EUR prints a two-month high

German Bund yield correction continues

U.S ISM manufacturing PMI could cause problems in thin conditions

U.K manufacturing PMI hurts sterling’s expectations

This time last year the Euro was trying desperately to drop through its one-month low of €1.3800. A year on, the single unit is again making some significant strides, albeit from much different price levels.

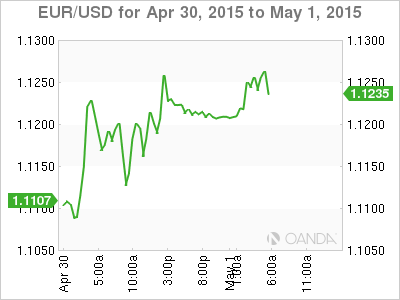

The EUR has started the month of May climbing to a new two-month high against the dollar Friday (€1.1258), extending its recent rebound outright in quiet European holiday trade.

The ECB’s €60b a month bond buying stimulus program managed to push the common currency down below the psychological €1.05 handle only six-weeks ago. With the market so bullish on the Fed timing of their first rate hike; many investors had expected that it was only a matter of time that the EUR would be trading at parity.

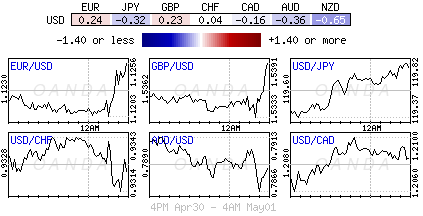

The Euro/U.S rate divergence argument (a hawkish Fed and a dovish ECB) has seen investors plough into the short EUR, long USD positions for months. So much so, that +78% of all forex long dollar positions has been against the Euro. The one directional, lopsided trade was always going to be in danger if any of the parameters suddenly changed.

Corporate Issuance and Supply Pressure Bond Prices

A string of weak U.S economic data releases in April (GDP, business investment, NFP) attributed to the dovish shift in Fed expectations. This change in sentiment initiated the broad dollar weakness, which has been supported by the assertive rally in German Bund yields this week.

The ECB’s aggressive QE program has encouraged investors to own core Eurozone bonds and stocks, alongside a massive build up in EUR short positions. The 10-year German bund has managed to back up +25bps as investor’s appetite for fixed income with a negative or flat return diminishes.

The loss in fixed income has pressured the DAX and in turn has encouraged some aggressive EUR/USD short covering. The rise in German yields is also encouraging investors to consider switching from EUR to JPY as the funding currency of choice.

Despite the European bond markets being closed for the May Day holiday – FX is open – there is little evidence that this week’s correction wants to come to an end. The dollar is heading stateside weaker against most G7 currencies. Against the EUR, crucial technical pivots remain intact (€1.0860 week’s low & €1.1320) and strong EUR offers are understood to be placed ahead of €1.1300 (option barrier protection). Above this level with momentum, a plethora of stop-losses are rumored to be parked, potentially opening the way for the February 3 high of €1.1534.

Speculators or “hot” money have been buoyed by yesterdays better than expected U.S data (Initial weekly claims and Employment Cost Index). They are keen to reenter there mostly closed out EUR ‘short’ positions as the data has boosted their expectations for next weeks NFP report. However, today’s U.S ISM Manufacturing PMI may have something to say about that (52 vs. 51.5). It is been released in ultra thin conditions, which tends to exaggerate forex price moves.

U.K Manufacturing takes a hit

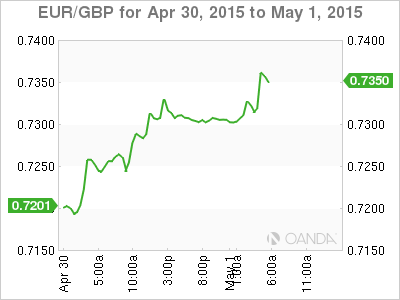

Month end EUR/GBP (€0.7360) buying yesterday was a prime factor in the Euro’s gains and because of event risk, next week’s U.K election is expected to keep the cross relatively perky.

Disappointing data out of the U.K this morning has been lending a helping hand to keep pressure on sterling. Outright, the pound is again eating through the bids at £1.5300 on the back of the U.K manufacturing PMI miss (51.9 vs. 54.6e – the lowest in seven months).

A print like this would suggest that the U.K economy wouldn’t be recovering quickly from its surprisingly sharp Q1 slowdown. Digging deeper, the data insinuates that U.K manufacturing is going to have a tough go of it over the coming months – new-orders are sliding, particularly on the export front due to the EUR/GBP underperforming. This is not good news for either Prime Minister Cameron ahead of next week’s election, nor for the “hawks” advocating a U.K rate hike before 2016.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.