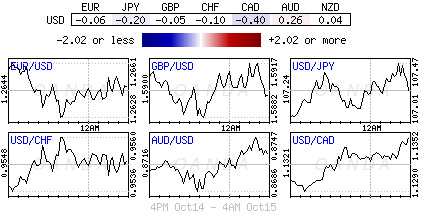

The USD continues to recover after the Federal Reserve Minutes took the wind out of its sails last week. Lower industrial production out of Japan (–1.9%), a flat German CPI (0.0%) were USD positive releases this morning. Even though the European Central President spoke at an event, Mario Draghi stuck to the matter at hand. Speaking at the Statistics Conference in Frankfurt the ECB president he outlined the importance of the continuing integration between the central bank regulatory functions and the data. The market is awaiting the US Retail Sales figures to decide if the USD will continue to recover versus the EUR and other major currencies.

The Swiss ZEW report came in way under expectations at –30.7 with a previous print of –7.7. The survey measures the optimism of analysts and investors at large institutions for the next six months. A reading above 0.0 is optimistic. This drop follows a similar negative move in the German ZEW survey fell yesterday into negative territory. Two european powerhouses are beginning to show that they are not immune to the economic ill that have ailed the rest of Europe. Chronic low inflation and geopolitical turmoil in the continent have taken its toll. The German government yesterday cut its growth forecast for this year from 1.8% down to 1.2%. If the engine of growth in the eurozone is stalling there are big question marks on how the member of the european union will react and take appropriate actions to spark growth and beat deflation. The main reason holding the ECB from releasing further stimulus into the EU’s economy is the lack of agreement from member states on the size and nature of the measure that will be taken. The ECB has done its part, and now the european commission will have to mediate to reach a compromise between divided factions.

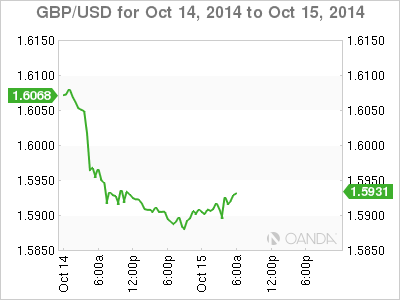

Slow inflation is keeping to the GBP on the back foot versus the USD. UK inflation growth is at a 5 year low and the GBP/USD pair is back close to 1 year lows. Inflation is a key indicator given the Bank of England’s plans to hike rates in the mid term. If there is no or low inflation it would be premature to raise rates as the growth of the country would be compromised by falling prices and higher cost of credit which would have a compounded effect on consumption. The US Federal Reserve continues to have the lead as the most likely central bank from the major economies to raise rates. The BOE had a strong string of data earlier this year, but comments from the central bank governor and disappointing data keep pushing back the data of an actual rate rise.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.