38.7%), Euro leaders preparing to hold an emergency summit tomorrow and a olive branch token from Greece – Greek Finance Minister Varoufakis is politically pressured to resign to possibly pave way for trust in potential future EU-Greece discussions.

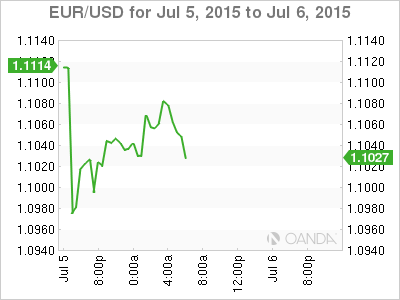

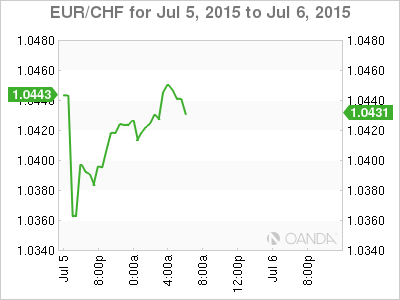

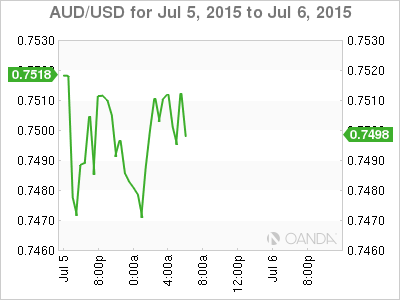

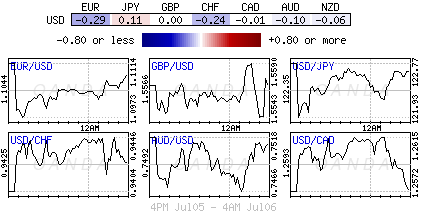

Initial market impact from Greek developments has been largely negative, global equities seeing red, aside from the Shanghai Composite managing to close the day higher to end a 4-day losing streak – aided by new Chinese policy measures – risk-averse currency trading (EUR temporarily plummeting to €1.0976, Yen and CHF rallying to ¥122.02 and €1.0370 respectively), commodity currencies like the AUD and CAD dollar weakening, while sovereign bond yields fall (Bund 0.75% and U.S 10’s 2.36%).

Greece’s rejection of the bailout terms in Sunday’s referendum considerably reduces the possibility of a deal with its three main creditors (ECB, IMF and EU), making it unlikely that the ECB will ramp up emergency lending anytime soon (ECB governing council to meet Monday), eventually pushing the country towards the eurozone exit.

Euro Market Fallout Contained

In relative terms, the muted reaction to the possibility of Grexit would suggest that contagion to the weaker central eurozone (Hungary and Poland) and its peripheries (Italy, Spain and Portugal) may prove limited. Currently, there seems to be no immediate financial stress in the market, which would imply that the market believes that the ECB has tightly corralled any immediate possible ‘knock on’ effects. Technically, investors have been in the process of reversing the one-directional trade (record short EUR’s), and they still have more to do.

Current Capital Market moves have more to do with political jousting rather than financial exposure. Investors, hedge funds and traders have significantly been reducing their direct exposure to Greece all along. Yesterday’s vote has obviously strengthened the position of the Greek government, but does not solve PM Tsipras immediate two risks – a deteriorating Greek economy and the lack of a mandate to leave the Euro. Investors seek clarity, and over the next few days’ markets will get a better handle on the Eurozone consensus rather than trading individual rhetoric headlines.

Nevertheless, unless plenty of constructive comments comes from both the EU and Greece that the worst-case scenario of Grexit can be averted, investors should expect risk aversion trading to remain heightened.

Central Banks to Dominate Weeks Proceedings

Central Banks are not having an easy go of things at the moment. Should the ECB be providing more liquidity to Greece? What else has the Fed to do to persuade the market to price in rate normalization? Is the market about to feel the wrath of the SNB? Will the RBA lend a hand to pressure the AUD further?

Besides the Greek bailout vote, Wednesday’s FOMC’s meeting minutes will be the main event of the week. Last month, U.S policy makers left the door ajar for a rate hike this year, but the market seems to be having some difficulty in aggressively pricing in rate normalization in the U.S for 2015.

Wednesday’s minutes could go along way in providing additional insight about the discussions around the possibility of a rate hike and the monetary policy of the Fed in general. Even though Yellen and her colleagues have come along way on the transparency front, the market is having a difficult time digesting regional anomalies – plummeting Chinese equities, the possibility of Grexit – not delaying the fist rate hike stateside. Nevertheless, be prepared for little guidance from Ms. Yellen – this is the FOMC event risk.

Expect the RBA to Remain Vocal

Last month, RBA left its cash rate unchanged at +2%. Current estimates are that the RBA will keep its rate flat later this evening. However, fixed income traders are pricing in a small percentage chance that Governor Stevens will reduce the rate again considering the recent developments in Europe and the weakness in China. Aussie policy makers have been very blatant with their market rhetoric – they want a weaker AUD ($0.7492). If the AUD was too strong the RBA would act, however, risk aversion is already pressuring commodity currencies which would suggest that there is not the same sense of urgency from the RBA to do so. Governor Stevens can afford to wait, especially with the AUD falling to a new six-year low outright overnight (AUD$0.7440). All investors need to worry about is if the RBA does stand pat, how aggressively will the AUD rally?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.