Fed’s normalization data dependent

Dollar longs feel the squeeze

Eurozone PMI’s continue slow recovery

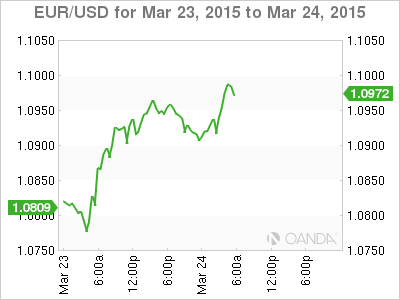

EUR Bulls break €1.1000 look for €1.1200

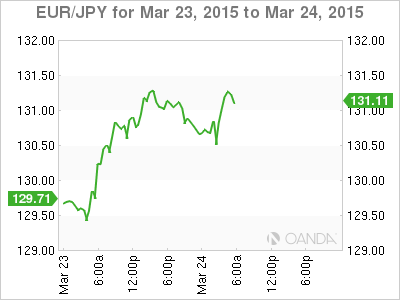

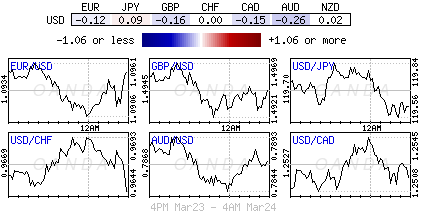

The dollar bull has been suffering greatly since last week’s FOMC “dovish” meet. The market conviction that the USD can rally from here has certainly taken a pounding, but they have to keep faith in the process of normalization of Fed monetary policy – a return to data dependence and lift off – as fundamentally it will eventually boost the dollar. The problem for most of the current ‘long’ dollar positions is whether they have the risk appetite or the funding to stay true to their convictions throughout this markets short squeeze. Even the timing entry of “new” dollar longs is taking a beating. The Fed’s expectation for the greenback is that coming policy changes will likely boost the dollar. The switch from “patient” to “not impatient” signals that normalization is coming, but there is maybe a reluctance to do so in June, for fear that dollar strength will get out of hand. The market prefers to price in a September hike or even further out the curve.

Dollar rise naturally slows

Since the Fed’s “patient” omission it’s not unnatural to witness the pace of the dollar’s appreciation slow, especially after some of the massive outsize gains against the majors so far this year. In fact, it’s normal for any currency to consolidate after such a move, especially with such positional interest at stake. Historically, following large moves, the USD has tended to trade sideways for several weeks at a time, and this time is no different. The Fed has basically shifted the markets focus towards data dependent releases in justifying the Fed’s stance and market currency positioning.

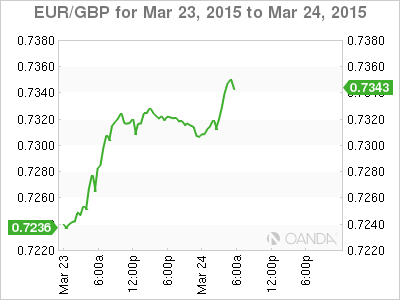

The bulk of the dollar rise this year has been driven by the EUR and Yen’s weakness. Rate differentials brought about a change in monetary policy at the BoJ and ECB obviously favors the dollar and reason enough why the greenback has been able to outperform despite some mixed U.S data of late. There will be a turning point that will not automatically favor the dollar, but that probably will not naturally occur until the market is much further along the U.S “normalization” route.

This dollar negative squeeze, initiated by the Fed, is certainly painful for many. However, the big picture dynamics remain intact. From here it’s all about the day-to-day position management. The structural drives for a lower EUR are very much in place, but short term positioning and the over shoot of rate differentials would suggest that the single-unit still has room to climb (€1.0975).

Eurozone PMI’s point to continued slow recovery

March’s small rise in the euro-zone composite PMI adds to signs that the slow recovery has continued in Q1, but France is still performing poorly. The increase in the headline economy-wide output index, from 53.3 to 54.1, was slightly better than the consensus forecast of a rise to 53.6 and left it at its highest level in four-years. After rising in January and February too, the average for Q1 now points to a rise in quarterly GDP of about +0.3%.

For France, there is no sign of sustained pickup in the economy as Q1 draws to a close, with there March composite PMI falling to 51.7 from 532.2 m/m. As expected, growth in the services sector eased after a strong February, while manufacturing activity continued to decline. However, there are some hopeful signs, with new orders on the rise for the fourth consecutive month and employment increasing for the first time in 17-months. And while businesses did cut their prices, they did so at the slowest pace in six-months.

In contrast and the backbone of the eurozone, the German economy appears to have picked up momentum in Q1. It’s own composite PMI rose to 55.3 from 53.8 in February – an eight month high. Activity increased at a faster pace in both manufacturing and service sector. This should continue, especially with new orders rising at the fastest pace in nine-months. The positive signs for the ECB are that German businesses are hiring new workers and are raising their prices for the second straight month.

Euro breaks psychological barrier

The better than expected PMI’s has help lift the EUR to briefly peek above the psychological €1.1000 handle. It’s not just the upbeat data that is pushing the dollar lower or pulling the EUR higher, the market continues to adjust their “positions” accordingly. The huge EUR/USD fall (down to €1.0464 last week as ECB QE got under way) has the EUR bull’s eyeing scope for a larger correction. The €1.1062 (March 18) high to date is seen as too small. However, the low after Syriza’s win in Greece (€1.1098) could be a tough hurdle to overcome.

The Euro bull is looking to the €1.1200-1.1300 handle for mid-term relief. However, they will require further easing of pressure from the rates market to fuel further EUR gains. So far this month, fixed income traders have managed to shave -12bp off the 2-year Treasury/Bund spread. It seems that EUR speculators are happy to set up buying dips below €1.0900 and €1.0875.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.