An eleventh hour break through by Greece

Greek capital controls remain a reality

ECB offers daily lifeline through its ELA program

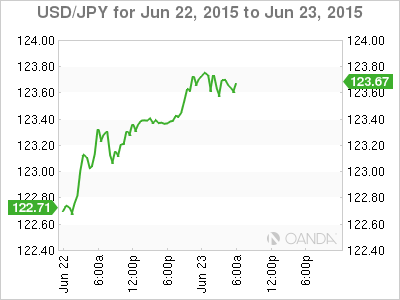

Yen losing its safe haven mojo

It’s normal and certainly more prudent to find most investors prefer dealing with the facts, while speculators on the other hand, do just that, and speculate. Yesterday’s supposed breakthrough in Greek/European talks are either beautifully timed at the eleventh hour by the inexperienced Greek PM, or “forced” lucked by a bunch of frustrated European officials.

Fact, there has been a calculated breakthrough in Greece’s talks with its creditors. Fact, both sides are short on details, but over the next two day’s a lot of work is required to be done, so the market has been told. Nevertheless, it seems that both Euro officials and Greece’s Syriza party are confident that the ‘process’ could be finalized this week, thus avoiding potential Greek capital controls, a debt default and Grexit. For most investors, they prefer to see it in black and white, while the speculator is making most of the market noise and adding risk again to their portfolios.

Greek Capital Controls Not Gone Away

In reality, the threat of capital controls remains ever present for Greece. Currently, the ECB continues to offer a daily lifeline to Greek financial institutions through their Emergency Liquidity Assistance (ELA) program. Earlier today, it was again necessary for the European Central Bank (ECB) to provide extra cash for the fourth time in seven day’s after another +€1.6b left the Greek banking system yesterday. On the flip side and when necessary, the Greek government should find it a tad easier to sell its proposals to their own government citing the constant threat of capital controls and flight of capital as a leverage.

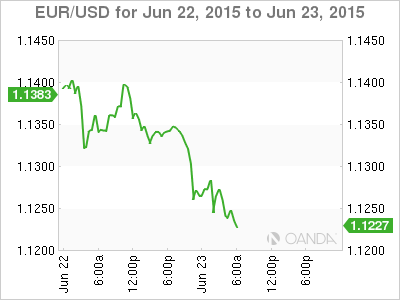

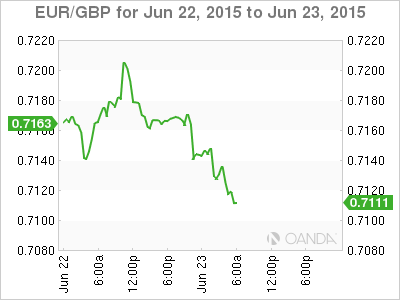

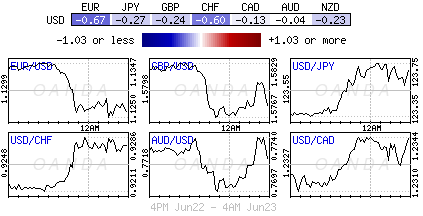

So far this week, the speculator has been pricing in a lot of market optimism ahead of tomorrows Eurogroup meeting, pushing both equity prices and Euro sovereign yields higher. For the investor, the EUR’s move lower over the past 24-hours has perhaps been a tad more puzzling than anything. Many had been expecting that with a reduction in Greek risk would be a positive for the common currency. However, the single unit so far this week seems indifferent to the Greek talks.

For the speculator, the easing of tension between interested parties has allowed the taking on of more risk, pushing the USD to build upon recent gains against the majors and commodity-related pairs. The optimism on Greece is perhaps bringing the focus back on the Fed and their first potential rate hike. With rate divergence back on the table is allowing many to reconsider re-entering one of the most popular traders of this year – short EUR/USD.

Single unit unable to benefit from stronger data

The EUR outright is trading at a one week low (€1.1235) and is unable to benefit from better data in the euro session ahead of the U.S open. Despite the eurozone economy appearing to rediscover its drive in June, the single unit seems content in cracking the psychological €1.1200 handle sooner rather than later.

Earlier this morning, Euro PMI’s surveys pointed to acceleration in the growth of the business activity. The composite PMI (measure of services and manufacturing activity) rose to 54.1 from 53.6 in May. The highest monthly level printed in over two-years. The details revealed that both the services and manufacturing sectors both picked up, although the “new order” component slowed for a third consecutive month. This may suggest, until Greece’s issues are resolved it’s not going to get any better. Despite the rosier picture, an ongoing concern for the ECB will be the fact that businesses continue to cut their prices.

Asian PMI’s provide mixed feelings

Thankfully Europe has not cornered market volatility entirely. In China, the Shanghai composite trading resumed where it left off last week, with another selloff in spite of equity strength being recorded nearly everywhere else. Not helping were the mixed results from China’s June flash manufacturing PMI data. Despite the headline print remaining in contraction for a fourth consecutive month (49.6), the print was above consensus (49.4). Nevertheless, the devil can always be found in the details. The output component rose to 50.0. Both new orders and backlog components were also notably stronger, but perhaps most important, the employment conditions print deteriorated further.

Not wanting to go it alone, Japan’s preliminary manufacturing PMI slid back into marginal contraction (49.9), as production growth slowed and new order demand contract for the third-time this year. Similar to China, Japan PMI employment component was also soft, even though Japan’s more favorable exchange rate (¥123.66) translated into an upbeat exports view.

The USD remains well supported against the yen at the moment for a number of reasons. The Bank of Japan (BoJ) monetary policies are still divergent, even if the Fed’s first rate-hike timing remains vague. Currently, rising Japanese energy import costs are bearish for JPY as export volumes struggle. Finally, CHF and GBP has been sapping the yen of some traditional safe haven Greek flows and is allowing the recent surge in speculative yen shorts to support USD/JPY on pullbacks at the moment.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.