FOMC expected to make some noise

“Old Lady” sets sterling alight

BoJ attempting to save face

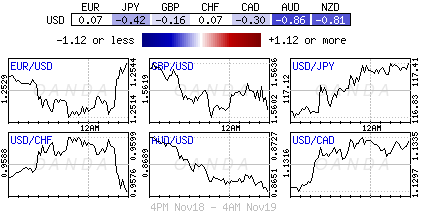

In today’s economic climate Central banks are never too far away from the heart of any forex move, and again overnight has been no exception. Monetary policy guidance, economic reassessment and policy makers’ outright voting results are influencing the forex price direction. The BoJ managed to hold center court throughout the Asian session. In Europe, the BoE is hugging the limelight, at least until the Fed gets to dominate proceedings in the late North American session with the release of the FOMC minutes. The bulk of the markets investor and dealer response is expected to come this afternoon, after the FOMC minute’s release.

FOMC expected to make some noise

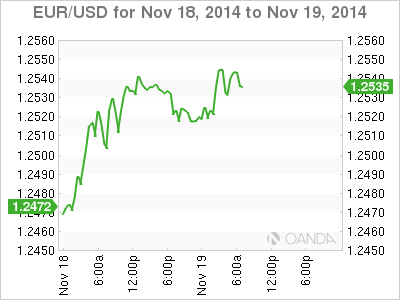

On the last go around, early October, when the Fed released minutes from an FOMC meeting, the U.S equity market managed its biggest rally of the year. That was because the market heard that day a more “dovish” tone than it had expected after the September meeting. Today, Fed watchers are looking for elaboration on a number of points, especially employment and inflation. The market will be expecting the usual range of opinions to be offered up – global development and inflation concerns. The varying views are likely to be balanced by discussion of removing the “considerable” period language and downplaying oil related softness in headline inflation (the weak energy prices are also helping – think of it as a form or stimulus). The market remains overtly bullish the U.S dollar, but it has sought a strong enough reason to kickstart the dollar’s next leg higher. Will investors get that reason later today? Currently, the 18-member single unit remains in a corrective mood (€1.2535) following the stronger than expected German ZEW investor confidence yesterday and dealers suspect that it has the potential to continue for the time being, unless the Fed has something to do with it.

“Old Lady” sets sterling alight

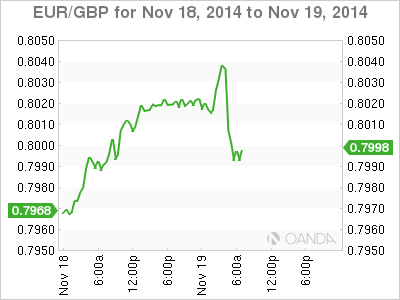

This morning’s Bank of England November minutes were not as “dovish” as expected – the vote remained 7-2 to keep policy steady at +0.5%. The minutes offered a subtle hint at deepening divisions among the seven-member majority led by Governor Carney. There was a “material spread of views” on the balance of risks to the outlook among members who voted to hold rates. Some MPC members expressed concerns about overshooting inflation target if wages pick up. Also some MPC members noted signs that slack was being absorbed sharply and could fuel inflation. The minutes imply that the “consensus” to keep rates on hold could weaken if the U.K economy continues to expand strongly, strengthening the minorities’ push for tighter policy. Currently, fixed income traders are pricing for the BoE to hike rates in the latter half of H2, 2015.

While this months QIR saw the MPC effectively support market pricing of an October 2015 rate hike the BoE (similar to other major CB’s) is as data dependent as it has ever been. Investors should be expecting greater volatility going forward as the market try’s to pin the BoE down to a rate hike timetable. Comments from any BoE hawk or dove will surely keep the market on its toes.

GBP/USD has succeeded to move away from its 14-month lows after this morning’s less “dovish” BoE comments. The pair has managed to move from £1.5590 to test above £1.5650 as a result (the psychological £1.57 looks in danger, nevertheless there is quiet a bit of wood needed to be chopped beforehand).

BoJ attempting to save face

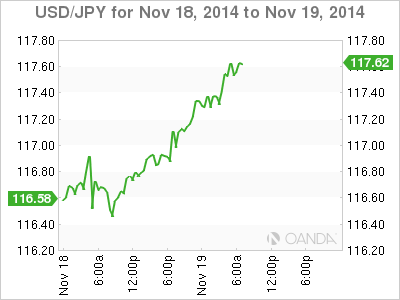

Despite some nervous moments from a few dealers, the BoJ managed to stick to the consensus game plan and maintain its large-scale easing policy (8-1 vote to maintain the ¥80t annual pace) and stick to its upbeat assessment of the Japanese economy despite the dismal growth data already delivered earlier in the week. The data revealed that Japan has again fallen into a technical recession, nevertheless, the BoJ maintains that a “moderate recovery trend has taken hold” and this despite some weakness on the production side of things. Governor Kuroda and company has also managed to raise their “export” expectations – to date they have been relatively flat.

In his post rate decision press conference, Kuroda reiterated the view that domestic economy was recovering “moderately,” and that domestic inflation was to hit their +2% target around the financial year-end 2015 on the back of improvement in Japanese employment and wages. Not surprisingly, he reiterated that the BoJ would check risks and make the necessary policy adjustments – policy was “flexible.” He did note that any chance of uncontrollable risk from delayed sales tax to economy was seen as limited.

PM Abe not so upbeat

The BoJ’s optimistic views are in contrast to PM Abe’s. He has managed to put the second increase in the planned sales tax on hold for 18-months (supported by -1.6% Q3 GDP affected by the April tax increase). He has also indicated and that he would seek a popular mandate for the postponement and Abenomics in a snap election next-month.

For the Yen bear, the current trend remains the investor’s friend. USD/JPY has managed to print fresh 7-year highs above ¥117.50 during the European session. There is no impetus to change, unless the FOMC minutes stray from the beaten path.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.