USD look for a spark- perhaps NFP?

Euro PMI’s fail to disappoint

Greece’s time is running out

CB’s to run down EUR reserves further

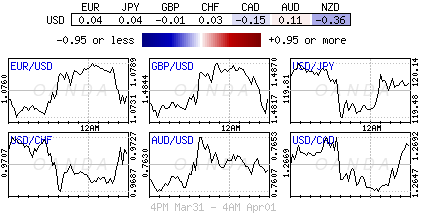

With month-end, quarter-end and a plethora of equity and forex option expiries now officially out of the way, investors will now be preparing themselves to sit tight and wait for Friday’s U.S non-farm payroll release. The dollar is looking for that specific spark that will propel it to the next level. With the market looking for rate clues, many expect the U.S employment headline to be the missing factor that’s required to push the USD beyond its contained trading ranges.

Investors Rebalance Portfolios

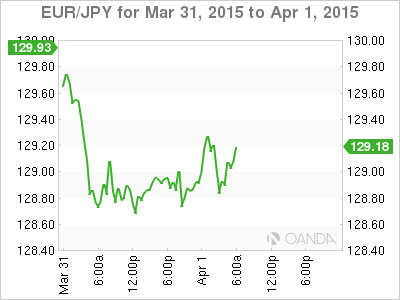

In 11-months, the USD has appreciated +28% versus the EUR. The record shift out of EURs has been brought about after the European Central Bank lowered interest rate on deposits. Europeans are “paying away” (negative rates) to deposit funds. Because of the U.S. yield differentials argument, investors want to purchase U.S. assets to maximize their returns. The pace of the greenback’s rally has been the fastest in over 40-years. For some, the danger is that the dollar’s move has been too rapid and could be overdone in the short-term.

Over the past few weeks, the market has witnessed a couple of massive dollar squeezes – post “patient” omission statement by the Fed saw a +8% whiplash up and down move by the EUR. U.S CPI headline conjured a +1% move in the greenback. Friday’s headline number could be a watershed moment for the dollar. Recent soft U.S data (retail sales & Industrial Production) due to colder weather could possibly taken a modest bite out of NFP U.S jobs (+242k vs. +294k – +5.5%). If so, investors will begin to fantasize about the Fed rate ‘normalization’ hike being further out the U.S yield curve rather than being imminent.

Greece’s time is running out

How far the EUR (€1.0742) is capable of progressing in the short-term will depend entirely on Greece as there “time is running out.” Greece needs to agree on a reform deal to unlock the next tranche of bailout money (April 20) or literally go broke. So far, they have submitted insufficient alternatives to their lenders that contain the kind of convincing details that would have them receive the much-needed funds. Euro leaders and politicians are very frustrated with Greece’s inexperienced political entourage. The longer this goes on there is a slight possibility that Russia may be able to come to the Greeks rescue. This would be a relationship that most of Europe would not be pleased about.

Euro manufacturing shows positive signs

For now, the EUR will have to rely on positive fundamentals for support. This morning’s better than expected eurozone manufacturing data (Italy, France and Germany) is another indication that the region’s economy is collectively picking up. Even the latest PMI’s for central Europe (HUF and CZK) suggest that industrial production growth could reach a combined average of about +8% over the coming months as German demand for ‘regionally’ made goods increases. The combination of lower oil prices and a weaker EUR has helped Euro manufacturing PMI’s to beat expectations. However, the weakening currency has also raised import costs for manufactures and coupled with some Euro businesses continuing to cut prices would suggest that the ECB has its work cut out to get its inflation rate back to its target of just under +2%.

On the flipside, Euro producers are benefitting from a weaker EUR; it’s helping boost their market competitiveness while making competing imports more expensive domestically. Draghi is hoping that a weaker EUR will boost inflation by raising prices of imported goods, and in time domestic business would follow suit.

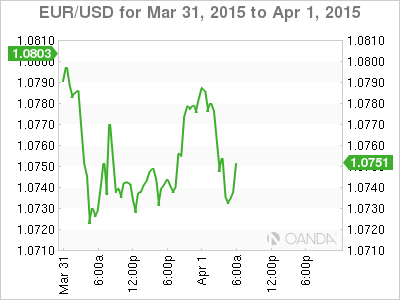

Dollar index itching to peek above 100

The dollar index (DXY) continues to suck in broad based demand on U.S policy outlook. The index has just completed its ninth consecutive bull month with a 98.382 March close. This close would suggest that the index is well positioned technically to take a peek again above the psychological 100.00 level. The massive trigger point on the topside still remains atop of 102. Through here with conviction, the USD will have strong momentum on its side. Investors are looking for that one headline to tip the scales in their favor. It could be today’s ADP or ISM headline print, but the smart money remains on Friday’s NFP release and wage growth numbers. Do not expect the EUR to stray too far from the above picture. Despite falling strongly against the ‘big’ dollar, the single currency still remains well above last months 12-year low of €1.0457.

Further Weakness for the EUR

Central Bank’s are the biggest currency traders and yesterday’s IMF Q4 2014 global forex holdings (Currency Composition of Official Foreign Exchange Reserves – COFER) indicated that CB’s share of EUR reserves dropped in Q4 to +22.2% vs. +22.6%. This was somewhat anticipated already by the market. However, CB’s in the Middle East and China are not captured by this report. They all have EUR’s and they have the largest potential to sell to run down reserves (China is running down their reserves at their fastest pace in history). Neither wants to hold low-yielding European assets.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

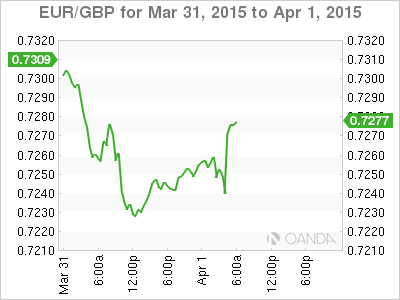

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.